Polished Diamond Exports and Manufacturing

June 30, 06

From the total value of $6.706 billion polished diamond exports (in 2005), $2.8 billion are polished in Israel - an increase of about one percent compared to 2004. The balance, $3.897 billion (58 percent) is re-exported polished diamonds manufactured in other polishing centers abroad ($3,562 million - 56 percent in 2004).

Israeli manufacturers have their own manufacturing facilities, or subcontract overseas and bring the resultant polished back to Israel for further sale. In many instances, they enjoy support from the governments in the Far Eastern manufacturing centers.

In addition, Israeli manufacturers purchase small diamonds in India in order to enable customers to secure all their diamond needs at one place. That may sound like a television commercial, but the industry is still faced with the aftermath of the first Gulf War in 1991: diamond buyers were afraid to come to Israel, so the Israeli exporters came to see them. The subsequent “intifadas” (armed Palestinian uprisings) didn’t help either. That trend has never been reversed, and there is a strong desire by Israeli exporters to be able to present a full range of products to those buyers that continue to purchase locally. This is quite a problematic issue. Many Israeli exporters now have sales offices in the United States, Japan, Hong Kong, and elsewhere – which means splitting up inventories while, at the same time, increasing one’s overall level of stocks.

In the 1980s and 1990s, the Israeli diamond industry employed some 30,000 workers. Since then, part of its production (and the melees) has moved to low-labor-cost countries, such as India, Thailand, China, Vietnam and other places. By 1999, the number of production workers in the Israeli diamond industry’s labor force had decreased to 4,500 in 440 factories and the downward trend continued. A low point was reached in 2004, when there were officially only 3,000 workers. Since then, the trend has turned and currently the local industry employs some 3,200 production workers.

The increasing involvement of Israeli principals in offshore production justifies the assumption that the output will continue to be marketed through Israel. In the past, the Israeli government and the diamond industry did not favor the opening of Israeli-owned factories in other parts of the world. However, the liberalization of the country’s foreign currency regulations and the consistent efforts to make Israel truly competitive have affected official attitudes. There is currently not a single major manufacturer in Israel that does not depend on low-labor-cost countries for part of its production.

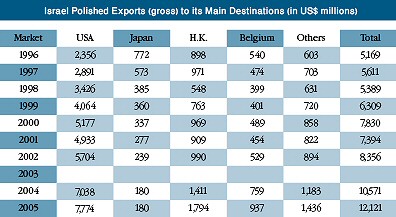

Israel’s exports have increased steadily in the past ten years, with the United States becoming the principal diamond export market. This gives rise to some concerns that the country is becoming too dependent on U.S. economic cycles. The role of Japan as an important export destination has been falling dramatically ever since the Far Eastern economic downturn.

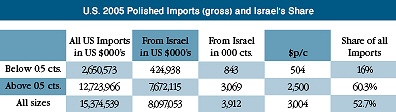

The Israeli exports to the U.S. grew in 2005 by about 10 percent compared to the growth of 17 percent in 2004. With this, the portion of exports in the U.S. of polished diamonds from Israel was reduced in 2005 and reached 64 percent of the total export from Israel (the rate was lower than that of 2004, which was equally profound). More than 60 percent of all large polished diamonds (i.e. diamonds above 0.5 carat) imported into the U.S. come directly from Israel, with an additional 20 percent coming from Belgium.

As Israel sells some eight percent (in 2005 $0.9 billion) of its polished output to Belgium, it is fair to assume that direct and indirect polished exports to the United States in the better goods are well above two-thirds of all such imports. In the smaller goods, the share of the Israeli suppliers is 16 percent, coming after India, which holds 69 percent in that category. Overall, Israel represents 53 percent of all polished diamonds into the United States (in 2005) making Israel that nation’s single-most-important direct supplier.

In 2005, an additional decrease occurred in polished diamond exports from Israel to Japan. Export to Japan at its record high was 20 percent of the Israeli export of polished diamonds, and reached about $400 million; it has lowered since 2000, and in 2005 totaled only 1.5 percent (about $180 million). The decrease in exports to Japan resulted primarily from the growth in market shares of other countries exporting to Japan: Primarily India and Belgium.

Export to Southeast Asia grew in 2005 at a high rate of 20 percent, in the background of the accelerated economic growth there, with an average rate of 8-9 percent. Israeli export to China demonstrates a stable increase over recent years.

Export of polished from Israel to China grew to $28 million in 2001 and to about $110 million in 2005; this occurred in the backdrop of substantial economic growth, thus enabling flexible terms of payment on the part of the Chinese buyers. The Belgian share of polished diamond exports from Israel was eight percent in 2005, representing 24 percent (from $760 million in 2004 to about $950 million in 2005).

Consolidation and Concentration Trend Slowing Down

The general trend towards concentrating the Israeli business in fewer hands came to a halt and actually reversed itself in 2005. This consequently gave new rise to the fact that smaller and mid-sized units, which traditionally have given Israel the flexibility to respond quickly to changes in market demand, will continue to play an essential role in Israel’s manufacturing and exporting scene.

From a distribution analysis of exporters (companies) in the diamond industry for 2005, it arises that 30 major exporters (that each export polished well above $30 million a year) represent about 3 percent of the total number of exporters, though they contributed 47 percent of the total export of polished (50 percent in 2004).

The combined exports of the 10 largest diamantaires in the industry in 2005 came to about $2.1 billion, representing 32 percent (a slightly lower rate than that of 2004 – 33 percent) of overall diamond exports. The first 23 largest exporters are responsible for a total of 45.6 percent of all the exporters. The first 58 companies are responsible for over 61 percent of all exports.

Nevertheless, in 2005, we witnessed for the first time in several years an evident reduction in concentration in the diamond industry. Clearly, the part played by the market leaders in the industry in total exports is decreasing, such that the part of the middle-range diamantaires is increasing. Such findings prove that there is also room in the industry for mid-sized companies and smaller companies to continue to strive; they should gain expertise in specific areas in which they can protect their competitive advantage, such as very specialized traders whose expertise and owner’s participation in the process of production represent a clear advantage.

If the trend is real, then it must also be reflected in the banking debt to the industry’s major players. Indeed, the data (provided by the Bank of Israel) reflects that in 2004, the 30 largest exporters enjoyed 73 percent of the total banking credit. Their role declined to 70 percent in 2005; it is expected that this trend will continue.