India's Weakness is Everyone's Weakness. But is it Weak?

May 09, 13

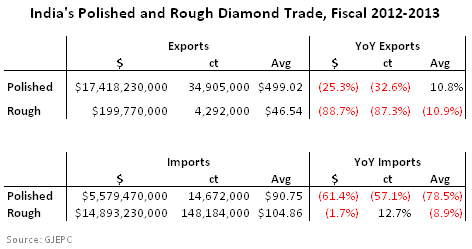

There is always an attempt, a psychological one, to sugar coat bad news. This is not healthy, at times misleading, and at the end of the day, stands in the way of taking the steps necessary to turn bad into good. It's important to examine these results because Deep Declines Most news outlets focused on the improved March figures or the overall gem and jewelry results, but examining the year as a whole has its advantages. All the small short-lived kinks are smoothed out and a fuller picture reveals itself. In this case, the full picture is that the past 12 months were not good for the diamond industry.

Polished diamond exports from

Falling Exports = Shrinking Demand

Buyers in the consumer markets cannot purchase goods that are not exported from a manufacturing center. However, this is not just a 'Push' system, where suppliers feed consumers, this is primarily a 'Pull' system where consumers express an interest that fuels supply.

Rough diamond imports by

They stocked up on lower-value goods – down 8.9 percent on average – but still sold less.

The Round-Tripping Effect?

It's possible that the above conclusion about

Let's assume that the nearly $9 billion decline in polished diamond imports is entirely round-tripping and that the goods were priced at the same value when exported. This means that we should subtract $9 billion from the 2011-2012 exports, leaving us with $14.4 billion of "genuine" exports during that year.

With that figure in mind, polished diamond exports in fiscal 2012-2013 have actually increased by more than 20 percent. Is it possible? In support of this theory is the 16.6 million carats in additional rough diamond imports. A yield of about 22-25 percent will generate approximately 4 million carats of polished that at an average value of almost $500 p/c, makes an additional $2 billion worth of extra polished available for export.

Tack this $2 billion to the assumed $14.4 billion of real exports brings us to ~$16.4 billion worth of polished diamonds, close to the reported polished exports in 2012-2013. If this back of the envelope calculation reflects what really took place, then where is the extra $1 billion of goods coming from? Possibly a combination of inventory sales, increases in the value of stocks and maybe there is still some round-tripping going on. Do all these assumptions hold water?

Reported Declines is Not the Full Story

Polished diamond exports from

High-end brands are reporting a continued increase in business thanks to high-income individuals who travel and buy top brands. This explains the good demand for top color and clarity as well as larger size diamonds.

There are plenty of additional pockets of strong business in the diamond jewelry trade, but they do not negate the overall story – one of a continuing murky economic situation, a slowdown in personal income growth and very limited advertising for diamond jewelry. Together, they result in mediocre demand for diamond jewelry and a shrinking business environment.

Follow Edahn on Twitter

Get in touch on LinkedIn

Connect on Facebook

Or email eg at edahngolan dot com