IDEX Online Research: U.S. Jewelry Industry Posts Solid Gains in November

February 03, 13

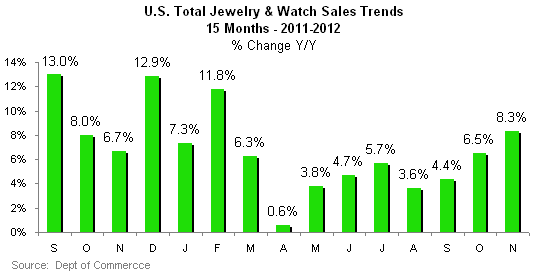

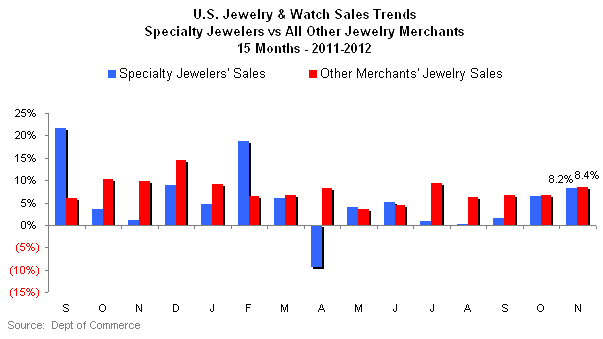

(IDEX Online) – Jewelry sales during November – the first month of the all-important 2012 holiday selling season – were up a strong 8.3 percent, according to the U.S. Commerce Department. Sales at specialty jewelers rose by 8.2 percent while sales at other multi-line merchants who sell jewelry were up by 8.4 percent.

However, it is important to note that the government’s sales figures are preliminary, and, unfortunately, they are inconsistent with sales reported by individual jewelers in the IDEX Online Research sample of retailers. Thus, we expect November’s preliminary sales numbers to be revised downward.

We also note that the same situation happened in October: preliminary data showed that specialty jewelry sales jumped by 8.3 percent. October’s numbers have since been revised to a smaller gain of 6.5 percent. While that is still a solid increase, it is not nearly as robust as first reported.

Based on sales reports from specialty jewelers, we believe that 2012 holiday sales will rise by a more modest low-to-mid single digit range.

The graph below summarizes total jewelry sales trends by month in the

Preliminary Sales Data Encouraging for November

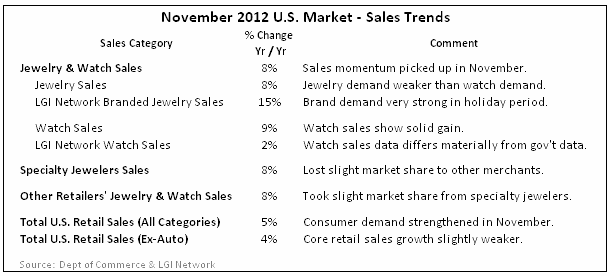

Here is what the data for November 2012 showed:

· Total jewelry sales at all retail merchants rose by 8.3 percent, according to the Department of Commerce. This reflects a continued pick-up in consumer demand, after a relatively slow late summer sales period.

· Specialty jewelers’ sales rose by a solid 8.2 percent, based on Commerce Department data. After nominal sales gains during most of the summer months, this is a positive change in trend.

· Jewelry sales at other merchants who sell jewelry – mostly multi-line discounters – rose by 8.4 percent. Historically, shoppers have been shifting their jewelry purchases to multi-line merchants rather than specialty jewelers.

· Specialty jewelers’ sales represented just under 43 percent of total jewelry industry sales, about in line with prior months, but down from historic levels. Specialty jewelers’ market share has been steadily eroding for decades.

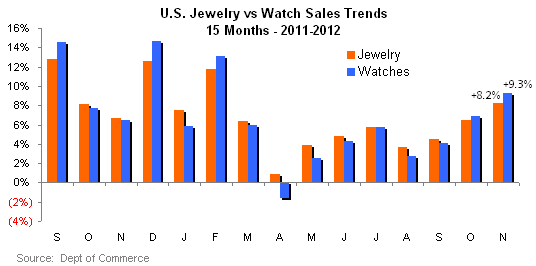

· Watch and jewelry demand both showed solid high-single digit gains. Jewelry (only) sales rose in November by 8.2 percent, while watch (only) sales rose by 9.3 percent.

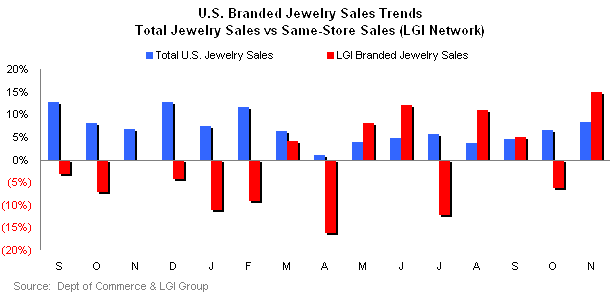

· LGI Network sales showed a 2 percent gain in watch sales, which differed materially from government figures. The LGI sales data for branded jewelry showed a 15 percent gain in November, a divergence from the government data. Brands are very important during the holiday sales period.

· Total

DETAIL of Jewelry Sales Trends

November 2012

· Total jewelry sales: $5.2 billion, +8.3 percent

· Specialty jewelers’ sales: $2.7 billion, +8.2 percent

o Specialty jewelers’ sales were just under 43 percent of total

· Other merchants’ jewelry sales: $3.5 billion, +8.4 percent

o Other merchants’ market share was just over 57 percent of total

· Total retail sales (all categories): +5.1 percent

o Total retail sales, ex-autos: +4.1 percent

o Retail sales trends accelerated in November in the

Eleven Months Year-to-Date 2012

· Total jewelry sales: $57.4 billion, +5.7 percent

· Specialty jewelers’ sales: $24.5 billion, +4.3 percent

· Other merchants’ jewelry sales: $32.9 billion, +6.8 percent

· Specialty jewelers captured 43 percent of the total jewelry sales in the

The following table summarizes full data about retail and jewelry sales in November 2012.

WHAT Sold In November: Watches Outpaced Jewelry

Demand for fine watches was modestly stronger than demand for fine jewelry in November, as the following data shows:

· Fine jewelry sales rose by 8.2 percent to an estimated $5.45 billion in November. Fine jewelry represented about 87 percent of total sales of fine jewelry and watches in November; this was consistent with prior months in 2012 as well as consistent with historic trends.

· Fine watch sales rose by 9.3 percent to an estimated $829 million in November. Fine watch sales were about 13 percent of total sales of fine jewelry and watches in November, which was consistent with prior months in 2012 as well as consistent with historic trends.

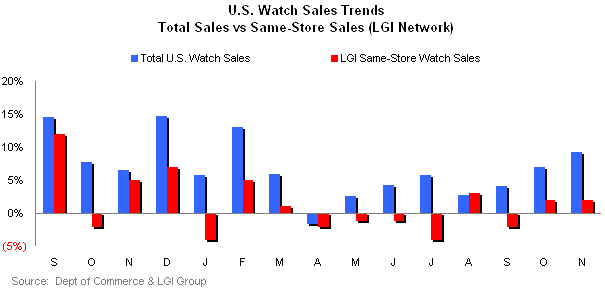

During most months in 2011, watch sales showed a greater sales gain than jewelry; in 2012, jewelry sales gains have been stronger than watches for nine of the first eleven months, as illustrated on the graph below.

The graph below summarizes sales trends for jewelry (orange bars) and watches (blue bars).

Branded jewelry sales data from the LGI Network indicated that demand was very strong, as the red bar on the graph below illustrates.

The branded jewelry sales figures are based on the performance of LGI Network's Branded Jewelry Tracker service which currently reports on eleven leading jewelry brands including David Yurman, Hearts On Fire, John Hardy, Kwiat, Marco Bicego, Ippolita Mikimoto, Precision Set, Roberto Coin, Scott Kay and Tacori. The branded jewelry sales trends are derived solely on the per-storefront productivity of independent specialty jewelers only.

LGI Network data for watches showed a modest gain, as the red bar on the graph below illustrates.

WHO Sold Jewelry in November: Multi-Line Merchants Took Slight Share

For most of 2012, the battle for market share has been bouncing back and forth between specialty jewelers and other merchants – mostly multi-line discounters – who sell jewelry. However, in July, August, and September, specialty jewelers lost significant market share to other merchants who sell jewelry. This is reflective of the long-term trend which shows that specialty jewelers have been declining in importance to American shoppers for decades.

In October, trends reversed, and specialty jewelers took market share from multi-line retailers by a decisive margin. However, in November, multi-line merchants took share “by a nose” from specialty jewelers.

Here is what the retail distribution channel data shows for jewelry and watches in November:

· Specialty jewelers posted a strong 8.2 percent gain in sales. This was only slightly below the overall sales gain of 8.3 percent for all jewelry and watches sold by any retail merchant.

· Jewelry sales at multi-line merchants such as Wal-Mart, JC Penney, Costco, and others rose by an 8.4 percent in November. Shoppers want “value,” and specialty jewelers have not been able to develop a credible value offer.

The graph below summarizes recent monthly sales trends by major retail distribution channel in the

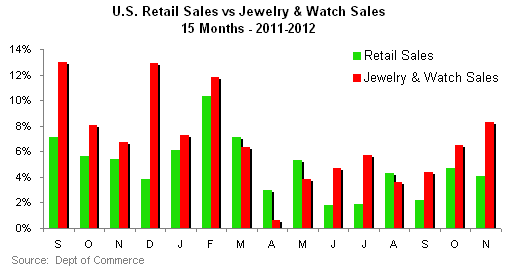

RETAIL Market Share: Jewelry Sales Gains Outpaced Total Retail Demand

During 2011, jewelry sales gains were much stronger than total retail sales gains (all categories of merchandise), indicating that jewelry captured significantly greater share of wallet during the year.

Jewelry’s share of wallet has been vacillating during 2012: one month, jewelry takes market share from other categories, only to lose it the following month. Beginning in the first quarter, jewelry sales were drummed by total retail sales gains, as the jewelry category lost consumers’ share of wallet. This trend continued in April and May, and then reversed in June and July.

However, August results show that jewelry lost market share to other merchandise categories. In September, October and November, the balance shifted once again: jewelry picked up share of wallet with consumers. Uncertain consumers typically have uneven spending patterns, and this has been the trend so far in 2012.

· Total retail sales, ex-auto, rose by 5.1 percent in November, somewhat below the 8.3 percent sales gain posted by total fine jewelry and watches.

· When automobile sales – often driven by price-based promotions rather than any underlying need for a new car – are added into the equation, total

The following graph summarizes retail sales ex-auto and food (green bars) versus jewelry sales trends (red bars).

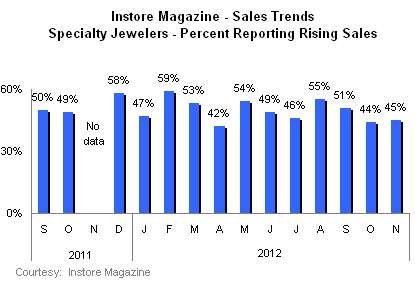

CORROBORATING Jewelry & Watch Sales Data

Instore magazine’s Brain Squad reports monthly sales trends. November’s sales data from Instore showed weaker trends than the government data, as shown on the graph below.

Outlook: Moderate Gains Expected

While November’s jewelry sales trends are encouraging, uncertain American consumers have continued to keep a relatively tight rein on their overall spending. Preliminary holiday sales reports suggest softness in consumer demand.

Worse, January 2013 jewelry demand appears to be off significantly. As one jeweler told us, “shoppers turned off their spending spigot on January 1.”

We continue to forecast that sales of fine jewelry and watches will rise by about 4 percent in 2012, when compared to 2011. While the percentage gain is modest, 2012 will be a record sales year for the American jewelry industry.

We are also forecasting a revised 3-to-4 percent jewelry sales gain for the 2012 Holiday Selling Season, when the final data is reported sometime in the second quarter of 2013.

Our preliminary sales forecast for the