In Praise of Investing in High-End Diamonds

February 14, 13

The debate about investing in diamonds in the popular and economic press mostly considers investment in 1-carat white goods, the kind considered the "bread and butter" of diamonds. At the same time, when these same outlets cover news about high-end goods sold at auctions, awe is expressed, usually without serious consideration of the investment qualities of these diamonds.

What a mistake because investing in high-end diamonds is an excellent investment. Over the years, these goods have high returns on investment, their value growing by 10%-20% annually, and sometimes by much more than that.

The opening bell sounded in the 70s. In 1972, Richard Burton bought Elizabeth Taylor a 69.42-carat, pear-shape diamond for an estimated $1.1 million. In 1978, after their divorce,

White diamonds, especially large D/IF and D/FL, have been doing well ever since. In the four years that passed between being auctioned at Christie's in 2003 and being auctioned again in 2007, a D/FL 20.22-carat emerald-cut stone with excellent polish and symmetry appreciated by 176% – about 28% annually.

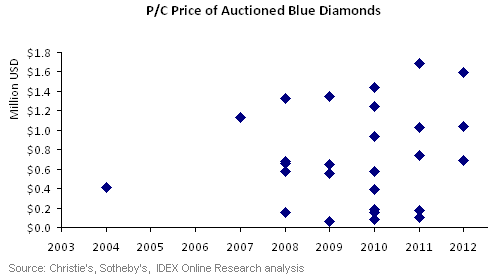

The star performers are, however, colored diamonds. In the past few years, Fancy Vivid blue diamonds have been the standout items among them. A 6.01-carat, cushion-cut diamond sold for a record $1.69 million per carat (p/c) in 2011 and an 8.01-carat square emerald-cut stone fetched $1.6 million p/c last year. Exceptionally high prices, for exceptional diamonds is the name of the game.

Investors' discovery of fancy color diamonds, beautiful blues and pinks in particular, has led to an explosion in demand and price in the past decade. Consider the following graph of per carat prices of blue diamonds from the past few years. All are diamonds that were sold at auctions; most are Fancy Vivid blues and all VS1 qualities and better. (The following data is a small sample we picked from our database, but it is representative of these kind of goods.)

Clearly, more such diamonds have been auctioned in the past few years, as opposed to being sold privately. Investors are already cashing in, with more investors joining the game in a limited inventory market. Next, the general price-per-carat trend is clearly upwards. We are on to something here…

The economics of this investment venue is straightforward. A minimum investment of $750,000, buy as close to the source as possible for a “low” purchase price, sell a few years later at auction to maximize return. In between, the price is relatively recession-proof simply because very few top diamonds are mined every year, plus the steady and still growing demand from buyers, mainly in the

On the downside, a diamond is not a source of passive income like dividends from stocks, but the knowledge that one can literally pocket a few millions and flee a collapsing country (or harassment by a less then democratic government/estranged spouse/criminal elements – pick your problem) makes up for that, at least partially.

While many along the diamond pipeline are brushing off the notion that diamonds are a commodity, they do so mainly because of how diamonds are sold to consumers: as a sign of love. The two, commodities and love, do not live well together. Even so, all along the pipeline diamonds are treated as a commodity. Polished diamonds are bought and sold based on parameters of weight, color, symmetry and more. These are all characteristics of trade in a commodity.

Some investors understand this and their numbers are growing. Clearly, investment in diamonds has come of age. This will lead to growing demand, rising prices, and establishing diamonds as a bona fide investment vehicle – as they should be.

A quick reminder, I will be speaking next weekend (February 23 at 5pm) about diamond prices at Inhorgenta Munich. You are welcome to attend.

Follow Edahn on Twitter

Get in touch on LinkedIn

Connect on Facebook

Or email edahn at idexonline dot com