Breaking News: Oppenheimer Cashing Out, Selling De Beers Stake for $5.1B to Anglo American (Update 3)

November 04, 11

Transaction remains subject to shareholder approval. Shareholder vote expected in December and closing expected in the second half of 2012. Anglo American has entered into an agreement with CHL and Centhold International Limited, together representing the Oppenheimer family interests (CHL Group), to acquire their 40 percent interest in DB Investments and De Beers sa for a total cash payment of $5.1 billion. The cash deal represents a $12.75 billion valuation for the diamond giant. The Government of the Republic of Botswana has pre-emption rights in respect of the CHL Group’s interest in De Beers, enabling it to increase its interest in De Beers, on a pro rata basis, to up to 25 percent. In the event that it exercises its preemption rights in full, Anglo American would acquire an incremental 30 percent interest in De Beers, taking its total interest to 75 percent. In such an event Anglo American's payment to the CHL Group would be reduced proportionately. De Beers Chairman Nicky Oppenheimer said: “This has been a momentous and difficult decision as my family has been in the diamond industry for more than 100 years and part of De Beers for over 80 years. After careful and deliberate consideration of the offer, and what is in the best interests of the family, we unanimously agreed to accept Anglo American’s offer. Anglo American is the natural home for our stake as they have been major shareholders in De Beers since 1926 and have a deep knowledge of the diamond business. I am certain that Anglo American will provide strong support to Philippe Mellier and the De Beers management team.” Anglo American said this is a "unique opportunity to consolidate control of the world’s leading diamond company." Alluding to past differences with the Oppenheimers, the company added that "Simplified ownership structure will enhance performance." Cynthia Carroll, Chief Executive of Anglo American, said: “This transaction is a unique opportunity for Anglo American to consolidate control of the world’s leading diamond company – De Beers." The Minister of Minerals, Energy, and Water Resources, Dr. Ponatshego H Kedikilwe, on behalf of the Following is the full text of the press release: Anglo American plc and CHL Holdings Limited (“CHL”) announce their agreement for Anglo American to acquire an incremental interest in De Beers, increasing Anglo American’s current 45 percent shareholding in the world’s leading diamond company to up to 85 percent. Anglo American has entered into an agreement with CHL and Centhold International Limited (“CIL”), together representing the Oppenheimer family interests (“CHL Group”), to acquire their 40 percent interest in DB Investments and De Beers sa (“De Beers”) for a total cash consideration of US$5.1 billion, subject to adjustment as provided for in the agreement. Under the terms of the existing shareholders’ agreement between Anglo American, CHL and the Government of the Republic of Botswana (GRB), the GRB has pre-emption rights in respect of the CHL Group’s interest in De Beers, enabling it to participate in the transaction and to increase its interest in De Beers, on a pro rata basis, to up to 25 percent. In the event that the GRB exercises its preemption rights in full, Anglo American, under the proposed transaction, would acquire an incremental 30 percent interest in De Beers, taking its total interest to 75 percent, and the consideration payable by Anglo American to the CHL Group would be reduced proportionately. Anglo American has a deep knowledge and understanding of De Beers and an appreciation for the unique nature of diamonds, having been the company’s largest shareholder since De Beers became a private company in 2001 and as a longstanding shareholder in De Beers prior to that. De Beers’ geographically diverse portfolio comprises large scale, low cost mining assets with proven distribution, sales and marketing capabilities and further potential from its leading pipeline of Cynthia Carroll, Chief Executive of Anglo American, said: “This transaction is a unique opportunity for Anglo American to consolidate control of the world’s leading diamond company – De Beers. Today’s announcement marks our commitment to an industry with highly attractive long term supply and demand fundamentals. Underpinned by the security of supply offered by a new 10-year sales agreement with our partner, the Government of the Nicky Oppenheimer, representing the Oppenheimer family interests, said: “This has been a momentous and difficult decision as my family has been in the diamond industry for more than 100 years and part of De Beers for over 80 years. After careful and deliberate consideration of the offer, and what is in the best interests of the family, we unanimously agreed to accept Anglo American’s offer. Anglo American is the natural home for our stake as they have been major shareholders in De Beers since 1926 and have a deep knowledge of the diamond business. I am certain that Anglo American will provide strong support to Philippe Mellier and the De Beers management team.” The Minister of Minerals, Energy, and Water Resources, Dr. Ponatshego H Kedikilwe, on behalf of the Sir John Parker, Chairman of Anglo American, added: “The purchase of an incremental interest in De Beers is fully aligned with the Board’s strategic priorities. The value created in De Beers and the diamond industry by the Oppenheimer family over the past century has been a remarkable achievement. We look forward to increasing our involvement in the business and building strong links and relationships with De Beers’ Sightholders and partners.” Safety and sustainable development are key value drivers for Anglo American, with its pioneering health and enterprise development programmes in The transaction is expected to be accretive to underlying earnings before depreciation and amortisation on fair value adjustments in the year of acquisition. The transaction does not alter the existing arrangements for the management of De Beers, including Mr N F Oppenheimer’s position as chairman, prior to completion. Mr P Mellier will continue as CEO of De Beers. In view of the fact that CHL and CIL are ultimately controlled through intermediary companies by trusts of which Mr N F Oppenheimer is a potential discretionary beneficiary and Mr N F Oppenheimer has been a director of Anglo American within the last 12 months, the proposed acquisition is categorised as a related party transaction under the terms of the Listing Rules and therefore requires Anglo American shareholder approval. A circular to Anglo American shareholders convening a General Meeting of Anglo American shareholders for the purposes of seeking such approval, in accordance with the requirements of the Listing Rules, will be sent to shareholders in due course. The transaction is also subject to regulatory and government approvals and required third party consents (if any) and is expected to close in the second half of 2012. Additional information: This announcement is available on the Anglo American website www.angloamerican.com, together with Anglo American’s slide presentation to investors, a fact sheet on De Beers, in addition to the pre-existing information available on De Beers. Anglo American is one of the world’s largest mining companies, is headquartered in the De Beers, established in 1888, is the world’s leading diamond company with unrivalled expertise in the exploration, mining and marketing of diamonds. Together with its joint venture partners, De Beers operates in more than 20 countries employing more than 16,000 people, and is the world’s leading diamond producer with mining operations across The CHL group holds a 40 percent interest in De Beers (including certain shareholder loans which at 31 October 2011 amounted to US$265 million). Central Management Services Limited (“CMSL”), a fellow subsidiary of CHL, was appointed under a management contract dated January 2002 (“the Management Contract”) to assist in the appointment of directors, senior executives and management. Under the Management Contract, CMSL also contributes to the strategic development of De Beers and to general marketing initiatives and relationships with key customers and suppliers. The Management Contract will terminate automatically on completion of the transaction. The CHL group is ultimately controlled, through intermediary companies, by trusts (the “Oppenheimer Trusts”) of which Mr N F Oppenheimer is a potential discretionary beneficiary. The Oppenheimer Trusts also have an indirect interest, through E Oppenheimer & Son International Limited (“EOSIL”), in 25.2 million ordinary shares of Anglo American. In accordance with the Listing Rules, EOSIL has undertaken to procure that such shares are not voted on the resolution to be proposed at the General Meeting of Anglo American to be convened for the purposes of approving the transaction. The proposed acquisition is to be implemented, subject to obtaining the required approval of Anglo American shareholders, and subject to Anglo American being reasonably satisfied with the results of a limited confirmatory due diligence exercise to be undertaken prior to the General Meeting of Anglo American shareholders in respect of De Beers’ material mining licences, and, in addition, subject to obtaining necessary regulatory and government approvals and required third party consents, by the CHL Group offering all of the shares and existing shareholder loans of the CHL Group to Anglo American and the GRB, pro rata to their existing shareholdings in De Beers, for an aggregate consideration of US$5.1 billion, subject to adjustment. Anglo American has agreed, subject to such shareholder approval and confirmatory due diligence and subject to obtaining necessary regulatory and government approvals and required third party consents, to accept such offer when made in respect of all of such interests. In the event that the GRB takes up such offer up to its pro rata entitlement, Anglo American’s acceptance will be scaled back accordingly and the interests in De Beers to be acquired by Anglo American, and the cash consideration payable by Anglo American, will be reduced accordingly, as described above. The US$5.1 billion aggregate consideration payable for the CHL Group’s interest in De Beers is subject to increase by an amount equivalent to interest at a rate of 3.5 percent per annum from 4 November 2011 to closing of the transaction and decrease by reference to any dividends or loan principal or interest received by the CHL Group prior to closing. If closing of the transaction takes place more than nine months from the date of this announcement (other than by reason of CHL extending the time for satisfaction of the conditions), the consideration will be increased by US$50 million. In addition, Anglo American has agreed, in the event of a listing of De Beers in the two year period following closing of the transaction, to pay capped additional consideration to the CHL Group, equal to 20 percent (if a listing were to occur in the first such year) or 10 percent (if a listing were to occur in the second such year) of any increase in the attributable value (determined by reference to the transaction consideration and the listing price) of the De Beers equity acquired by Anglo American from the CHL Group in the transaction. Anglo American has agreed to pay to CHL (or as it may direct) a break fee of US$75 million in the event that the transaction does not close.

After 80 years, the Oppenheimer's are no longer part of

De Beers and their future endeavors are not yet known.

Anglo American, the firm the family founded some 100

years ago, has bought the family out of De Beers, the

company they are so identified with.

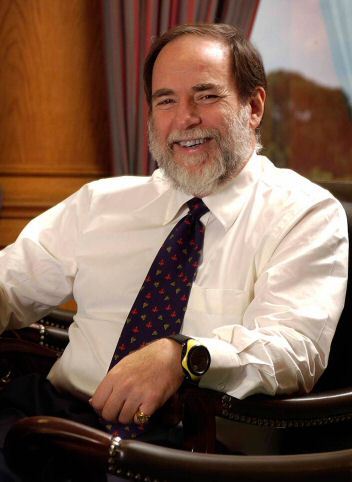

Above, Nicky Oppenheimer.