IDEX Online Research: The U.S. – A Growing, Important Jewelry Market

June 30, 11

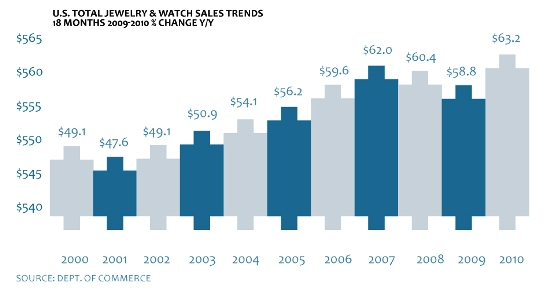

The size of American market makes it the most important jewelry market in the world. The U.S., with a population of more than 310 million people represents just under 5 percent of the world’s 6.9 billion people. The country’s economy, as measured by Gross Domestic Product, represents about 28 percent of the global economy. Most importantly, shoppers in the U.S. spent over $63 billion on jewelry and watches in 2010, or over 40 percent of the estimated $150 billion of jewelry and watches sold in the global market.

It has been said that “Americans are born to shop.” They have more aggregate discretionary spending power than any other consumer group in the world, and they invented the concept of “recreational spending.” The challenge for jewelers is how to tap this vast market opportunity.

The U.S.: A Growing Market for Jewelry

In 2010, American consumers bought more than $63 billion of jewelry and watches, as graph 1 illustrates. Jewelry represents about 88 percent of the $63 billion sales; watches represent the balance of about 12 percent of industry sales.

|

The U.S.: Important to the Diamond Industry

The U.S. is also important to the global diamond industry. American consumers purchase roughly 40 percent of all diamonds and diamond jewelry sold in the world, as measured by value (in U.S. dollars). Diamonds are traded in U.S. dollars in the world market.

Broadly, here are 2010 diamond and diamond jewelry sales trends in the global market as well as the U.S.:

· Diamond and diamond jewelry in the global market were up during 2010. Preliminary estimates suggest that worldwide polished diamond sales were about $64 billion, up about 9 percent from 2009. Polished diamond sales in 2010 were still far below their peak of $73.1 billion in 2007.

· Diamond and diamond jewelry sales in the U.S. market were estimated to be just over $25 billion in 2010. Previously published data for the prior year – 2009 – suggests that polished diamond sales in the U.S. were just over $22 billion, though we now believe that this number is too low. Despite an improvement in polished diamond sales in the U.S. market, 2010’s total diamond sales of $25 billion were far below the record year of 2007, when sales reached nearly $29 billion (revised).

U.S. Jewelry Retail Sales Showing Improvement

Retail specialty jewelers’ sales reflected the same bubble-busting trends that affected other retail sectors, as the U.S. economy – and the global economy – went into a tailspin during 2008. Initially, jewelry sales held up reasonably well in the first half of 2008, but plummeted in the final two months of the year during the all-important holiday selling season. These dismal sales levels caused retailers to virtually stop re-ordering replacement inventory during 2009. As a result, sales in the jewelry pipeline at the wholesale and manufacturing level fell by as much as 70 percent.

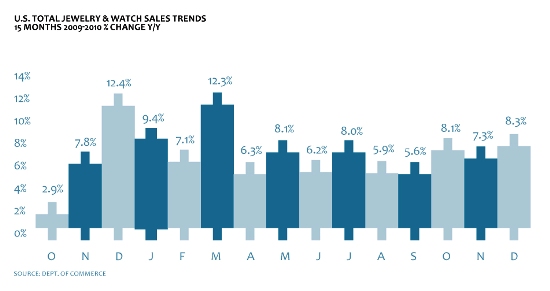

Total jewelry sales in the U.S. are showing a remarkable recovery. Graph 2 illustrates monthly sales trends at all merchants who sell jewelry in the U.S. market, including discounters, mass merchants, specialty merchants and non-store retailers, as well as specialty jewelers. For all of 2010, jewelry sales were up by mid-to-high single-digit levels each month. The total market for jewelry in the U.S. was about $63.2 billion in 2010, a record level.

|

|

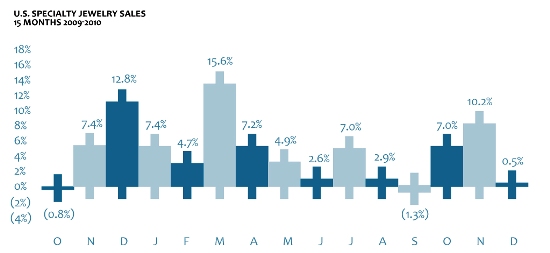

Specialty Jewelers’ Sales Recover

Specialty jewelers’ sales have also shown significant improvement, especially during the all-important 2010 holiday selling season, as graph 3 shows. We note, however, that specialty jewelers’ sales have not recovered as rapidly as jewelry sales at other merchants. Specialty jewelers including chains and smaller independents generated just under half of all jewelry sales -$29.7 billion in 2010 – out of a total of $63.2 billion of U.S. jewelry sales.

|

Why Buy Jewelry – An Enduring Product for the Ages

Jewelry is not a fad product; archeologists tell us that humans have worn jewelry for at least 100,000 years. In its earliest days, people wore jewelry to denote their social and cultural identities: wealth, power and privilege. Early jewelry also provided identification of gender, age and social class. After thousands of years, these same factors drive demand for jewelry today.

The so-called Great Recession of 2008-2009 will not derail humans’ cultural affinity to buy jewelry. Jewelry sales and share-of-wallet studies during 2010 and early 2011 confirm this trend.

Why Do People Buy Jewelry?

In his book, Call of the Mall, retail guru Paco Underhill says that jewelry has traditionally been purchased by men for women for one of three reasons:

· Keys to the front door – Engagement, anniversary, birthday, all public statements of affection and intention.

· Keys to the back door – Presents for the mistresses or girlfriends that are meant to ensure access, but bypass all the front-door commitments.

· Keys out of the doghouse – To make amends for bad behavior. Flowers are nice, but of limited power to affect a woman’s mind. Nothing says “Dear, I am so sorry!” like a fine necklace or a pair of diamond earrings.

While men buy more than half of all jewelry, at estimated 98 percent of all jewelry, by value, is worn by women.

The Psychologists’ Viewpoint: Jewelry Differentiates Us

For centuries, jewelry has been used to denote wealth, power, class and status. With jewelry, the wearer is saying, “I’m different from the rest of you.” Psychologists would agree: they would tell us that people buy jewelry to differentiate themselves. Thus, jewelry, as ornamentation that is similar to other fashion accessories such as scarves, handbags, shoes, sunglasses and cosmetics, offers us a chance to say, “I’m different.” Recently, tattoos have become more popular; they, too, are a way of differentiating one’s self.

American Consumers: Image Is Everything

Americans have serious issues with their physical appearance, and many are willing to try anything to give their image a boost – even if it means a nip here, a tuck there. According to an American Demographics survey, 87 percent of adults say that if they could change any part of their body for cosmetic reasons, they would.

Primping and preening are inherent human characteristics. Psychologists also tell us that women are more likely to care about how they look; men measure themselves by what they can do. That’s why we have beauty contests for women, and wrestling matches for men. It is inherent in the human psyche; thus, it is no surprise that most jewelry is worn by women.

Why Consumers Shop: “The Urge to Splurge”

A great majority of American consumers value shopping as an activity in its own right. Two-thirds of all women say shopping is relaxing and enjoyable, and more than half list it as one of their favorite activities. Among teenage girls, 93 percent cite recreational shopping or “store hopping” as their favorite activity. A researcher at WSL Strategic Retail says, “Shopping in the U.S. isn’t purely about need. It’s about our emotional connection to who we are and how we live.” Shopping is so much a part of our lives that it is both a necessity and therapy. The time-pressured American consumer uses “retail therapy” to relieve stress, celebrate and to improve their mood.

Shoppers Tell Us Why They Buy Jewelry

There are two sets of factors that consumers use to determine why they buy jewelry. The first set relates to the decision to shop for jewelry. The second set of factors relates to the actual purchase of the jewelry.

In the first set of factors, consumers tell us that they buy luxury items such as jewelry for these reasons, ranked most important to less important, according to an Advertising Age study:

· To buy things I know will last

· For my well-being

· To enjoy my favorite brands

· To feel good about myself

· To indulge myself

· To express myself

· To be able to rationalize my purchase

· To feel successful

· To be optimistic

· To be lighthearted

· To make an impression

· To be fabulous

· As a status symbol

Many big ticket durables purchases are not made rationally. Using an automobile as his example, consumer psychology expert Charles Kenny of Memphis says that most people think they choose a car rationally. “Not so,” says psychologist Kenny. Car choice comes from the right side of the brain – the emotional, irrational side. It’s driven by psychological needs that most of us don’t recognize. That’s why we go to the dealer to buy a subcompact, but end up driving home in a racier model with four-on-the-floor. The bottom line: How does this purchase make you feel? Kenny could just as easily be talking about jewelry.

Another study by realtors shows that people buy homes emotionally and support their decision with logic. Coldwell Banker says that if real estate agents can create a high “wow” factor from the time the potential buyers open the front door until they leave, price becomes less relevant. Hearts On Fire, the premium diamond brand learned this long ago: its diamonds have a high “wow” factor and sell well, despite being priced above other premium diamonds.

A study conducted by National Jeweler magazine uncovered the top 10 reasons women wear gold jewelry:

· Sentimental value

· Feel good about self

· Express individuality

· Be modern and up-to-date

· Be cool and trendy

· Make a good first impression

· Look professional at work

· Make a good impression on the opposite sex

· Be admired and respected

· Display wealth and status

Jewelry Is Generally A Planned Purchase

According to a study by JCK Magazine, about two-thirds of all jewelry is a planned purchase, while the remaining one-third is an impulse purchase.

When jewelry is a planned purchase, consumers cite “price” as the most important factor that determines which piece of jewelry they are likely to buy. After “price”, the following factors are most important, ranked in order from most important to less important, according to the JCK Magazine study.

More than 50 percent of jewelry shoppers cited these factors as most important:

· Product quality

· Salesperson’s honesty

· Service

· Store reputation

· Salesperson’s knowledge

Branding Becoming More Important

Unlike the watch industry which is all about brands, the jewelry industry has few highly recognizable brands. Hearts on Fire, David Yurman, Roberto Coin, Tiffany and a few others have a reasonable level of brand recognition with consumers. But, basically, the jewelry industry is still dominated by unbranded goods, or in some cases private label or created brands that sound like national brands. Estimates in the industry suggest that less than 15 percent of all jewelry sold is a highly recognized brand.

Jewelry Is Purchased As A Gift

About 88 percent of all jewelry is purchased by someone in the household that is buying it – husband buying diamond jewelry for his wife, wife buying a fine watch for her husband, jewelry purchased for first communion or similar life cycle events – while just under 12 percent of all jewelry is purchased as a gift for someone outside of the household.

Celebrities Sell Jewelry

As a young impressionable mind (read: teenager) why they buy jewelry, and they are likely to answer, “Because my favorite musician wears it.”

Research was done to determine if it really made sense to supply celebrities with flashy jewelry for public events in Hollywood. The answer: definitely, especially for young consumers. The key question that returned these findings was this: “When you have found yourself wanting possessions that others have, those people are most often...”

Jewelry Is Not An Investment Product

Many consumers perceive jewelry as an investment. At most, it may be an “emotional investment” to preserve the memory of a life cycle milestone event. But it is not a financial investment such as a stock, bond, home, or savings account. The value of precious metals, such as gold, and gemstones represent only a fraction of the retail price of the jewelry; labor is often the largest cost component of jewelry, especially among lower-priced goods.

During the 2008-2009, many jewelers began purchasing consumers’ gold jewelry. This was driven by two factors: 1) some consumers needed extra cash; and, 2) gold was rising sharply in price. As a result, consumers have begun to perceive that precious metal jewelry has a store of value, and could be a long-term investment.

Jewelry’s Competition

Industry research shows that diamond jewelry’s most important competition is a cruise or major vacation trip. The following is a list of spending priorities for discretionary income compiled by JCK Magazine:

· Vacations

· Investments

· Fine jewelry

· Collectibles

· Antiques

· Luxury car

· Boat

· Fur coat

· Art work

· Spa resort

What Jewelry People Buy – Fashion Is Important

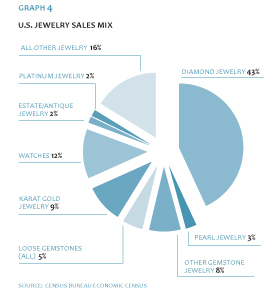

Marilyn Monroe said it for American jewelry shoppers: “A diamond is a girl’s best friend.” More than 40 percent of all jewelry bought by U.S. consumers is diamond jewelry or loose diamonds. The second largest category is watches with a 12 percent market share, followed by precious metal jewelry (primarily gold) and other gemstone jewelry, both of which have only a single-digit market share.

Graph 4 illustrates jewelry sales in the U.S. market by broad jewelry segments, based on the latest data from the Census Bureau’s Economic Census. This sales mix includes jewelry sold at all retail outlets, including specialty jewelers as well as multi-line merchants (Wal-Mart, J.C. Penney), online sellers and others.

|

|

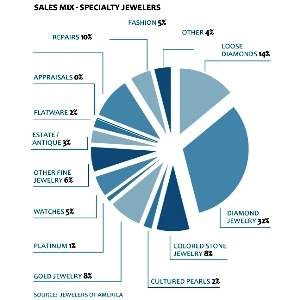

Specialty Jewelers’ Sales Mix Shows Bias Toward Precious Metals & Precious Gemstones

The Jewelers of America (JA) Cost of Doing Business Survey provides the most credible snapshot of the sales mix of a typical independent or small chain specialty jewelers in the U.S. In addition, it provides the most detail by product category.

Graph 5 illustrates the detailed sales mix from the most recent survey for independent specialty jewelers in the U.S. market.

|

It is important to understand that the jewelry sales mix varies widely by retailer. For example, at Sterling Jewelers, which operates stores under the names of Kay Jewelers, Jared and some regional brands, diamond jewelry is an extremely important product category which generated 76 percent of sales in 2009. At the other end of the range, leased jewelry departments in major U.S. department stores generate less than 25 percent of their sales from diamond jewelry.

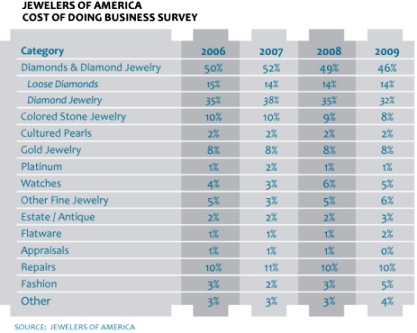

Changes in Sales Mix

Table 1 summarizes changes in specialty jewelers’ sales mix between 2006 and 2009, the latest data available.

It is notable that diamond jewelry sales continue to decline. According to a survey by The Edge, diamond jewelry sales were 43 percent of a typical specialty jeweler’s sales in 2010, down from about 52 percent in 2007. In part, consumers are spending less per piece of jewelry; since diamond jewelry is expensive compared to most other jewelry, shoppers are buying less expensive fashion jewelry. In part, consumers are looking for “something new”, and diamond jewelry producers have not kept their merchandise fresh.

|

Current Trend: Fashion Jewelry In Demand

In the current market, traditional jewelry demand has given way to several new sub-categories, including the following:

· Fashion jewelry

· Unique jewelry

· Annuity merchandise (charms and beads, for example, that create repeat sales)

· Custom jewelry

· Estate jewelry (or an “estate” look)

· Bridal jewelry

· Silver jewelry

Weaker-than-average jewelry categories include the following:

· Gold jewelry

· Diamond solitaire jewelry

· Watches (there has been a modest recovery in recent months)

Americans Buying Lower-Priced Jewelry

Not only have key jewelry retail price points declined in the post-recession period, but the value of the average retail ticket has dropped up to 10 percent for some jewelry categories.

There are two reasons for the decline in the value of the average retail ticket and key price points for jewelry. First, consumers are seeking value-priced goods. With smaller bonuses and paychecks, American shoppers have had to rein in their spending patterns and cut back on debt. Despite media reports to the contrary, peak-to-valley jewelry sales only fell by just over 5 percent on an annual basis during the 2008-2009 recession. In other words, the desire for jewelry is ingrained in the shopping culture of the typical American, and no recession or depression or other cataclysmic event seems to be able to break this cultural habit. But, it is important to note that shoppers sought value-priced goods, and the average retail price point for jewelry fell by up to 10 percent during the recession, depending on the category.

An increasing number of shoppers are purchasing jewelry – especially diamond jewelry – online. Online jewelry merchants offer significantly lower prices than store-based jewelers. Thus, as the mix of lower-ticket online jewelry purchases rises, the average ticket for all jewelry has begun to decline. Unit jewelry sales are holding up – and could increase if shoppers discover the values offered online – but the value of the average ticket is down.

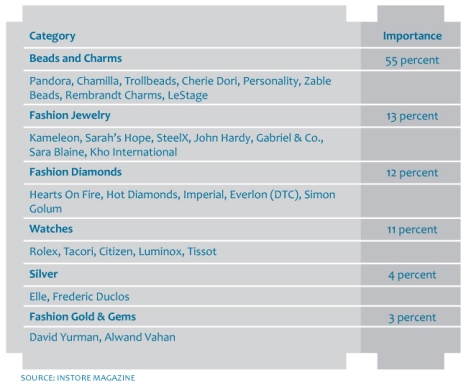

Consumers Seek Jewelry Brands

American consumers love brands! They wear clothes with the brand logo showing on the front and back of the garments. They buy goods based solely on the brand name, seemingly regardless of the quality or value. Brands bring credibility to merchandise that might otherwise be a commodity.

Recently Instore Magazine polled American specialty jewelers to determine what branded jewelry shoppers desired. Table 2 summarizes responses from a cross-section of retail specialty jewelers. The percentages shown illustrate the number of times that a particular category was mentioned as “very important” for jewelers to carry. The brands most mentioned are shown following each category.

|

When People Buy Jewelry – Mostly Event-Driven Demand

Beyond the basics such as food, most retailing is event-driven. In a society with high levels of discretionary income, merchants must create reasons – usually events – to drive shoppers to their stores.

In the jewelry industry, sales are largely driven by three types of events:

· Calendar Events

· Holiday – Christmas, Kwanzaa, Chanukah

· Valentine’s

· Mother’s Day

· Life Cycle Events

· Weddings / Anniversaries

· Births / Birthdays

· School Graduation

· Religious Events – First Communion, Bar/Bat Mitzvah

· Other Events

· Merchant-Created Events – Trunk Shows, “Midnight Madness”

· Impulse – “I Just Want It Now” – Generally Self-Purchase

Calendar Events Are Important to Jewelers

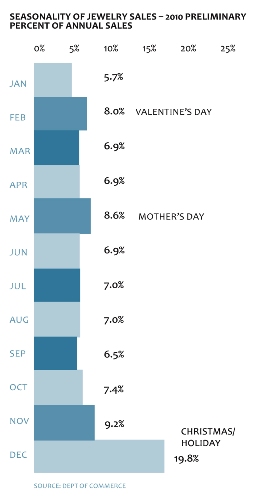

Key calendar events create jewelry demand in the U.S. market (as well as other global markets) that tends to be highly seasonal. For example, the typical American jeweler generates nearly one-third of annual revenues in the all-important November-December Holiday Selling Season. The other two key calendar events that drive jewelry demand are Valentine’s (February) and Mother’s Day (May). However, these events are only minor, when compared to the Holiday Season of November-December, as graph 6 illustrates.

|

The most notable change over the past decade is the percentage of business that specialty jewelers do in the month of December. Just over 10 years ago, specialty jewelers generated one-quarter of their annual sales during December. In 2010, a relatively normal year in the post-recession period, specialty jewelers generated only one-fifth of their annual sales in December.

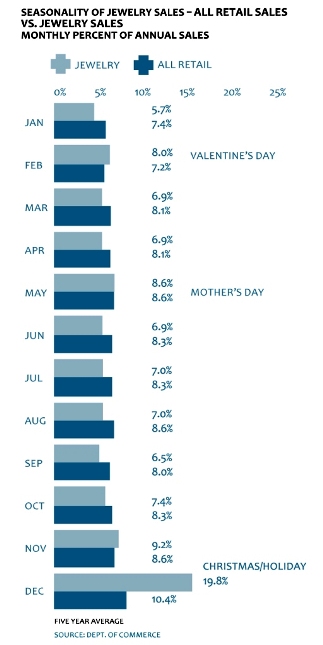

Jewelry: Demand Is Highly Seasonal versus Other Retail Categories

While retail sales are greater in the November-December holiday period – driven mostly by Christmas – jewelry sales are particularly seasonal. Graph 7 compares the seasonality of jewelry sales by month to the seasonality of all retail sales (ex-automobiles) by month. Data is preliminary for 2010.

|

Life Cycle Events Are Less Seasonal

The most important life cycle event driving jewelry demand is the wedding market. The bridal market – engagement rings, wedding bands, attendants’ gifts – represent up to 40 percent of a mass market jeweler’s annual sales. For high-end jewelers, bridal sales represent about 20 percent of annual sales.

Contrary to popular opinion, the traditional “June bride” is a myth: August is the biggest month for weddings.

Births Rate by Month Shows Little Seasonality

A gift of jewelry often marks the birth of a baby. Further, some families have a tradition to mark each birthday with a gift of jewelry. Births and birthdays have little seasonality, based on the latest data from the National Center for Health Statistics.

Other Events Driving Diamond Jewelry Demand

While weddings and diamonds go together, there are many other life cycle occasions that trigger the purchase of diamond jewelry.

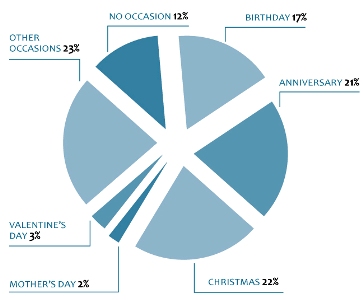

Graph 8 illustrates the large number of events creating demand for non-bridal diamond jewelry in the U.S. market, based on data from the former Diamond Information Center.

|

No Special Occasion Is Needed to Buy Jewelry

Research suggests that about one-third of all jewelry is purchased on impulse, mostly by women. Research also confirms that women are more likely to buy jewelry on impulse than men.

About 12 percent of all diamond jewelry is purchased with “no special occasion” in mind, while another 23 percent is purchased for “other occasion” which is often translated to “I-just-want-it-now.”

Self-purchasers of jewelry are a relatively new consumer group. Shoppers don’t need to be married or have a man buy jewelry for them anymore. (Research about self-purchasers of jewelry is detailed in the section, “Who Buys Jewelry.”)

Economic Cycles Drive Jewelry Demand

Aggregate demand for jewelry in the U.S. market is highly sensitive to economic cycles. When the economy is strong, jewelry demand typically soars. When economic activity is lagging, jewelry demand typically is very weak.

However, during the recession of 2008-2009, there were two unusual changes in demand: 1) jewelry sales did not drop as much as historic trends would have suggested; and 2) bridal demand remained relatively robust.

Where People Buy Jewelry – A Crowded Marketplace

The quick answer to the question, “Where do Americans buy jewelry?” is “almost anyplace.” Choices. That has always been a hallmark of American retailing. Lots of choices: what to buy, where to buy it, how much to pay for it and when to buy it.

More Retailers Selling Jewelry

If you think that there’s more retail competition than ever selling jewelry in the U.S. market, you are correct. While the number of specialty jewelers has shown a steady, though modest, decline, the number of retailers – typically multi-line merchants – who also sell jewelry has risen steadily.

· The number of specialty jewelers’ doors in the U.S. has declined by about 2 percent annually over the past five years to about 22,800 doors currently, down from about 26,600 in 2004, according to the BLS.

· The number of “other” merchants selling jewelry has increased by about 3 percent annually over the past five years to about 115,000 doors, up from about 99,700 doors, according to the latest CenStat data. These 115,000 doors that sell jewelry along with other merchandise represent about 10 percent of all retail stores in America.

Overall, the number of retail establishments in the U.S. fell by 26 percent in the U.S. between 1992 and 2007, though it is important to note that the total square footage in U.S. shopping centers has risen by about 32 percent in the same period. Why? It is no secret that the number of small mom-and-pop retail merchants has declined sharply in the U.S. as large chains and big box retailers have replaced these small independent merchants.

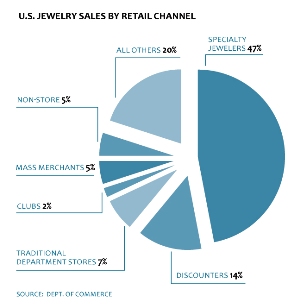

Where Jewelry Is Sold

Where can a shopper buy jewelry in the U.S.? Of the almost 138,000 retail merchants selling jewelry, according to the Census Bureau’s Economic Census, roughly 16 percent of them – 22,800 – are specialty jewelers, the traditional retail outlet for jewelry sales. It is important to note, too, that the 138,000 retailers of jewelry do not include an estimated 41,000 jewelry merchants who have no paid employees.

While specialty jewelers’ doors – 22,800 – represented just 16 percent of the stores where jewelry is sold, their sales represented about 47 percent of total U.S. jewelry industry sales in 2010.

There are a large number of competitors vying for shoppers’ jewelry expenditures. Table 3 summarizes the major merchants who sell jewelry in the U.S. market by number of establishments.

|

* All Other – Includes stores that also sell furniture, home furnishings, consumer electronics, food & beverage, health & personal care items, hobby merchandise and books, as well as non-store retailers (catalogs, online, home party merchants).

Long-Term Bias Away From Specialty Jewelers

The retail industry has been consolidating for several decades, driven largely by consumers’ desire for convenience and value, with a wide variety of goods in one location at reasonable prices. As a result, there are fewer and fewer specialty retailers in almost all retail categories.

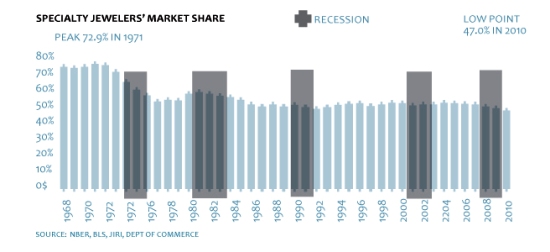

About four decades ago, specialty jewelers sold nearly 75 percent of all jewelry in the U.S. Since then, they have been losing a small amount of market share each year, with a significant loss of market share in recessions.

There is no reason to believe that specialty jewelers will suddenly regain market share, especially given consumers’ long term shift toward big box retailers and online merchants, both of which offer a stronger perception of value.

Graph 9 summarizes the decline in specialty jewelers’ market share over the past four decades. The yellow highlighted years are recession periods.

|

While the jewelry industry remains highly fragmented, it has begun to undergo some consolidation. The pace waxes and wanes, depending largely on the economic cycle. When the economy slows, jeweler failures usually accelerate, lagging the economic cycle by just under a year.

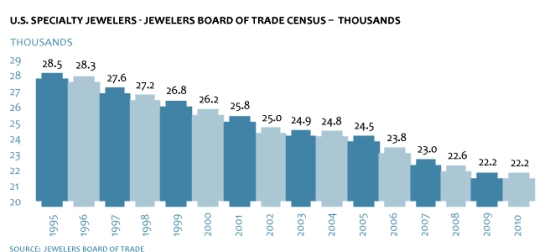

Jewelers Board of Trade Data Shows Decline in Specialty Jewelers

As graph 10 illustrates, the Jewelers Board of Trade (JBT) data shows a total of 22,164 jewelry firms at the end of 2010, just a few less jewelers than at the end of the prior year. However, two decades of data from JBT shows a steady decline in specialty jewelers in the U.S. It is important to note that JBT counts chains such as Zale and Kay as one “firm” each. Census data from most other sources count each store individually.

|

U.S. Specialty Jewelry Industry Remains Dominated by Small Jewelers

The U.S. retail jewelry industry is bifurcated: retailer specialty jewelers are either single-store merchants (90 percent of businesses) or chains (about 10 percent of businesses).

· About 90 percent of the 22,800 specialty jewelers in the U.S. – just over 20,000 firms – generate annual sales of $2.5 million or less. Most of these firms operate only one or two stores, as table 4 shows.

· The top 13 specialty jewelers in the U.S. market – all of whom generate more than $100 million in annual sales – generate 14 percent of total U.S. jewelry sales. These firms generate an aggregate of more than $8 billion in annual revenues for specialty jewelry.

· Broadly, the large jewelers are getting larger, and small jewelers are dropping out.

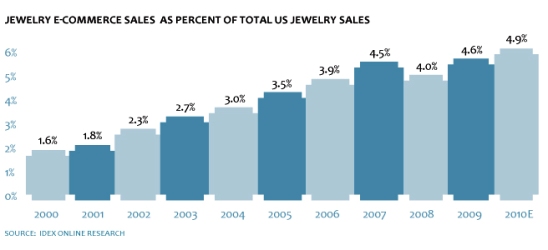

Impact of Online Jewelry Merchants

Online jewelry sales in the U.S. market in 2010 were estimated to be slightly over $3 billion, or just under 5 percent of total jewelry sales, according to preliminary data from the U.S. Department of Commerce. Graph 11 summarizes jewelry online sales for the U.S. market for the past decade.

|

In contrast, total online commerce for all retail categories was about 4 percent of total U.S. retail sales.

The primary reason online jewelers have captured significant market share is because of the product mix of online jewelry sales. In a typical specialty jeweler’s store, about 43 percent of the sales are diamonds and diamond jewelry which carry an average ticket (at the mass market level) which is double the average ticket of the entire store.

Online merchants, by contrast, generate an estimate 70 percent of their sales from diamond jewelry, with its inherently higher average ticket. Further, the average ticket for online jewelers who specialize in diamond engagement jewelry is far higher than a store-based merchant.

Among bricks-and-mortar stores in the U.S. market, the average ticket for a diamond engagement ring is about $3,200. For specialty jewelers, the average diamond engagement ring ticket is just over $4,500, while Blue Nile’s average ticket for a diamond engagement ring is about $6,100.

Further, Blue Nile’s average jewelry ticket is nearly $2,000 while the typical mass market jeweler generates an average ticket of about $350 and a better-end AGS type jeweler generates an average ticket of nearly $1,100. Thus, online jewelers are “skimming the cream” by taking the big ticket sales that generate significant gross profit dollars, even though the online jeweler’s margin is far below the industry average for a store-based jeweler.

Jewelry Shoppers Have Many Alternatives for Buying Jewelry

Where do shoppers buy jewelry in the current market? Graph 12 summarizes the key retail outlets for jewelry sales in the American market. Discounters and online jewelers – those merchants offering the perception of value – have been taking market share from traditional jewelry merchants.

|

|

Who Buys Jewelry – Follow The Money

They say money can’t buy happiness, but it can buy jewelry. And that gives some consumers pleasure. Give American shoppers a little money, and they will buy a little jewelry. Give them a lot of money, and they’ll buy a lot of jewelry. It’s that simple.

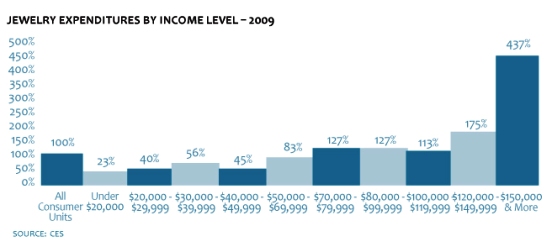

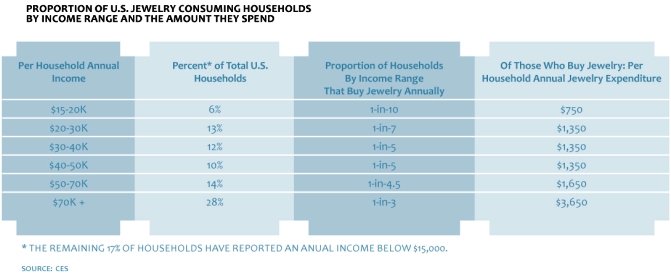

A consumer’s income level trumps every other demographic factor that has an impact on a shopper’s jewelry expenditures. The more money a person makes, the more likely they are to buy jewelry.

The relationship between income and jewelry expenditures is logarithmic: as income rises linearly, jewelry spending rises exponentially. For example, a household earning $25,000 annually spends about 40 percent of the national norm annually on jewelry. A household earning $150,000 – or six times as much – spends more than 400 percent of the national norm annually on jewelry, or more than 10 times as much.

There is an almost perfect mathematical correlation between consumers’ income levels and their jewelry expenditures, as graph 13 illustrates. Prior years’ data reflects this same trend.

|

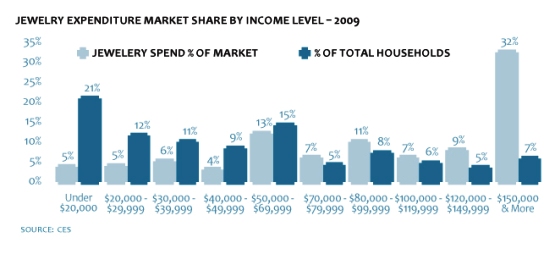

High income consumers spend disproportionately on jewelry. While the proverbial 80/20 rule does not apply, it is close: 18 percent of all American households – those making $100,000 or more annually – are responsible for nearly half (48 percent) of all jewelry expenditures, as graph 14 illustrates.

|

All Ages Buy Jewelry

Historically, there were two distinct age groups which purchased jewelry: 1) the twenty-something diamond engagement ring shopper; and 2) older consumers who no longer were supporting children, educations and second homes.

However, it now appears that shoppers of all ages are buying jewelry. In the recession, younger consumers – ages 25-44 – continued to shop for jewelry at a greater pace than their parents. Why? Most of the older consumers – Baby Boomers – saw a sharp decline in their wealth levels due to a drop in the stock market and housing values.

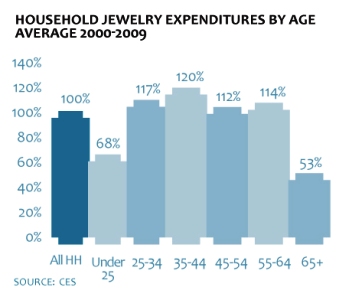

Despite all of these year-to-year variations in jewelry spending patterns by age, when jewelry purchases by age are averaged for the past ten years, it is clear that consumers of all ages now buy jewelry, both for themselves and as gifts. Graph 15 illustrates household jewelry expenditures by age group.

|

New Consumer Segments

Three distinct new jewelry consumer segments are emerging in the American market:

· Younger Wealthy Consumers – Historically, young consumers purchased an engagement diamond ring, and did not visit their local jeweler until they reached the age of about 50.

However, today young shoppers are among the most important consumer segments for jewelers. They are 25 to 44 years old and include older Millennials (Gen-Y) shoppers and younger Gen-X Americans. They are typically married, have no children and both work. Their work is likely to be in a high-paying industry such as information technology (IT).

Further, many of these young consumers do not yet have stock portfolios. When the stock market dipped dramatically in 2007 and 2008, their personal wealth did not suffer. In addition, many of the younger consumers – under 30 years of age – do not yet own a home, so they have not been affected by the sharp decline in home values.

In 2005, there were 42,000 Millennial consumers – those aged 24 and younger – who earned $100,000 or more annually. By 2015, the Census Bureau estimates that 2.2 million Millennial consumers – who will be aged 34 and younger by then – are expected to be earning $100,000 annually or more. This group offers huge market potential for jewelers.

· Self-Purchasing Females – While jewelry has always been bought and worn mostly by females, there was typically a male in the background funding the purchase. However, a new consumer segment of self-purchasing females has emerged. Those females have significant discretionary income, and they are willing to spend it on themselves.

By 2050, there will be an additional 50 million women in the U.S. population, according to estimates by the U.S. Census Bureau. At least half of those women will be employed outside of the home. They will have substantial discretionary income, and they will become one of the most important consumer targets for American jewelers.

· Bridal Customers – Driven by a baby boomlet in the late 1980s, the number of weddings is expected to rise substantially over the next several years, with a peak coming in 2016 or 2017. Currently, about 2.1-2.2 million couples marry annually in the U.S. Over the next decade, the number of couples marrying each year could reach 2.6 million. About 75 percent of all brides receive a diamond engagement ring. The total amount spent on wedding jewelry is $8,000-$10,000 per couple in the U.S. market.

Despite news reports to the contrary, the average age at which U.S. couples marry is not rising rapidly. Further, the marriage rate – couples per thousand – is relatively unchanged. The only change is this: the divorce rate in America is declining modestly.

How Americans Buy Jewelry – Credit Is Important

In an average year, the typical consumer spends just about 0.6 percent of take-home pay on jewelry. This “share-of-wallet” is calculated using spending on both goods and services (insurance, mortgage payments, etc) for the typical American consumer, based on newly revised data from the Department of Commerce (previously published data suggested that jewelry expenditures held a share of wallet of about 0.8 percent).

As expected, jewelry’s “share of wallet” dipped during the recession, but recovered somewhat during 2010.

Consumer Credit Availability Important to Jewelers

Historically, about half of all jewelry sold in the American market was purchased by shoppers on the monthly “easy-payment” plan. This does not include credit card sales (which are counted as “cash” sales by the merchant). The monthly payment plans may be administered by the jeweler, or by a third party (typically a bank).

There are two advantages for jewelers to offer “easy-payment” in-house credit plans:

· The average ticket for a credit sale is typically three times as large as a cash sale ($475 for credit versus $175 for cash with the average ticket being $350) for mass market jewelers such as Zale and Kay.

· Credit offerings can drive jewelry sales in several ways:

· “No interest” and other special promotions will entice consumers to shop.

· Shoppers will visit a jeweler’s store more often, if they know they have an established credit account where they can charge new purchases.

· If a customer balks at the high price of jewelry, the merchant will offer to finance the purchase over time.

· Some jewelers use credit promotions – “interest-free” or “low-interest” or “extended payments” – as a way to drive incremental jewelry demand.

· Credit is important for consumers with limited budgets: it allows them to enjoy the luxury of jewelry without emptying their bank account.

In-house credit sales do not include traditional credit card sales such as Visa or MasterCard. IDEX Online Research estimates that at least 85 percent of all jewelry is purchased using some kind of credit instrument – 50 percent using in-house credit and 35-40 percent or so using a major credit card. Less than 15 percent is purchased using cash or check.

Lack of Credit Hurt Jewelry Sales During Recession

Unfortunately, there has been less consumer credit available for shoppers during the recent recession. Some mass market jewelers saw their credit sales drop from 50 percent of total sales to as low as 30 percent of sales because credit providers were accepting fewer requests for credit. Further, fewer consumers applied for store credit, due to dire reports in the media about the lack of credit availability (no one likes to be turned down for credit). However, the banks offer a contrary view: they say they have plenty of money and are willing to lend it. In the past few months, credit availability seems to have improved.

Average Purchase Size Varies Widely

How much does the average household – those that buy jewelry – spend on jewelry each year? Averages are deceiving, but the mathematically derived answer is about $2,500. Among mass market consumers, the average is nearer $1,300, while upper-end consumers are likely to spend several thousand dollars for a piece of jewelry. Table 5 summarizes the proportion of U.S. households by income levels that purchase jewelry annually and the average amount they spend.

|

Near-Term Jewelry Demand: Headwinds And Tailwinds

The recessionary environment is behind us, and both the U.S. and the global economy are in a recovery period. Still, there are headwinds (negative factors) that we must deal with. Luckily, there are some significant tailwinds (positive factors) affecting jewelry demand and retailers’ sales, as the following list illustrates:

Headwinds

· The average jewelry ticket is down about 8-10 percent at retail.

· Lack of consumer credit availability has dampened jewelry sales.

· Conspicuous consumption has been temporarily out of favor; this has hurt demand for luxury goods.

· The lack of new exciting jewelry has cut down on consumers’ frequency of shopping trips to local jewelers.

· The lack of an industry promotional focus – especially by diamond suppliers – has not kept jewelry a “top-of-mind” category with consumers.

· A focus on price by retail jewelers to exclusion of other factors hurts merchant credibility and detracts from the “luxury” image of jewelry.

Tailwinds

· Consumer traffic is up in U.S. malls; jewelry sales have strengthened.

· Jewelers and other retail merchants are reporting an increased number of transactions.

· Most merchants are reporting an increased conversion rate – browsers-to-buyers – in their stores.

· Bridal jewelry demand remains strong.

· Demand for unique jewelry/ fashion jewelry/ custom jewelry is solid.

· There is no “hot” must-own consumer product – such as an electronics gadget or other $200-$500 retail ticket item – vying for consumers’ discretionary dollars.

· The likelihood of a double-dip recession is now a non-event.