IDEX Online Research: Polished Diamond Prices Depreciate in April

May 02, 13

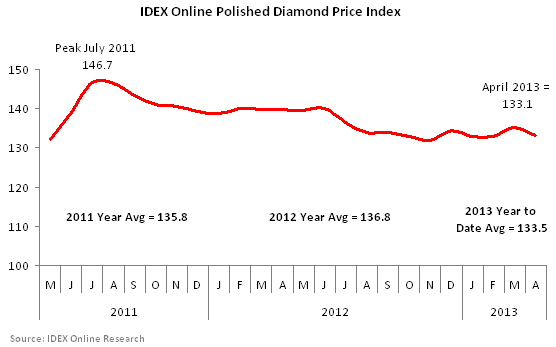

(IDEX Online) – Prices of polished diamonds drifted lower in April, according to the IDEX Online Polished Diamond Index. The index averaged 133.1 during the month, a 1.5 percent month-over-month decline.

The IDEX Online Polished Diamond Index started the month at 133.4 and closed at 132.8.

April is traditionally a slow trading month among polished diamond wholesalers, and the month's softening prices can be, at least partially, attributed to that.

The downward drift in polished diamond prices in January paused in late February, and seemed to end in March. However, this general trend, despite the earlier positive signs, continued throughout April, according to the IDEX Online Polished Diamond Index.

The Index declined despite rough diamond prices edging up and financing in the wholesale trading centers continuing to be an issue. Buyers' resistance to higher polished diamond prices, especially in the

Price Trends

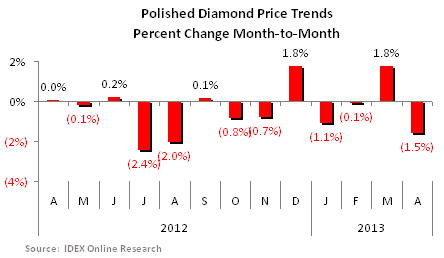

In April versus March, the index declined by 1.5 percent, compared with a 1.8 increase in March vs February. The last month-over-month increase in prices took place in December 2012, late in the holiday season.

In the 21 months since August 2011, after diamond prices peaked in July, the index increased only during six months. In the other 15 months, the index declined. The cumulative affect is a 9.3 percent decline since the July peak.

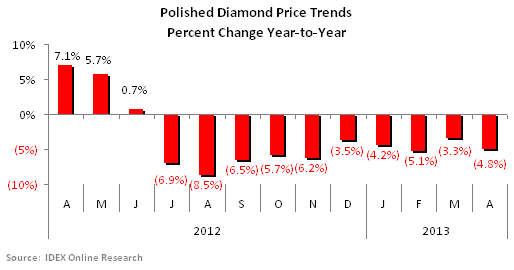

Compared to April 2012, the IDEX Online Polished Diamond Index declined 4.8 percent in April 2013. This is the tenth consecutive month that the index has declined year-over-year.

Throughout April, the index declined on a day-to-day basis. On April 1, the Index stood at 133.4 and on April 30, it closed at 132.8, slipping 0.4 percent on a first-day to last-day basis.

Diamond Prices by Size and Shape

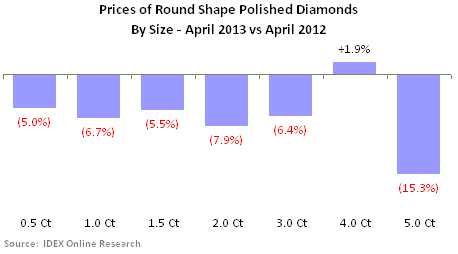

The price index of almost all key sizes of round shape diamonds declined during April. Apart from 4-carat rounds, the index declined for all key-size rounds on a year-over-year basis.

Four-carat rounds increased 1.9 percent in April 2013 compared to April 2012, while the rest of the key sizes declined by 5-15 percent year-over-year. This is an 11-month long trend.

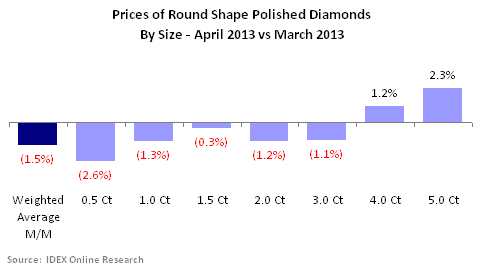

On a month-over-month basis, the price index for most round goods, from 0.5-carat to 3-carat round goods, declined in April as compared to March. Only the large 4- and 5-carat round diamonds increased in April, as the following graph shows.

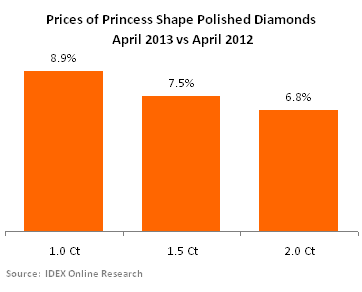

For the recent darling among retailers and consumers, Princess shape diamonds, the long run of price increases may be abating, even though compared to April 2012, the key-size Princess shape diamonds increased by a large single-digit.

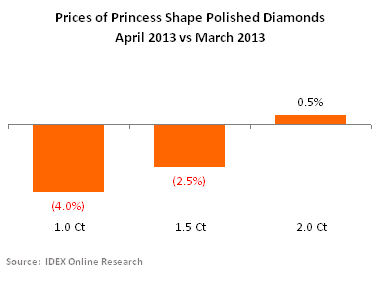

However, compared to March of this year, the index for 1, 1.5 and 2-carat Princess shape diamonds declined during April, especially the 1-carat goods that enjoyed a revival in recent months.

Long Term Historic Trend: Round Diamond Prices Keep Drifting

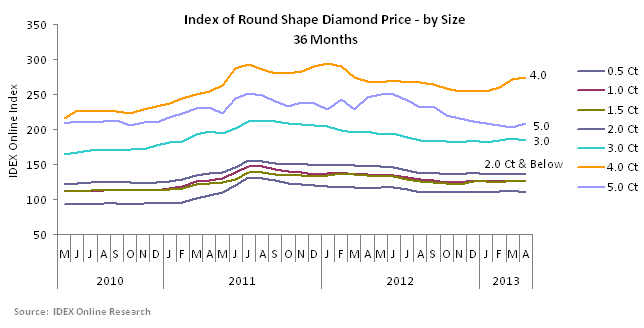

After steadily increasing from the 2009 crisis, developing into runaway prices in the first half of 2011, the IDEX Online index peaked at 146.7 in July 2011, and has been on a general downward trend ever since.

The notable exception so far this year, are the 4-carat round goods that are bucking the general trend. Representing less than half a percent of the global wholesale polished diamond trade, 4-carat rounds do not have enough weight to lift the overall price index.

Outlook

The short-term outlook remains lackluster.

Continued economic difficulties, and the frequent discussion in the global press about hardships in the

In the long-term, we remain confident that polished diamond prices will increase when consumer demand turns around and growth resumes, and as rough diamond supplies decreases. Rough diamond production is already below 130 million carats annually, and has not passed this level since 2009.