IDEX Online Research: Surging Metal Prices Spawns Inflationary Jewelry Prices

October 29, 12

(IDEX Online News) – Jewelry prices in the American market surged in September, at both the retail and supplier levels, primarily as a result of sharply higher commodity prices for precious metals.

The full analysis and statistics on jewelry industry inflation for September 2012 is available to IDEX Online Research subscribers and IDEX Online members here.

During September, gold prices rose by over 7 percent from August, while silver and platinum posted double-digit increases in September versus August. Diamonds were about the only major jewelry commodity that did not post an increase in price during September, a trend that has continued into October.

What’s behind precious metal price inflation? Global economic worries continue to push investors to seek “hard” assets such as gold, rather than “paper” assets such as stocks and bonds. After languishing during the summer, precious metals prices began rising late in the third quarter, and have continue to move higher in the fourth quarter. Despite attempts by the industry to try to “monetize” diamonds as a hard asset, investors remain skeptical and have not focused on these gemstones as a “store of value.”

The Big Picture: Will Higher Jewelry Prices Scare Off Shoppers?

Earlier this year, retail jewelers were hesitant to raise their retail prices, since jewelry demand was relatively weak. Though retail jewelry sales remain relatively weak, jewelers have had to raise prices in the face of higher supplier prices for jewelry that contains gold, silver and platinum.

Retail merchants are betting that jewelry demand will not be affected significantly; further, they need to move prices higher prior to the holiday selling season. In some cases, they have raised prices so they can discount them during the holiday selling season, without breaking any commerce laws (which say that an item must have been offered for a minimum period at the higher price, if the discount is legitimate).

However, it is important to note that the consumer environment of high levels of uncertainty is unchanged. The current climate of uncertainty is being driven by the upcoming presidential election, a faltering economy, the lack of job security, and a weak housing market. When consumers are uncertain, they tighten their purse strings.

WHOLESALE: Jewelry Prices Jump in September

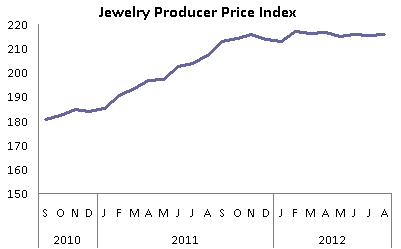

In September, the Jewelry Producer Price Index (JPPI) stood at 220.1, up from August’s 216.0. A year ago, the JPPI stood at 213.0. Since February, the index had remained relatively stable in the 216-217 range, but it jumped in September. Here’s what this data means:

· Wholesale jewelry prices rose modestly by 1.9 percent on a month-to-month comparison basis: September versus August 2012. As the graph below illustrates, there had been little jewelry price inflation on a monthly basis since the beginning of 2012; prices had been relatively stable. However, this “stable” trend changed in September.

· Wholesale jewelry prices rose by about 3.3 percent on a year-to-year comparison basis: September 2012 versus September 2011. While this inflation rate is down substantially from the double-digit inflation rates in the first quarter of 2012, it compares against a month in 2011 when supplier price inflation rose at an unusually high rate, so the percentage change is modest.

· Wholesale jewelry prices were up 8.7 percent for the nine months year-to-date 2012 versus the same period a year ago.

· The graph below summarizes the JPPI over the past two years. The sharp upward turn in inflation is clearly shown on the graph.

Source: BLS |

RETAIL: Jewelry & Watch Prices Rise in September

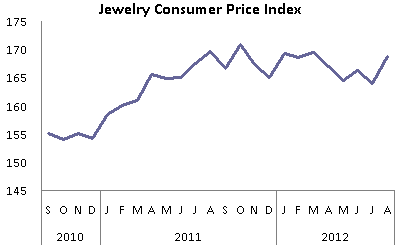

In September, the Jewelry & Watch Consumer Price Index (JCPI) stood at 171.3 versus August’s 168.7. A year ago, the JCPI stood at 166.7. For the first eight months of the year, the retail jewelry and watch price index was relatively stable in the 167-168 range, though it had shown some volatility, dipping to 164 in May and July. Here’s what the sharp increase in the index during September means:

· Retail prices of fine jewelry and watches rose by 1.5 percent on a month-to-month comparison basis: September versus August 2012. This implies an annual inflation rate of nearly 18 percent, an unrealistic level.

· Retail jewelry and watch prices in September were 2.8 percent above prices in September 2011. Retail prices of jewelry and watches had shown no significant inflation since mid-2011, but in both August and September, there is solid evidence that retail jewelry and watch prices are headed higher.

· Retail jewelry and watch prices were up by a moderate 2.1 percent for the nine months year-to-date 2012 versus the same period a year ago.

· The graph below summarizes the JCPI over the past two years:

Source: BLS |

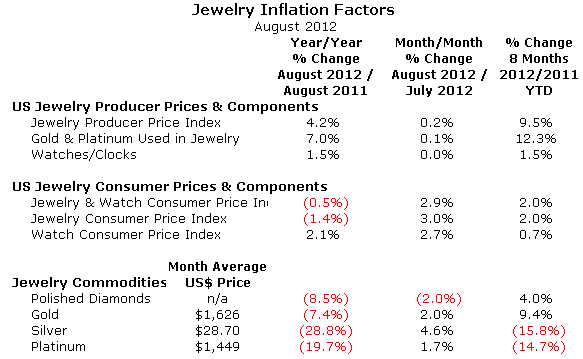

The table below provides detailed inflation / deflation rates for jewelry components as well as inflation rates at various levels of the jewelry distribution channel in the U.S. jewelry industry. The following data is shown: 1) year-to-year price comparisons for the month of September 2012 versus September 2011; 2) month-to-month price comparisons for September 2012 versus August 2012; and 3) nine months year-to-date 2012 price comparisons versus the same nine-month year-to-date period in 2011.

Source: Various Markets |

Jewelry Inflation Outlook Unchanged: Moderate Inflation in 2012

Our outlook for jewelry price inflation remains unchanged: jewelry prices are expected to move modestly higher at all levels of the distribution channel throughout 2012. But, the rate of inflation is expected to be well below 2011’s torrid pace, both at the supplier level and at the retail level.

The full analysis and statistics on jewelry industry inflation for September 2012 is available to IDEX Online Research subscribers and IDEX Online members here. Click here for more information on how to subscribe or become a member.