Buckle Your Seat Belts, Diamond Heaven Just Ahead

July 06, 11

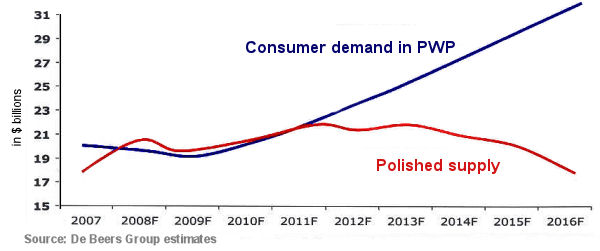

For years we have been looking at this chart. I believe De Beers first created it some years ago, and its former CEO Gareth Penny, used it in most of his famous PowerPoint presentations. Consider it the Pep Chart, because it is used to instill optimism. It's the polished demand versus rough supply chart that shows that in the near future, rough supply will fall short of demand. Have we just reached that inflection point?

De Beers was not alone, Rio Tinto and Alrosa have their own versions of this graph. The premise is simple: With rough supplies dwindling and consumer demand expected to grow, at some point demand will exceed production.

The measurement is commonly done in dollar value and the crossing point was always somewhere around 2011 or 2012. All of the old figures are now out of tune as no one predicted that prices would rise so much (only last year Alrosa predicted rough price increases of 3% and another 15% in 2012. They must be very happy with this unexpected windfall of cash.)

In the coming weeks De Beers and the rest of the major producers will issue production figures for the first half of 2011. In the first half of the year, global rough diamond production will total approximately 60 million carats, with De Beers and Alrosa providing nearly two-thirds of this.

The sudden surge in polished diamond demand surprised many in the industry, including the producers. Naturally, diamond prices surged upwards as a result of this demand

It is very possible that we have crossed the Rubicon. The large gains in the polished prices are (at least partially) the markets’ response to shortages in rough diamonds. While polished prices are easing a little in the last few days, this is possibly a summer lull or a brief recoil in response to the speed and velocity of the surge before prices resume their advance.

Consider the following price graph. We see the pre-crisis price bubble (not the industry's fault as the world stock and real estate markets also ran wild at the same time), popping above the price trend in mid-2008. Another such spike is taking place now.

The reason Penny showed the demand-is-about-to-outstrip-supply slide was to show that things would get much better in the future. The understanding was, prices of polished will run higher and subsequently allow margins to grow.

Cool. But what will happen to the price of rough? You must have guessed right – it will really run high. Rough demand will run wild, the Kimberley Process will be forced to let