IDEX Online Research: Retail Jewelers Cut Prices in October

November 20, 12

(IDEX Online) – Faced with slowing sales, retail specialty jewelers in the U.S. market cut their prices in October in an effort to attract customers by offering “bargains,” according to the latest government BLS inflation data.

In contrast, suppliers’ prices continued to edge upward, driven mostly by higher precious metal prices.

What’s behind precious metal price inflation? Global economic worries, coupled with the looming “fiscal cliff” in America and sparring in the Middle East, continue to push investors to seek “hard” assets such as gold, rather than “paper” assets such as stocks and bonds. After languishing during the summer, precious metals prices began rising late in the third quarter, and have continue to move higher in the fourth quarter.

However, polished diamond prices fell in October, on both a year-to-year basis as well as month-to-month (October versus September 2012). Despite attempts by the industry to try to “monetize” diamonds as a hard asset, investors remain skeptical and are not convinced that these stones are a “store of value.”

As retail prices moderate and supplier prices rise, jewelers’ margins are more imperiled than ever.

The Big Picture: Will Lower Prices Boost Demand?

Early in 2012, retail jewelers were hesitant to raise their retail prices, since jewelry demand was relatively weak. However, in the face of rising wholesale prices, jewelers felt compelled to raise prices for jewelry that contained gold, silver and platinum. Those retail merchants were betting that jewelry demand will not be affected significantly. Further, they wanted to test the market with higher prices prior to the all-important holiday selling season.

As it turned out, fundamental consumer demand for jewelry has remained tepid, and it could be argued that higher retail prices drove shoppers away from specialty jewelers, whose sales have been particularly weak. Those few retail consumers who are buying jewelry are shopping at multi-line discounters who offer a credible value.

Will lower prices at jewelers help boost demand, especially so close to the holiday shopping season? Probably not. There are far too many competing products to attract shoppers, especially exciting consumer electronics merchandise at $200-500, the “sweet spot” for Christmas jewelry. Thus, jewelers’ price-based promotions probably are ignored, and profits will suffer.

WHOLESALE: Jewelry Prices Jump in October

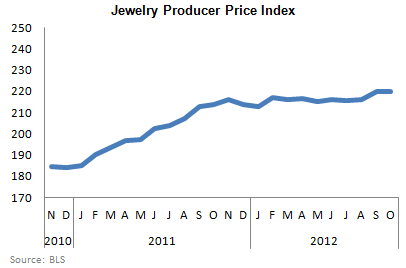

In October, the Jewelry Producer Price Index (JPPI) stood at 219.8, down slightly from September’s 220.1. A year ago, the JPPI stood at 213.3. Since February, the index had been relatively stable in the 216-217 range, but it jumped in September and October. Here’s what this data means:

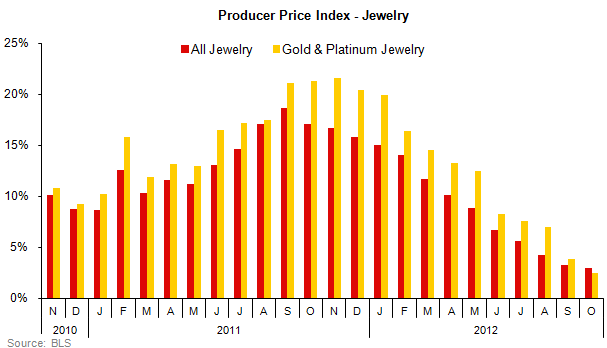

· Wholesale jewelry prices were about flat on a month-to-month comparison basis: October versus September 2012. As the graph below illustrates, there had been little jewelry price inflation on a monthly basis since the beginning of 2012; prices had been relatively stable. However, wholesale prices rose in September and held at the new higher level in October.

· Wholesale jewelry prices rose by about 3.0 percent on a year-to-year comparison basis: October 2012 versus October 2011. While this inflation rate is down substantially from the double-digit inflation rates in the first quarter of 2012, it compares against October 2011 when supplier price inflation rose at over 17 percent, an unusually high rate, so the percentage change this year is more modest.

· Wholesale jewelry prices were basically unchanged for most of 2012, until the end of the third quarter.

· Wholesale jewelry prices were up 8.2 percent for the ten months year-to-date 2012 versus the same period a year ago.

· The graph below summarizes the JPPI over the past two years. The sharp upward turn in inflation in September and October is clearly shown on the graph.

|

RETAIL: Jewelry & Watch Prices Fall in October

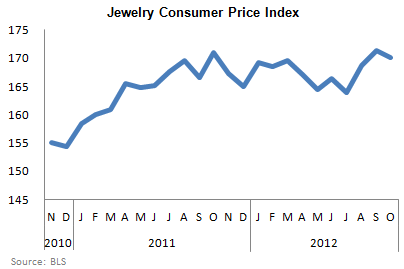

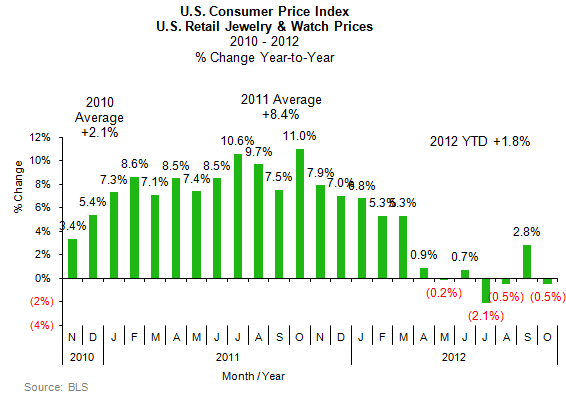

In October, the Jewelry & Watch Consumer Price Index (JCPI) stood at 170.1 versus September’s 171.3. A year ago, the JCPI stood at 170.9. For the first eight months of the year, the retail jewelry and watch price index was relatively stable in the 167-168 range, though it had shown some volatility, dipping to 164 in May and July. In September, the JCPI posted a sharp increase, only to fall back notably in October.

· Retail prices of fine jewelry and watches fell by 0.7 percent on a month-to-month comparison basis: October versus September 2012. This implies an annual deflation rate of about 8 percent, an unrealistic level.

· Retail jewelry and watch prices in October were 0.5 percent below prices in October 2011. Retail prices of jewelry and watches had shown no significant inflation since mid-2011. However, in August and September, retail jewelers tried to push prices higher in anticipation of the holiday selling season. Based on the latest government data, jewelers have rolled back their prices

· After sharp month-to-month retail price increases in August and September, jewelry and watch prices were back above the former peak levels at the beginning of 2012. However, the price rollback in October took prices below last year’s peak levels, squeezing jewelers’ margins dramatically.

· Retail jewelry and watch prices were up by a moderate 1.8 percent for the ten months year-to-date 2012 versus the same period a year ago.

· The graph be low summarizes the JCPI over the past two years:

|

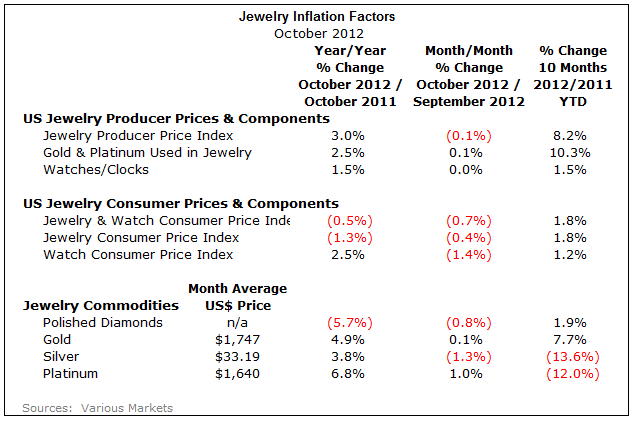

The table below provides detailed inflation / deflation rates for jewelry components as well as inflation rates at various levels of the jewelry distribution channel in the U.S. jewelry industry. The following data is shown: 1) year-to-year price comparisons for the month of October 2012 versus October 2011; 2) month-to-month price comparisons for October 2012 versus September 2012; and 3) ten months year-to-date 2012 price comparisons versus the same ten-month year-to-date period in 2011.

|

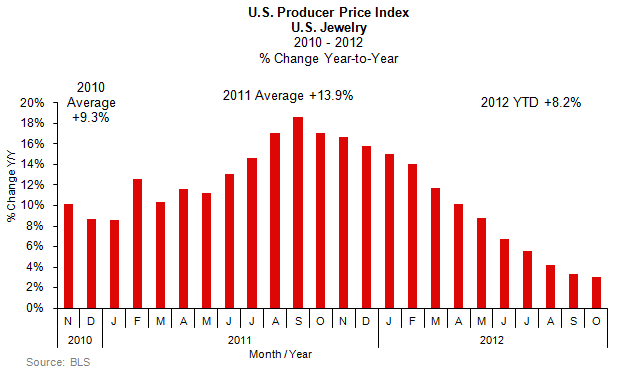

Jewelry Suppliers’ Price Inflation Still Running Below 2011 Rate

October’s jewelry supplier price inflation rate of 3.0 percent, year-to-year, was significantly less than 2011’s inflation rate of 13.9 percent, and it was well below the jewelry supplier inflation rate of 9.3 percent for the full year 2010.

After ten months of 2012, jewelry supplier price inflation is up by 8.2 percent, a rate which has been slowing all year, dragged down by deflation earlier this year.

The graph below summarizes year-over-year jewelry supplier price inflation.

|

Precious Metals Prices Up, But Gemstone Prices Soft

Jewelry suppliers’ prices of precious metals jewelry rose by less than three percent during October 2012 versus the same month a year ago. After ten months, precious metals price inflation is up by over 10 percent.

On a month-over-month basis, jewelry suppliers’ prices for precious metal jewelry eked out a modest 0.1 percent gain, based on prices in October 2012 versus September 2012. On an annualized basis, this would suggest that suppliers’ jewelry prices could increase by just one percent or so. However, we do not put much weight on monthly price swings simply because they are not meaningful.

The graph below compares the jewelry supplier inflation rate for precious metals jewelry (gold columns) versus the overall jewelry supplier inflation rate for jewelry (red columns). These comparisons are year-to-year.

|

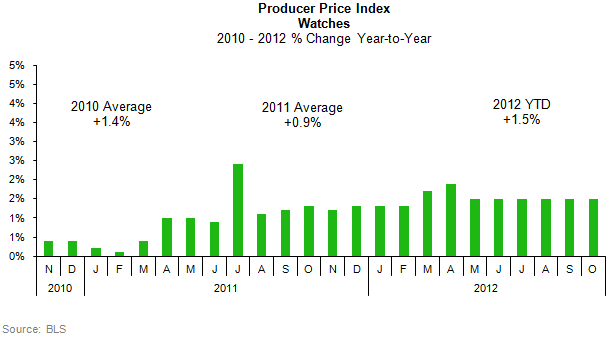

Supplier Watch Price Inflation Steady for Past Year

Fine watch prices at the supplier level in October showed a moderate gain – +1.5 percent – when compared to the same month a year ago (October 2011). This level of inflation is reminiscent of inflation trends in 2009 and early 2010, when watch prices rose by a low single-digit level at the supplier level. After ten months of 2012, watch prices are up a modest 1.5 percent year-to-date.

On a month-to-month basis – October 2012 versus September 2012 – supplier prices of watches were flat, showing neither deflation nor inflation.

In recent months, watch demand and watch sales in the U.S. market have been relatively solid. However, some watch manufacturers have been reticent to raise prices because management worries that it could hurt consumer demand.

The graph below shows year-to-year supplier price inflation for watches for the past twenty-four months.

|

Retail: Fine Jewelry and Watch Prices Fall in October

Jewelry and watch retail price inflation had been moderating since the third quarter of 2011 on a year-over-year comparison. But that does not tell the full story. After drifting lower for most of 2012, retail prices of jewelry showed a sharp increase in August, when compared to July. September price inflation showed another sharp increase. But, October’s data negated a large portion of the inflation that the industry experienced in August and September.

Year-over-year prices were down by 0.5 percent at the retail level. Muted consumer demand for jewelry, along with moderating price inflation for jewelry commodity materials, had kept a lid on retail jewelry prices earlier this year.

On a month-to-month basis, retail jewelry and watch prices in October were down 0.7 percent, when comparing October 2012 to September 2012. Comparing the first ten months of 2012 versus the same ten-month period last year, retail jewelry prices are up by 1.8 percent; this implies an annualized inflation rate of two percent or so.

The graph below summarizes year-to-year retail jewelry and watch price inflation in the U.S. market. It is clear that retail price inflation had slowed significantly, but picked up in September, only to fall in October.

|

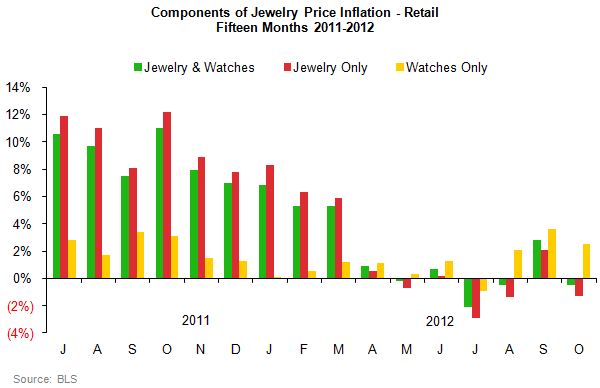

Retail Watch Prices Up, Jewelry Prices Down in October

Retail and supplier prices of watches historically have tended to move together, both on a month-to-month basis and a year-to-year basis, over the past few years. This trend did not occur in October.

Retail Fine Watch Prices Up

For the month of October 2012, retail watch prices rose by a solid 2.5 percent from October 2011. This is higher than recent monthly comparisons of year-over year prices.

However, watch prices declined by 1.4 percent, when comparing October to September 2012 prices.

Retail Fine Jewelry Prices Drop

Retail prices of jewelry, excluding watches, were down 1.3 percent in October 2012, when compared to October 2011 prices. This is a dramatic change from the past several months, when fine jewelry prices were volatile – marginally up, or down significantly.

The graph below compares the inflation rate for jewelry and watches (green bars), jewelry only (red bars), and watches (gold bars).

|

Jewelry Inflation Outlook Unchanged: Moderate Inflation in 2012

Our outlook for jewelry price inflation remains unchanged: jewelry prices are expected to move modestly higher at all levels of the distribution channel throughout 2012. But, the rate of inflation is expected to be well below 2011’s torrid pace, both at the supplier level and at the retail level.