IDEX Online Rough Diamond Market Report: Is It A Bubble?

March 03, 11

At BHP's Spot Market, prices increased by some 17%, DTC followed with a 7% average hike and Alrosa is expected to increase prices too |

As expected, the DTC raised prices on many of its boxes at the second Sight of the year. The price of many boxes was increased by 4-8 percent, with the average overall increase estimated at about 7 percent. The Sight is estimated at $570-$600 million.

A number of producers, dealers and others that spoke with IDEX Online this week were wondering how come the market is willing to pay so much for rough, particularly, how can polishers afford the goods, when they complain that rough is too expensive and the increase in the prices of rough are outpacing increases in polished prices. Manufacturers, in turn, tell IDEX Online on condition of anonymity that they can protect their profits.

Not that they take it easily. One Sightholders called DTC's price hikes an "earthquake." Yet, they can swallow the hikes due to very high demand for polished diamonds driven by renewed consumer purchases and subsequent inventory replenishments. This is seen mostly in

Against this increase in consumer demand, diamond production is still below pre-crisis levels and manufacturing is still trying to catch up. It should also be remembered that the cost of manufacturing is rising, a result of increased labor costs.

Of course, not all purchases are for manufacturing. Some view rough diamond buying as a futures market, sure that price will continue to increase. The trick, however, is to turn around the goods very quickly.

Finally, polished prices are rising swiftly, although, it’s not clear how long this is going to continue. Historically, prices increase just before important trade shows, especially when a strong sense of optimism is in the air. After the shows, prices tend to slide. On Friday, the

So, are rough diamond prices a bubble about to burst? Demand for smaller goods is solid, while for bigger goods the demand is viewed as less steady, and their prices may soften, though don't expect a collapse. In other words, it's not a price bubble, though they may be just a little too "fluffed."

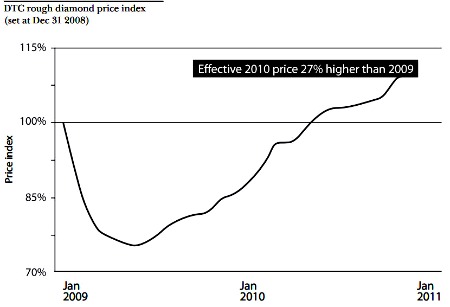

Rough diamond prices fell sharply and recovered quickly, passing the pre-crisis high, as this DTC two-year rough diamond price index shows Source: DTC |

Prices & Premiums

In the past, sharp price hikes were met with a decrease in paid premiums, but that was not the case this time. Not only that premiums did not shrink, premiums continued to increase during the Sight week .

And so, Commercial Spotted 4-8grs, which the DTC increased its price by more than 7 percent, fetched an additional 10 percent on the secondary market. Makeable 4-8grs was hiked +8 percent by the DTC and another 12-13 percent by the market. Sawables 3grs +7 are up 5 percent and the premium added another 10 percent. Demand for Makeables High 3grs +7 increased even though the list price was up 10 percent and premiums added another 20 percent to the price, a de-facto 32 percent increase. The high demand Preparers Low 3-6grs increased by 3.5 percent by the DTC and another 14 percent by the market, same as the Clivage 2.5-4 ct boxes.

The list goes on. The premium on the box called Blacks was 12 percent; many of the 2.5-4 ct boxes commanded an extra 10 percent, though for the 2.5-4 ct color box an 11 percent premium was paid.

The DTC supplied a sizable amount of ex-plan goods, mainly to

Demand did not skip BHP Billiton's Spot Market, a barometer of rough prices. BHP sold some $160 million worth of goods at its February sales event, 382,000 carats at an average price of about $418 p/c. The selling price of the +9 -8gr Rejections increased by more than 25 percent to about $38 p/c. The White 4-8gr sawables rose a 'modest' 6 percent, while the white 4-8gr clivage jumped by 13 percent to $492 p/c and a low cost 4-8gr item saw its price increase by 18 percent. Generally (with one exception, the white sawable) the price of the +9 -3gr items had a double digit increase – ranging from 13 percent to 26 percent.

Outlook

Prices of rough are set to continue their rally. Alrosa is expected to join the DTC and BHP and increase prices too. The DTC, seeing the continued large premiums, is expected to continue to try and eat away at them. This is renewing calls among some Sightholders that De Beers increase prices very sharply at once, as a form of shock treatment. If polished prices slide, the affect could be unpleasant for some.

Further down the line, Sightholders are focusing on their Sight application for the 2012-2015 contract period. They want to look good and sound good, which may generate some extra and not very necessary diamond buying activities.

Demand for DTC Boxes, Sight 2

| Article | Demand | Remarks on Demand |

| Fine 2.5-4 ct & Fine 5-14.8 ct | Very High demand for 2.5-4 ct and 5-14.8ct | Much higher demand compared to previous Sight |

| Crystals 2.5-4 ct & | Medium demand for both boxes | Higher demand compared to previous Sight |

| Commercial 2.5-4 ct & Commercial 5-14.8 ct | Medium demand for both boxes | Higher demand compared to previous Sight |

| Spotted Sawables 4-8 gr | High demand | Higher demand compared to previous Sight |

| Chips 4-8 gr | Good demand | Similar demand compared to previous Sight. |

| Colored Sawables 4-8 gr & Colored 2.5-14.8 ct | Very High demand for both sizes | higher demand compared to previous Sight |

| Makeables High 3 gr +7 | Very Good demand | Higher demand compared to previous Sight. |

| Preparers Low 3-6 gr | Good demand | Similar demand compared to previous Sight |

| 1st Color Rejections (H-L) | Very High demand | Higher demand compared to previous Sight |