IDEX Online Research: 2012 Holiday Jewelry Sales Forecast: +4%

October 24, 12

(IDEX Online News) – American jewelers can expect good, but not great, sales during the upcoming all-important 2012 holiday selling season of November and December. Overall, jewelry sales in the

The full holiday forecast is available to IDEX Online Research subscribers and IDEX Online members here.

Here are highlights of the 2012 Holiday Selling Season Forecast:

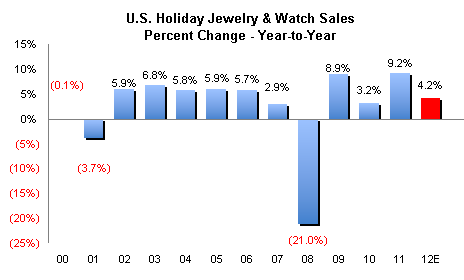

· Total

Source: US Dept of Commercce |

· Estimated jewelry sales of $19.7 billion will be a new record for the holiday period. The previous record, $19.5 billion, was set in 2007, just prior to the Great Recession of 2008-2009.

· While online jewelry sales growth is not reliably tracked during the holiday selling season, it is expected to grow at a slower rate this year than in prior years, mostly because the market is beginning to mature. Overall, online jewelry sales represent about 6 percent of total

Factors Affecting Consumer Demand During 2012

Positive Factors

· The

· Unemployment seems to be headed lower. When shoppers are worried about losing their job, they tighten their purse strings. With the job market stable – and perhaps improving slightly, depending on which figures you believe – consumers should be more willing to spend money in the 2012 holiday selling season.

· The presidential election will be over in early November. While there will be some lingering negative impact, especially as the losers lick their wounds, the uncertainty of the nation’s next president will be resolved. Retail sales generally return to a more normal level several weeks after a major election.

· Weather forecasts call for “near normal” cold. Cold snowy weather puts consumers in the holiday mood more quickly than warmer, unseasonal weather such as most of the nation experienced in 2011.

Negative Factors

· Competition for consumers’ spending will be especially intense this year, due primarily to many new electronic tablets that have retail price points in the range of jewelers’ average ticket ($200-500).

· There is lingering uncertainty about longer-term economic growth. The recession of 2008-2009 (which still feels like it is going on) has kept a damper on consumer spending.

· The consumer “Wealth Factor” remains uncertain. The housing market appears to have hit bottom and may be recovering in some markets. Stock market volatility continues to put fear in consumers’ retirement portfolios.

· Political instability in global hotspots – for example, the

· The possibility of a European recession is very real, and it could drag the

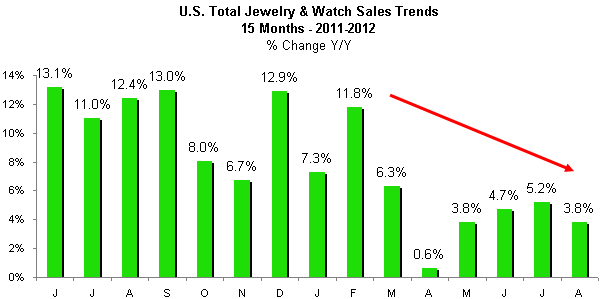

· Jewelry sales gains have been trending lower this year, partly due to weaker consumer demand and partly due to strong gains in 2011 (which makes this year’s percentage gains more difficult). The graph below illustrates recent weakening jewelry sales gains in 2012.

Source: US Dept of Commercce |

Non-Factor: Consumer Confidence

Astute readers will notice that we did not mention the Consumer Confidence Index as either a positive or a negative factor. The fact is this: Consumer Confidence is not a reliable predictor of consumer spending. As illogical as it may be, a study in late 2011 proved this (one again), and it noted that most credible forecasts for the economy and consumer spending either do not include the Consumer Confidence Index or minimize its impact on the forecast. IDEX Online Research ignores the Consumer Confidence Index in its forecasts.