KP Figures Are Revealing

August 01, 13

An examination of KP’s global rough diamond production and trade report reveals little hidden secrets about the diamond industry: odd export prices, low production value and may uncover more truths. Also, how much of the global production is controlled by just two companies? Fiddling with figures is an odd habit, but at times it unveils some interesting facts and raises worthy questions. This is true for the latest Kimberley Process figures, which report production, imports and exports of rough diamonds of all KP members. We tend to blast KP for its slow reaction and deadlock politics, even its lack of transparency. Yet, the one thing it does well (though belatedly) is its annual summary.

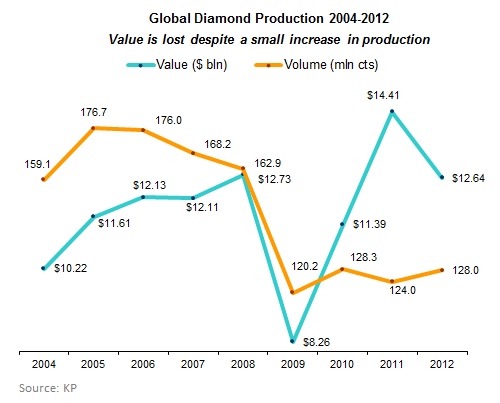

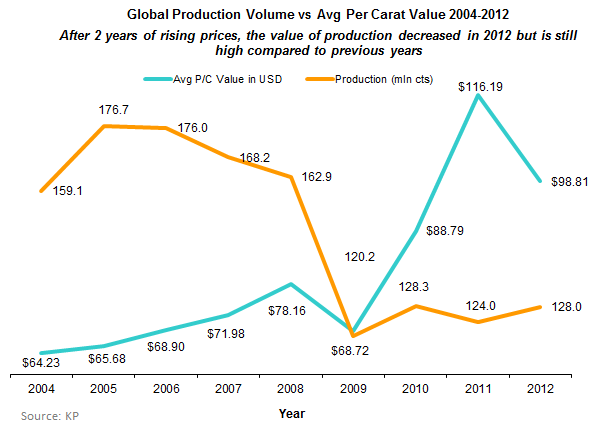

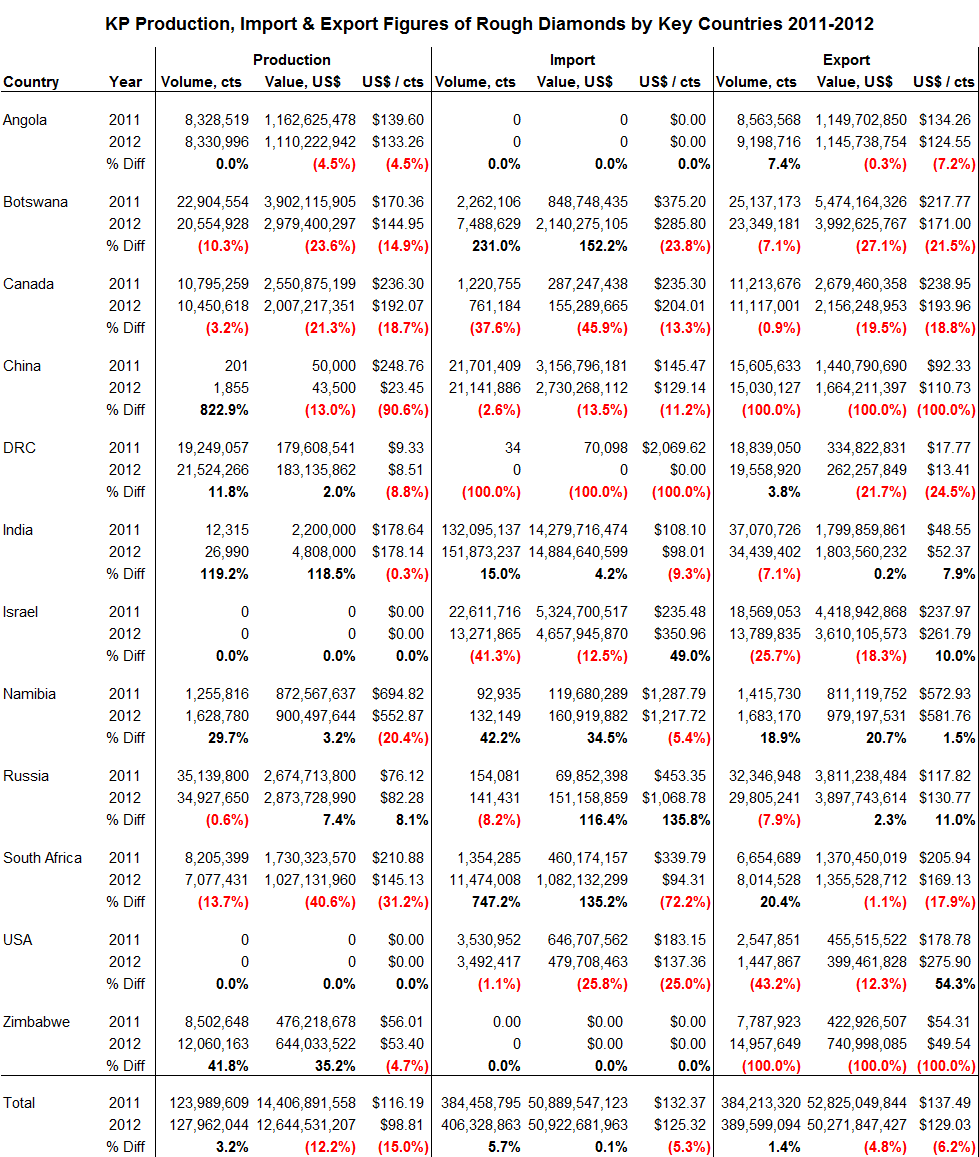

It was already reported that global production increased by 3.2 percent to 128 million carats and that the value of production fell 12.2 percent to $12.65 billion. Production decreased in several large producing countries, most notably Canada, down 3.2 percent in volume and 21.3 percent in value.

In Angola, the average value of goods at production decreased 4.5 percent to $133.26 per carat in 2012. Oddly, once again the value of exports is lower than at production, averaging $124.55 p/c in 2012, a 6.5 percent loss of value. This continuing trend raises many questions. In 2012, Angola exported some 800,000 carats more than it produced. Assuming that these goods are stocks from previous years, and that their average value was low, this could explain the discrepancy in 2012. However, it still raises questions for it being a regular occurrence in the past decade.

India, the world’s leading diamond manufacturer, increased imports, but their average value declined 9.3 percent. Conversely, Israel decreased imports significantly, but the average value of imports increased 49 percent to $350.96. Is the shrinking Israeli market focusing on higher value goods?

The Democratic Republic of Congo, which is suspected of a wild collection of ills – including child labor, corruption and smuggling, reported that the average value of its production was only $8.51 p/c, near the value of industrial goods and not worth the cost of mining. One of its main mines, MIBA, is known for the low value of its goods, estimated at one point at about $20-$80 p/c, yet this is far from explaining the single-digit average value for the entire country.

In Zimbabwe, where Robert Mugabe was just re-elected as President, production increased 41.8 percent in 2012 compared with 2011, but the average value declined 4.7 percent to $53.40 p/c. The fears of Zimbabwe flooding the market are somewhat misplaced. True, it produced more than 12 million carats of diamonds in 2012, but their low color means that they are not fit for a nice diamond engagement ring, the main driver of diamond consumption.

Clearly, global consumers, as a whole, are buying less, and mostly paying less for diamonds. Even China, the bright hope of the diamond industry, imported far fewer rough diamonds in 2012, indicating a decline in manufacturing in the country.

The diamond industry mostly deals with companies, and hardly with countries or governments; manufacturers buy rough from mining companies. In 2012, Alrosa, the world’s largest producer by volume, mined 34.4 million carats and De Beers, the second largest miner by volume, 27.9 million carats, respectively 26.9 percent and 21.8 percent of global production. These two giants mine nearly 49 percent of the world’s diamonds.

The global economy is obviously in a transition period. Today, many economists expect a slow economic global recovery with an improvement later this year or in 2014, six years after the tumble began.

When we wrote about the KP figures last year, we expected global production to rise by 3 percent. This year, we expect global production to rise by a mid-single digit and prices to inch upwards in 2013. For this to happen, the industry needs first to see more demand from consumers. At this point, that seems harder than a diamond, although far from being impossible.

Follow Edahn on Twitter

Get in touch on LinkedIn

Connect on Facebook

Or visit EdahnGolan.com