Bread and Butter

August 22, 12

The many initiatives forming today offer a couple of different ways of investing in diamonds. In addition, they differ in the type of goods on which they are focusing. Some are looking at high-end diamonds – fancy color diamonds and very large diamonds – while others are focusing on "bread and butter" items, mainly 1 carat white goods.

The idea of investing in 1 carat white diamonds is not new. The Thomson McKinnon Diamond Investment Trust, formed in March 1981, was offering investors the chance to profit from skyrocketing polished prices some 30 years ago. Unfortunately, the fund's timing was horrible. The mushrooming prices were unsustainable and started falling shortly before the fund started trading.

|

The fund's shares will be sold to the public at prices determined by the price of 1 carat, investment grade and GIA-certified round diamonds, which the fund intends to buy and hold with the proceeds of the initial offering.

While the financial press did not view the suggestion very favorably, it failed to notice a number of crucial issues. One observer, for example, said in a webcast that diamond funds are a bad idea because a fund "can be very easily gamed," and that "market participants in the diamond industry…are able to influence the grading of certain diamonds and therefore able to maybe influence the types of diamonds that get into this portfolio."

A worrisome point, perhaps, but it has more to do with the perception of the diamond industry. Public perception of the industry may be a hurdle, although we already know it will stand or fall on its reputation.

An issue raised by many is the inconsistent character of diamonds, their fungibility – the property of a good or a commodity whose individual units are capable of mutual substitution. It is true that on an individual basis, diamonds are not homogenous. The non-standardness of individual diamonds raises the question of how they are priced.

However, in large quantities of narrowly defined categories, diamonds price trends are trackable. IDEX Online, Polished Prices and Rapaport have done it for many years. Wherever there is a market, there is a price.

This is where some of the funds, those dealing in 1 carat white goods, have an interesting offering, one that Alain Vandenborre, a serial entrepreneur and founder of the Singapore Diamond Exchange (SDX), a private exchange for private investors, calls "capital preservation."

Vandenborre identifies an opportunity and a number of problems. "There is a macro structure that includes an imbalance in the [diamond] market – the supply of diamonds is limited and demand for it is increasing," Vandenborre says. "I believe there is an opportunity, but the market has some issues. The market is closed, so I [as a consumer] can only buy on the street and don't know about the GIA." SDX is the solution Vandenborre envisions, a place where investors cab buy directly from the wholesale market.

Unlike IndexIQ, SDX is not a fund. Set to launch on July 25, it offers investors a wide range of goods. Investors will have the option of buying what it calls portfolios, a range of goods with a total value starting at $250,000, going up to more than $1 million. Investors will have a choice of portfolios to choose from, each representing a different combination of goods and expected appreciation. Such a portfolio will typically consist of 1-5 carat round diamonds, D-I color, IF-SI2 clarities, all GIA certified. Some portfolios may also include large or fancy colored diamonds.

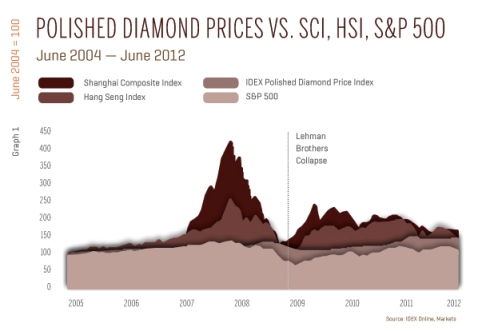

From Vandenborre's perspective, the allure is clear. "Diamonds are a low volatility commodity." Compared to some of the more common investment venues, such as real-estate or the stock market, this is correct, as shown in graph 1. It compares three leading stock indices – the Shanghai Composite Index, the Hang Seng Index and S&P 500 – to the IDEX Online polished diamond index, of which 1 carat diamonds represent more than 12 percent. While the stock performance is widely volatile, the overall average price of diamonds is fairly stable.

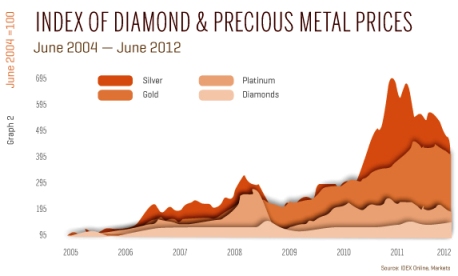

This brings us back to the concept of "capital preservation." If the value of 1 carat diamonds is fairly stable – as attested by these graphs – then investors can expect a small return on their investments, but one that offers them protection when a colossal economic downturn hits – such as the one that took place in the third quarter of 2008.

Because the return on investment is not high, this venue of investment should be of interest to people trying to find a way protect a certain amount of their money for a rainy day.

Underscoring this, Vandenborre emphasizes that SDX is not a fund, saying that SDX's model is the "opposite of how funds work – quick turnaround, like with gold."

Market Response to Investments

One important question is how the diamond industry will accept, understand and participate in such a market. While some hesitance exists, mainly among veterans who remember the Thomson McKinnon Diamond Investment Trust and who lost money in the 80’s boom and the subsequent bust. Others, however, are looking forward to the opportunities investment vehicles offer.

The most important aspect is the inflow of much-needed cash into the wholesale polished diamond sector, income from financial institutions. In a way, this is a whole new market. Today the financial market offers the diamond industry financing, which allows companies to grow and helps them operate. This has a cost in the form of interest.

Further, with the banks refusing to increase their funding of the diamond industry, the narrow-margin sector – especially diamond manufacturers – is in dire need of new sources of cash in order to develop. Investment in diamonds has the potential to generate a new flow of capital, real income that has the potential to reinvigorate the entire diamond pipeline. By buying diamonds in the market, diamond funds, and other diamond-related investment tools, could stream hundreds of millions from the financial sector.

Another concern some traders see is ballooning prices. "This will create a price bubble," many traders have told IDEX Online. Only the future will tell how true this is. Surely, with greater demand, prices will increase. In the long-term, the belief among supporters of investment in diamonds is that the increase will be balanced by consumers' willingness and ability to pay for diamond jewelry. In other words, if consumers, the main source of income for the diamond industry, find the prices too high and stop buying, this may bring down prices of polished diamond. Between the upward trend driven by the new market – investors – and the downward trend caused by the old market – consumers – a new equilibrium will be found.

Some diamond traders are seeking to take part in this new arena. A number of them are actively involved in such endeavors, either as entrepreneurs initiating an investment vehicle partnering with financial institutions, recruited by financial institutions seeking diamond insiders, or as guaranteed sources of goods that will also buy back diamonds when investors decide to cash out.

Potential Yet To Be Unlocked

Many of those involved in the efforts to create investments in 1 carat white goods that we spoke to quote the potential of their specific endeavor at $100 million or more. The Harry Winston fund Diamond Asset Advisors wants to raise $250 million in its first round. The London Stock Exchange-listed Diamond Circle Capital (DCC), on the other hand, has a market cap of about $26.9 million.

Conventional wisdom among many analysts in the diamond industry and financial markets is that the total capital that the financial sector and private investors may earmark for diamond investments is below the total expectations of hopeful entrepreneurs. Some will do well, but not all; and not everyone will find the level of investment they are seeking.

That being said, bankers and wealth management firms today understand that such an investment venue should be part of their portfolios. The wide-range estimate today is that by buying diamonds in the market, diamond funds, and other diamond-related investment tools, could stream hundreds of millions of dollars into the diamond industry.

Transparency, Trading Tools

The need for transparency in the diamond market is crucial. This includes coming forward on ethical issues, ensuring that the Kimberley Process operates well and that issues such as certification bribery and lab-made diamonds are not part of the equation. Absolute confidence that a certificate accurately reflects diamonds' characteristics and that lab-made diamonds are not passed off as natural goods is essential.

Other issues are also on the table, for example price transparency. Many prospective firms, especially those that have diamond traders deeply involved with them, need an objective, third party source of information to provide unbiased price disclosure.

In the past year, IDEX Online Research was approached a number of times with requests to use its polished diamond price index as a source of information on price trends. It also provided analysis on price trends of different diamond categories.

SDX will use the IDEX Online spot market Guaranteed Diamond Transactions to buy and sell the goods, giving investors full price disclosure and net asset valuation.