IDEX Online Research: Rollercoaster Polished Diamond Prices Reflect Insecurity

August 05, 13

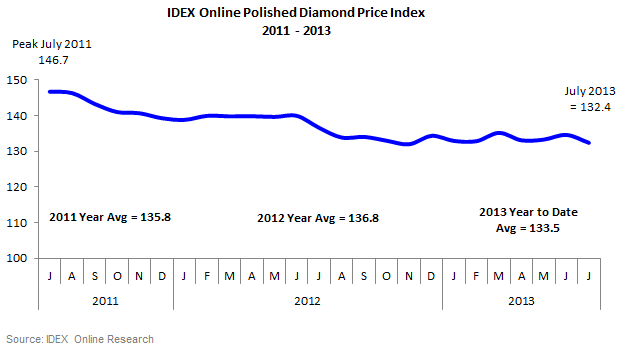

(IDEX Online) – Prices of polished diamonds decreased in July, according to the IDEX Online Polished Diamond Index. The index averaged 132.4 during the month, down 3.1 percent year-over-year and 1.7 percent compared to the preceding month.

After two months of increasing prices, the index declined in July, resulting in a seesaw effect in month-to-month prices since the beginning of 2012. With the direction of prices changing almost every month, at most every other month, the IDEX Online Polished Diamond Index rose eight times in the 19-month period, and declined 11 times.

The overall effect of this trend is a 4.6-percent decline since January 2012, and a 0.4-percent decline in 2013.

With continued growing demand for jewelry in the U.S., the economic factor behind the rising prices in June, why did the index decline in July? It could be that while jewelry sales went well in the first five months of 2013 (the latest figures available), in the past couple of months sales may have declined a little, resulting in a feeling of uncertainty among retailers, an uncertainty that is trickling up the diamond pipeline.

It is true that polished diamond prices are reeling from a combination of pressure for lower prices by retailers, liquidity issues by manufacturers who prefer selling more for less to generate turnover, and continued economic uncertainty in the China, the second largest diamond-consuming market. However, this is not seen in the U.S. – so far.

Price Trends

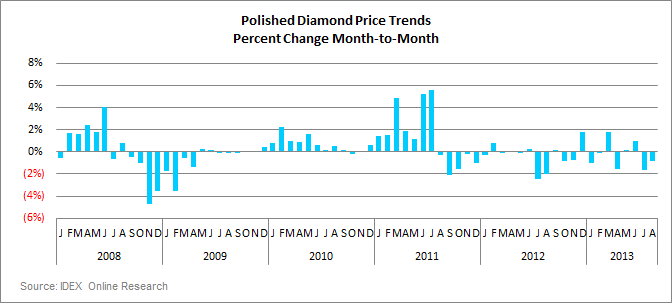

Despite the gloomy trend in July, the changes in month-over-month prices are still resulting in an upward trend, as the graph below shows due to strong price increases in December 2012 and May of this year.

In the 24 months since August 2011, after diamond prices peaked in July, the index increased only during eight months. In the other 16 months, the index declined. The cumulative effect is a 9.5-percent decline since the July 2011 peak. Looking at the half-full glass, three of the eight increases took place in the last five months, as the American economy is showing signs of continued recovery.

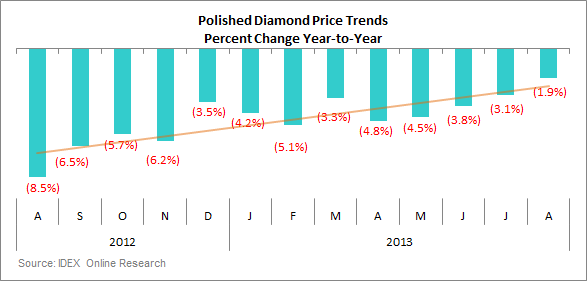

Compared to July 2012, the IDEX Online Polished Diamond Index declined by 3.1 percent in July 2013, completing 13 months of year-over-year declines.

The year-over-year declines take place against a weak 2012, which is worrisome. However, after a very strong first quarter of jewelry sales in the U.S., retailers and jewelry wholesalers are slowly willing to buy more and the result is that the year-over-year declines have been shrinking in the past few months.

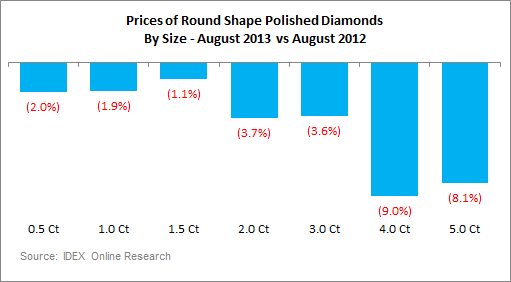

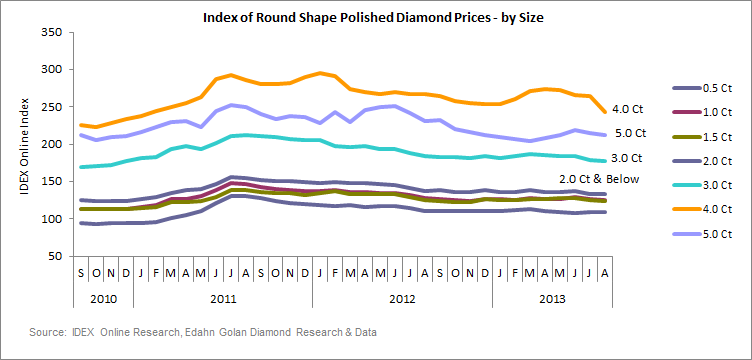

Round Shape Diamonds Prices by Size and Shape

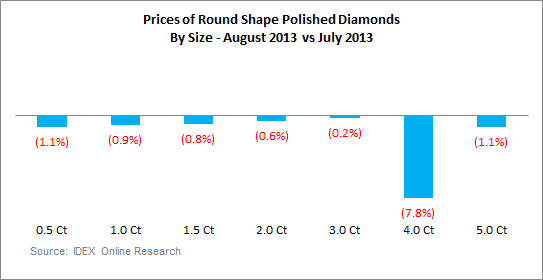

The price index of almost all key sizes of round shape diamonds decreased in July on a month-over-month basis. Only 0.5-carat rounds increased in July compared to June, gaining 1.7 percent.

The index for the important 1-carat rounds lost 1.4 percent compared to June. Larger declines of 2.5-3.5 percent were seen for 1.5-, 2- and 3-carat rounds in July.

On a year-over-year basis, the price index for round goods declined for all key sizes during the month. One-carat rounds are lagging 3.7 percent behind their prices a year ago, the average price of 2-carat rounds are 5.7 percent lower and 5-carat rounds are 11.3 percent below their prices a year ago.

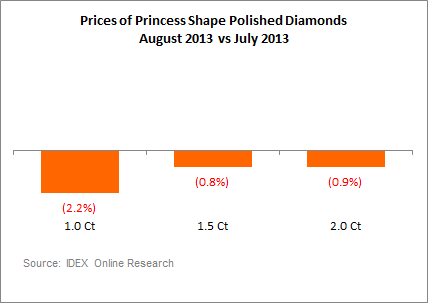

Prices of Princess Shape Diamonds Fall

After the price dip in May and the small recovery in June, the price indexes of 1-, 1.5- and 2-carat Princess-shape diamonds fell on a month-over-month basis. This is a widening, if not reversal for these items.

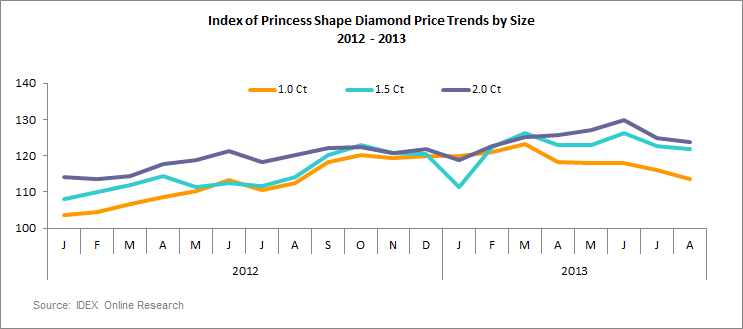

After years of depressed prices, Princess goods became an alternative of growing popularity to rounds among retailers and consumers. The result was steadily rising prices in the past year and a half. However, in recent months, prices of Princesses have been cooling, and in July they fell.

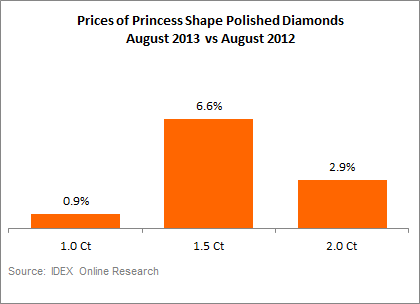

On a year-over-year basis, the three key-size Princess shape diamond categories are still exhibiting price increases, mostly the 1.5-carats, which increased by only 9.9 percent compared to July 2013. We say only because in June 2013 this item increased by 12.3 percent compared to June 2012.

The long-term trend of Princess shape diamonds in the three key sizes shows that the index for 1.0-carat stones has been declining since March of this year, while 1.5-carat and 2-carat Princess-shape goods are only recently suffering from declines.

Long Term Historic Trend

After steadily increasing from the 2009 crisis, developing into runaway prices in the first half of 2011, the IDEX Online index peaked at 146.7 in July 2011, and has been on a general downward trend ever since. In the last few months, we are seeing this trend moderating.

Outlook

The cautious optimism we expressed in July may seem short-lived, however the recent declines should be taken within the context of a gloomy outlook in the diamond industry, coupled with the departures of many traders for early vacations.

U.S. retailers enjoyed a good run in the first quarter of 2013, and the most recent information indicates that the trend continued into the second quarter. Solid demand from China and Japan provide additional reasons to expect a temperate improvement in the coming months. Lackluster demand from Indian consumers, hurt by the weakening rupee, is dampening the global demand outlook.

With the stock markets continuing to rise, an improving U.S. economy, and expectations that the slowing Chinese economy won’t deteriorate further, we expect polished diamond prices to increase in the long-term, especially with the improving Japanese economy, which is propelling demand in what is still a leading diamond-consuming market.