Diamond Jewelry Sales Forecast 2008

December 09, 07

By Ken Gassman The good news is that the economies of most developing nations – Asia, China, India – are expected to post strong, if perhaps slowing, growth in 2008. The bad news is that these regions are not particularly important to the diamond industry because spending by shoppers in those countries remains a very small portion of total global diamond demand.

Further, there are still risks in the U.S. economy. While it appears that the American economy could post slightly stronger growth in 2008 versus 2007 – up about 2.3 percent versus 2 percent in 2007, both of which are still well below the long term average of about 3.5 percent – there are risks that could send the U.S. into a major slowdown.

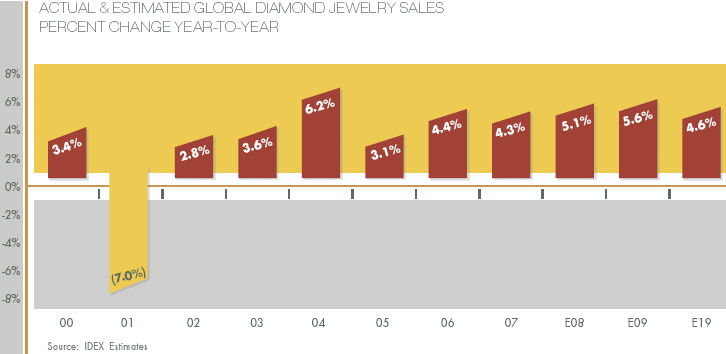

Our current forecast for diamond and diamond jewelry sales for 2008 calls for a gain in the 4 percent range, about in line with the estimated gain for 2007 across all global markets. This is below a solid 5 percent gain that was posted in 2006 versus the prior year. Worldwide, retail sales of diamond jewelry have grown at slightly less than 4 percent annually since 1999. Therefore, our forecast for 2008, while below the robust growth of 2006, is about in line with the average of this decade.

| |

|

Economy and Diamonds: High Correlation

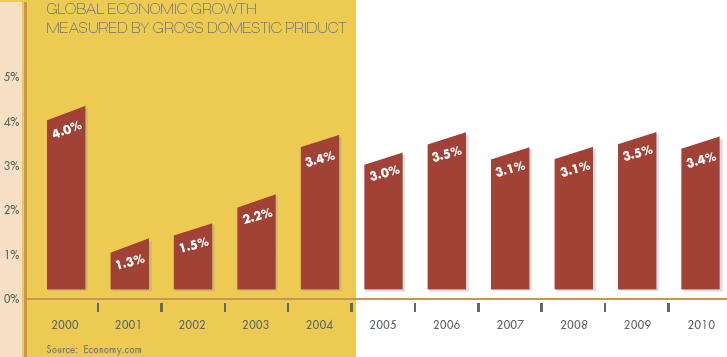

Demand for jewelry and diamonds is inextricably intertwined with the economic cycle: when the global economy is growing, sales of jewelry are strong.

When the global economy cools, sales of jewelry

Several factors will have an impact on global economic growth in 2008. Many of them have their roots in 2007 or earlier.

• Impact of Commodity Prices – Commodity prices, including oil, are sky-high. The high prices of these goods cut into consumer discretionary income.

• Impact of U.S. Housing Market – A shaky U.S. housing market hurts demand for luxury goods spending by U.S. shoppers. In turn, slowing U.S. demand for jewelry causes the worldwide jewelry industry to slow.

• Impact of Soft U.S. Economy – Below average economic growth will cap consumer demand. Further, consumer spending by Americans is at risk due to weak housing prices, high debt burdens and slowing job growth and wage gains.

• Impact of China’s Economy – Although China’s economic growth is expected to remain robust, export growth will slow due to fewer shipments to the U.S. Overall, economists are predicting China’s export sector will soften in 2008. However, while the Chinese claim they have more-or-less removed the U.S. dollar – Renminbi peg, China’s currency still reflects the value of the dollar. Therefore, as the dollar continues to weaken (consensus economic forecasts call for a weaker dollar in 2008), China’s exports remain a value in world markets, creating continuing trade deficits.

• Impact of Business Spending – The weakening trend in business confidence and the risk of a new shock to the financial markets poses a threat to our forecast. Global corporate profits, however, are at record heights and balance sheets are strong. Therefore, if banks tighten, it won’t have an immediate devastating impact on the corporate segment of the global economy.

• Impact of U.S. Federal Reserve – The Federal Reserve’s decisive action to cut interest rates and prime the financial pump of the U.S. economy provided a muchneeded shot in the arm for investor confidence and helped settle unrest in financial markets around the world. Although financial liquidity remains strained, there are signs that banks are taking short term lending risks again, after shutting off the loan spigot in the late summer.

• Impact of Developing Nations – Economies of developing nations will help offset uncertainty in the American economy. However, these nations in Asia, India and elsewhere have only a modest impact on diamond demand.

When all of these factors are assimilated into a global economic forecast, the following is our outlook for economic growth worldwide. As we noted earlier, these growth cycles are highly predictive of diamond demand.

Diamond and Jewelry Market Analysis

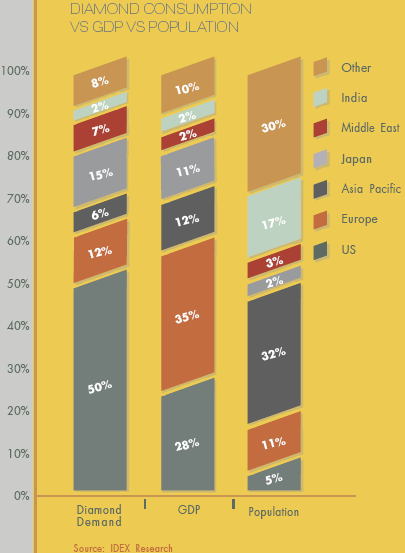

IDEX Research has segmented diamond and jewelry demand by major diamond consuming regions of the world. The graph illustrates the importance of each regional market by diamond jewelry consumption, economic impact and population. These statistics reflect actual results during 2006.

Here’s how to read this graph: The U.S. market represents about 50 percent of global diamond demand (left bar, bottom area), contributes about 28 percent of global GDP (middle bar, bottom area) and has about 5 percent of worldwide population (right bar, bottom area).

Based on this graph, it is easy to see that the U.S. and European markets account for almost two thirds of global diamond demand (by value), but represent only about 16 percent of worldwide population. Likewise, Japan’s demand for jewelry is also important in the global market, despite an

uncertain economy. The Middle East is one of the most important developing markets, but it still represents only 7 percent of total global diamond jewelry demand by value.

Market-by-Market Diamond Demand Forecast for 2008

IDEX Research’s comments on the outlook for diamond demand on a market-by-market basis are as follows:

United States - Economic Acceleration in the Second Half

If there is one economy under the microscope of every economist in the world, it is the U.S. economy. In part, this is due to the myriad of statistics that

are available from the government. In part, it is due to the sheer magnitude of the U.S. economy and its potential impact on every other economy in the world.

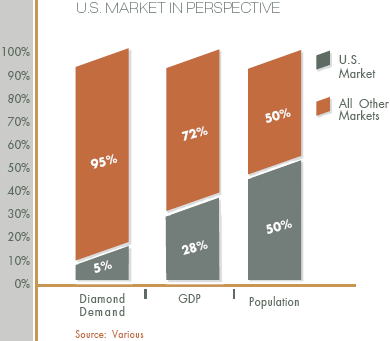

For the diamond industry, the U.S. market is by far the most important, as the graph below illustrates.

• Over the longer term, annual U.S. economic growth is in the 3.5 percent range. In 2007, it slowed to about 2 percent, and is expected to pick up to about 2.3 percent in 2008. Although this is not robust growth by historical standards, it is directionally positive. Further, on a quarterby- quarter basis, the first two quarters are expected to show anemic growth, with notable acceleration in the final half of the year. This would be a positive trend for jewelers, since they generate roughly 40 percent of their annual sales in the final three months of the year.

• The U.S. dollar is predicted to continue to lose value in 2008. Although several central banks in developed countries are calling for the U.S. to prop up its currency, there is not much the Fed can do. When it lowers interest rates, it almost guarantees the U.S. dollar will fall; without lower interest rates, the economy will sink into a recession. A weaker U.S. dollar is either bad news or good news, depending on your location in the diamond pipeline. Our basic assumption is that diamonds will continue to be denominated worldwide in U.S. dollars. Therefore, miners will be hurt, since mining costs are denominated in local currencies, which are rising against the dollar. Suppliers will also feel some impact from this trend. On the other hand, retailers in markets with strong currencies will be able to offer a better value to their customers, and improve their bottom-line profits.

• Jewelry sales in the U.S. market are projected to rise by 5 percent (a range of 4-5.5 percent) in 2008, with the possibility that diamond jewelry sales will post a slightly stronger gain. Jewelry sales in the early months of the year won’t be particularly strong, but holiday sales could be

Europe - Under Pressure

• The economies of the Euro-Zone, including the UK, are a mixed bag. The U.S. credit crunch has had a negative impact on the financial system of the region, though central banks throughout Europe reacted decisively. In addition, some regions in Europe are undergoing their own credit and housing crunch. Germany, an economy that depends on exports, is being hit by a slowdown in demand from U.S. customers due to a weaker dollar. The bottom line is economic growth in the European region will likely slip modestly in 2008 to about 2.6 percent annualized growth from this year’s 2.8 percent growth. That’s not a disaster, but it is directionally negative.

• Although output demand has probably peaked in Europe, relatively solid domestic demand combined with strong demand from Asia, Russia and the Middle East will help support growth. In Europe, unlike the U.S., consumer confidence levels and consumption are aligned. Unfortunately, there are signs that consumer discretionary spending will be pinched in 2008.

• Despite a common heritage, European consumers are not like American consumers when it comes to spending for jewelry: they just don’t buy luxury goods with the same zeal. Soft economic growth

Asia-Pacific - Slowing Growth, But it Means Nothing

• Economic growth in the Asia-Pacific region of the world is expected to slow in 2008. But this means only that the current torrid pace of economic growth will slow to a less torrid (but still torrid by global standards) pace in 2008. Economists are forecasting that the economy in the region will post a growth rate of just over 6 percent in 2008, down from about 7 percent in 2007. But on an individual basis, China’s economy will cool to a 10 percent growth rate from near 12 percent in 2007; that's meaningless to the jewelry industry.

• With China’s appetite for goods, its exportoriented neighbors will benefit in 2008. Further, despite some slowdown in U.S. demand, which will take the froth off Asia’s export business, buoyant economic activity in most other regions of the world will help cushion the impact of weak exports to the U.S. Further, the torrid pace of industrialization in the region and the surge in infrastructure development will help keep economic growth well above average.

• Despite being the home of roughly one-third of all the people in the world, the Asia-Pacific region consumes just 6 percent of all diamonds and diamond jewelry. We never look a gift-horse in the mouth, but this horse’s appetite just won’t matter much to diamantaires.

Japan - Pessimism Continues

• At some point, Japan will pull out of its economic slump. Economists have been looking for that inflection point for several years, and it always seems just over the hill. The forecast for 2008 is no exception: economists are predicting economic growth of a puny 1.8 percent, down from 2007’s estimate of 2.1 percent. Directionally, Japan seems to be sliding into a black hole.

• Capital spending and investing are weakening. Lingering domestic deflationary pressures continue to act as a drag on household spending as consumers put off expenditures in hopes of lower prices. Further, Japan’s ongoing turmoil in the financial markets is also a damper on economic growth. The only good news is Japan’s export sector seems to be posting solid gains.

• Once again, diamantaires will need to be patient with their customers in Japan. In 2006, Japan’s impact on worldwide diamond demand shrank from 16 percent of total consumption in 2005 to 15 percent of consumption in 2006; no other market showed a notable annual change in consumption patterns.

India - Solid Growth, Both Short and Long Term

• In 2008, India’s economic growth will slow from a gallop to a fast trot. In 2007, India’s economy leaped ahead at a 9 percent pace; in 2008, growth could moderate to about 8 percent or slightly above. The best news is economic growth is balanced between government spending, business investment and consumption by shoppers. This economy is in a long term horse race that it will win.

• The biggest problem for India is its aging and crumbling infrastructure. You can read about it, and you can see pictures, but unless you experience it, you really do not know. During our recent visit to India, it took us more than one hour and 15 minutes to drive between the diamond processing towns of Surat and Navsari, a distance of just 40 kilometers (25 miles) on a road that was mostly potholes and over bridges

• Anyone who has been following our forecasts knows we think India is the next big market for jewelry and diamonds. We recently spent two weeks in the Indian countryside, visiting diamond and jewelry producers, and one thing is very clear: India is open for business. The surprise is India is able to produce quality goods, especially with larger stones. No longer is this country “cheap, cheaper and cheapest.” Diamantaires should focus on the Indian market, both in 2008, when economic growth will be robust, and beyond, when economic growth will be more robust. India’s middle class, once estimated to be about 300 million people (the size of the entire U.S. market), is now estimated to be closer to 400 million people. This is multiples of the size of the middle class of China, which will also be a rich market – in ten years.

Middle East - Solid Growth

• They are but specks on the map – Dubai and Riyadh, for example – but they hold solid long term potential for economic growth. With this economic growth comes increased diamond demand. With high energy prices, much of the Middle East is awash in cash. Local consumers are spending this cash like it is water.

• Many of the local Middle Eastern economies are attempting to boost jewelry demand from tourists. For example, Dubai is positioning itself as the luxury goods capital of the world. It already has a huge niche in the gold and diamond jewelry business, and it plans to carve a niche for other luxury goods, including colored gemstones.

• The women may wear an abbaya, but underneath there are some of the most exquisite luxury products such as jewelry and clothing. And the men of the region know how to buy jewelry for their wives. Jewelry and diamond demand is expected to continue to rise in the Middle East for the foreseeable

future. Even if global GDP slows, consumers in this geopolitical region have plenty of reserve cash to spend as they please.