IDEX Online Research: Polished Diamond Prices -1.9% in August

September 08, 13

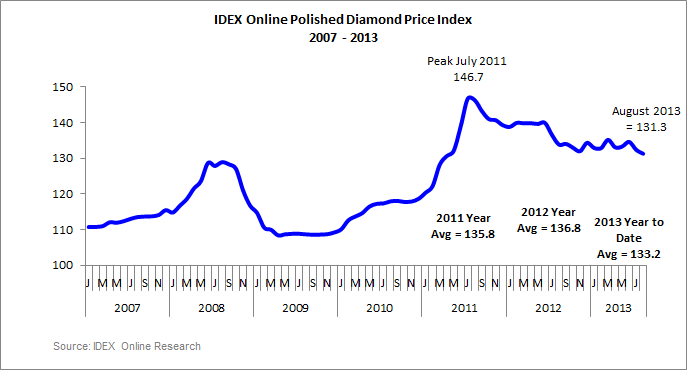

(IDEX Online News) – Prices of polished diamonds continued to soften in August. The IDEX Online Polished Diamond Index averaged 131.3 in August, down 1.9 percent year-over-year and 0.8 percent compared to the preceding month.

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here.

The overall August decline is a slowdown in the decline compared to July. This is the second month in a raw of overall month-over-month price declines, and it follows two months of increasing prices, resulting in a seesaw effect in month-to-month prices since the beginning of 2012.

With the direction of prices changing almost every month, at most every other month, the IDEX Online Polished Diamond Index rose eight times in the 20-month period, and declined 12 times.

The overall effect of this trend is a 5.4-percent decline since January 2012 and a 1.2-percent decline since January 2013.

There are a number of reasons for the recent price declines. During the summer months, many of the diamond traders are away on vacation and trade is limited. As a result, prices tend to ease in July and August.

The second, more important, reason for the declines is a result of large supplies and limited demand. Finally, while demand for polished diamonds is not wild, prices of rough diamonds are high and manufacturers are trying to maintain polished diamond prices to avoid losses.

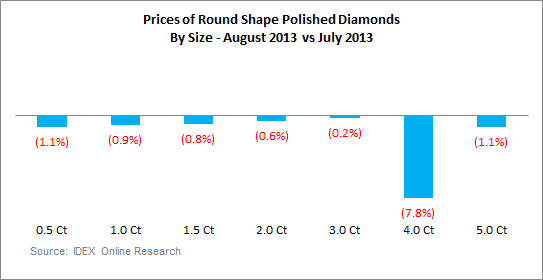

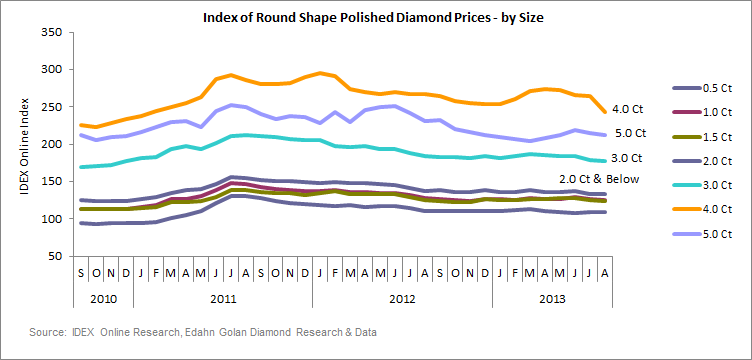

The price index of all key sizes of round shape diamonds decreased in August on a month-over-month basis. The index for the important 1-carat rounds lost 0.9 percent compared to July. The fluctuating 4-carat rounds declined 7.8-percent compared to July.

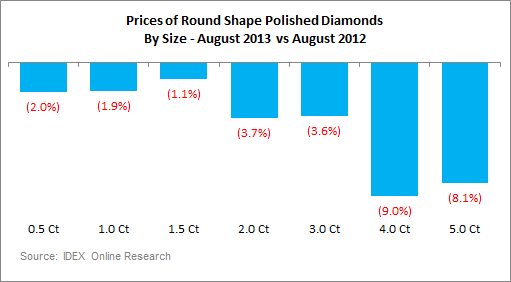

On a year-over-year basis, the price index for round goods declined for all key sizes during the month. One-carat rounds lost on average 1.9-percent of its price compared to the overall price a year ago, the average price of 2-carat rounds are 3.7 percent lower and 4-carat rounds are 9.0 percent below their prices a year ago.

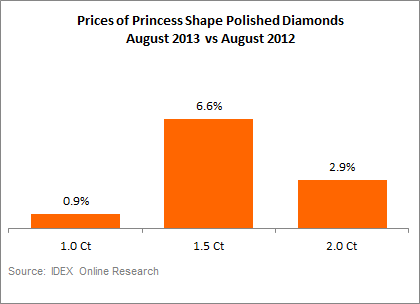

After the price dip in May and the small recovery in June, the price indexes of 1-, 1.5- and 2-carat Princess-shape diamonds declined again in August on a month-over-month basis.

This is a reversal in the price trend for these items. After years of depressed prices, Princess goods became a popular alternative to rounds among retailers and consumers. The result was steadily rising prices in the past year and a half. However, in recent months, prices of Princesses have been cooling.

On a year-over-year basis, the three key-size Princess shape diamond categories are still exhibiting price increases, mostly the 1.5-carats, which increased by 6.6 percent compared to August 2012.

After steadily increasing from the 2009 crisis, developing into runaway prices in the first half of 2011, the IDEX Online index peaked at 146.7 in July 2011, and has been on a general downward trend ever since. In the last few months, we have been seeing this trend moderating.

Outlook

U.S. retailers enjoyed a good run in the first half of 2013, and the most recent information indicates that the trend continued into the third quarter. A rising stock market in the U.S. – the S&P 500 increased by 14.5-percent in the first eight months of 2013 and is set to continue rising by 19-percent according to recent forecasts – means that many Americans will have deeper pockets for discretionary expenses in the November-December holiday season and diamond jewelry will benefit from this spending.

Solid demand from China, despite the recent slowdown in demand growth, provides additional reasons to expect at least a temperate improvement in demand in the coming months. However, lackluster demand from Indian consumers, hurt by the weakening rupee, is dampening the global demand outlook.

With global stock markets continuing to rise, an improving U.S. economy, and expectations that the slowing Chinese economy will not deteriorate further, we expect polished diamond prices to increase in the long-term, especially with the improving Japanese economy, which is still a leading diamond-consuming market.

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here. Click here for more information on how to subscribe or become a member.