The Lazare Legend

January 15, 04

The Lazare Kaplan story dates back a hundred years, far from the company’s present-day headquarters in a Manhattan skyscraper. While waiting in a conference room for LKI’s president, the genial Leon Templesman, my eye was drawn to a painting on the wall. The picture was a watercolor of the Antwerp harbor, probably painted a century or so ago. In the background, the spire and the half of the Antwerp Cathedral could be seen against the backdrop of the harbor and its boats. Probably as the painter was recording the scene in front of him, some place in the distance, hidden by the cathedral, somewhere in the city’s warren of cobbled streets was the young Lazare Kaplan, busy cutting diamonds.

Lazare Kaplan wasn’t a newcomer to Antwerp’s then burgeoning diamond industry; in fact he learnt the art of diamond cutting from his cousin - none other than the renowned diamond cutter Marcel Tolkowsky. In 1903, Lazare Kaplan struck out on his own establishing his own company - Lazare Kaplan. By 1919, LK was cutting diamonds to his cousin’s original idea-cut proportions - by the time the company marked it’s 100th birthday - it had grown from a small Antwerp diamond cutting firm, into an international diamond conglomerate with operations ranging from diamond exploration to top-end jewelry lines. We take a look at the goings on of LKI over this past century.

IDEX Magazine: What have been the major milestones for Lazare Kaplan over the past hundred years?

Leon Templesman: Obviously a great deal of credit for the Lazare Kaplan history over the past hundred years has to go to the Kaplan family - they were the founders and originators of many of the important elements of the Lazare Kaplan strategy that we carry forth today. They had a particular approach to business with the departure point being that it is important to behave in an ethical fashion - to be forthright and behave in the classic ethos of the diamond industry - where a man is as good as his word. They of course launched into a number of important commercial elements. For example, they were the first to cut on a commercial scale ideally proportioned stones. The family was very much committed to technical excellence, to produce the most beautiful diamond. Lazare was in fact the inventor of the modern oval cut.

The company has also been committed to the development of new forms of technology. George Kaplan was instrumental in the development of the laser-inscription process. He was the original inventor and patenter of that process which has been a very important part of our LK strategy over the past twenty years. Looking at most recent events, in 1985 we were the first among diamond companies to begin branding a diamond, which is now very much in vogue. As far as we’re concerned this is not a new game, rather one that has been very much part of a core strategy that LKI has been pursuing for 20 years. Other elements of that strategy include commitments to marketing, a commitment to high-end jewelry and a commitment to the independent retailer as the appropriate channel of distribution.

We have also been focused on the role of evolving technology, which has brought about the odd combination of Lazare Kaplan, one of the premier companies in the high-end natural diamond business, being the first company to come to the fore with one of the most important technological inventions to confront the diamond business in many years - HPHT

IDEX: Namgem - Namdeb’s polishing plant in Namibia recently selected LKI as a technical and marketing partner. What exactly does this entail and how does LKI foresee the partnership developing?

LT: There are great changes taking place in the diamond industry. These are changes that many other industries have already experienced. They are traditionally called an industry roll-up or consolidation - this is something currently confronting the diamond industry. Companies have to take a view as to where they stand in the rapidly evolving process of consolidation. At Lazare Kaplan, we are focused on assuring an appropriate supply of diamonds in order to satisfy our broad-based distribution network of polished diamonds. This is an element in the strategy that we were pursuing in our co-operation agreement with Russian diamond miner Alrosa, and it is certainly an element in our discussions with Namgem. We believe that the technical proficiency that Namgem’s diamond cutting staff have, combined with the global distribution network that we have built up over the past hundred years, will lead to significant value added opportunities. We look towards a commitment with Namgem as an important step in the process of developing closer relationships with producers in a consolidating industry.

|

|

IDEX: The company is famed for the ideal cut diamond - the Lazare Diamond. What exactly is the Lazare Diamond?

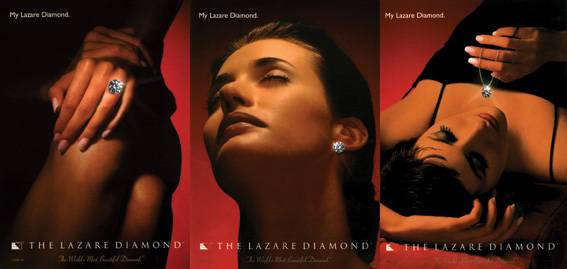

LT: In essence, it goes back to the work of Marcel Tolkowsky in the early part of the 20th Century. Basically, we start with a diamond and calculate what is the optimum characteristics you can cut and polish the diamond to, in order to optimize the brilliance, sparkle and fire of the stone. The Kaplan family was the first to undertake a large-scale cutting operation for ideal proportioned gems. Beginning in 1985 we decided to take the package somewhat further, which was to take the ideally proportion stones, and in a sense, begin the branding process through the laser inscription process that was developed by George Kaplan. Doing this, we were able to create a marketing package around that particular stone, enabling consumers to differentiate it from other diamonds that were less well proportioned. Effectively it became a branded ideally proportioned stone, committed to a certain standard of excellence surrounded by a marketing package. It’s primarily sold through independent jewelers throughout the world. When you’re dealing with better quality diamonds we discovered that as a rule, the independent jeweler has better access to the consumer purchasing those diamonds. They also have the capacity to train their staff and have the owner’s equity interest in staff training.

IDEX: What is behind Lazare Kaplan jewelry collection? Where does it retail and who is it targeted to?

LT: The line goes to the same independent retail customer base as the Lazare Diamond. It is focused on high quality materials, 18 karat gold and platinum. It is an appropriate vehicle in which to feature a high quality stone such as the Lazare Diamond. In certain markets, we have achieved quite a high level of recognition, but we still have quite a long ways to go. We don’t in any way, shape or form feel that we’ve maxed out.

IDEX: How have sales been in 2003?

LT: We are looking quite confidently at an expansion of the business, for example we are entering into a number of new markets like China. We are also seeing quite a significant improvement in our Japanese business, which is rather encouraging. We are also focused at expanding our penetration in our existing base. This is partly why we offer not only the Lazare Diamond, but we also offer a jewelry line which is capturing additional share in our jewelry base. In addition, we also offer the Lazare Diamond Centennial stone, which is a square emerald cut, as well as a cushion cut.

We are also quite aggressively marketing a collection of diamonds, which are cut in conjunction with Alrosa. These stones are primarily commercially cut stones from Russia, along with a limited line of jewelry associated with those stones.

IDEX: Are you also looking at upstream ventures with miners?

LT: We have a number of exploration projects that are going on around the world. The problem with diamond mining is that there are very few good mines. If though the right opportunity presented itself, we would certainly be interested, but good diamond mines are far and few between. We have a small exploration program with Trans Hex in Namibia. We are also closely looking at opportunities in Angola as the Government there changes their policy on the development of resources in Angola.

IDEX: What are the targets for LKI in 2004?

LT: We are realistic optimists and see tremendous opportunities that are before LKI. We have quite an interesting position in the market place. This was not a position that was developed in a day or two. It is something that has developed over the last hundred years, with a great deal of hard work and effort. We have had a number of successes and a number of failures. These were important in the terms of shaping the company’s life experience and understanding how best to position the company in the changing world. We are very optimistic about 2004.

IDEX: Looking ahead what do you expect will be the issues and the market situations affecting the worldwide diamond industry in 2004?

LT: There are quite a few issues that need to be overcome. One issue is an excess of leverage in many businesses’ capital structure. It is nice to have a lot of leverage in a time when interest rates are low, but as interest rates go up, which sooner or later they will, if you are highly leveraged the margins that are normally associated with diamond transactions will not support the level of leverage on the market at the moment. Also, in order to capture market share, a number of companies are following unrealistic business strategies, which are not sustainable. If you give diamonds out on consignment without ever expecting to be paid and have unconditional return policies, sooner or later something bad will happen. It’s very easy to put such plans in motion, but it is very hard to take them away once you’ve given them to your customers.

There are also issues of margins up and down the pipeline that need to be reallocated. There are too many people in the middle of the pipeline and perhaps there are too many retail stores. We need to have the number of rooftops reduced in order to have a more rational industry. In most industries, these changes would have occurred very rapidly. The diamond industry though is a little quirky that way, changes tend to flow through the system a little bit slower than in other industries. Changes though do occur and companies need to make modifications.

If you look at issues like a price list or lab grading reports, all of those things are simply manifestations of the consumer saying I want more information about the product that I’m buying. The trade can resist it for a period of time, but sooner or later, the consumer gets exactly what they want. That process, the information flow and information sharing, means that the balance of power in terms of margin distribution shifts more directly into the hands of the consumer. In the rest of the pipeline adjustments have to be made, so margin is more equably distributed between miner, manufacturer, wholesaler and retailer.