IDEX Online Research: U.S. Jewelry Sales Rose 5.3% in September

November 21, 13

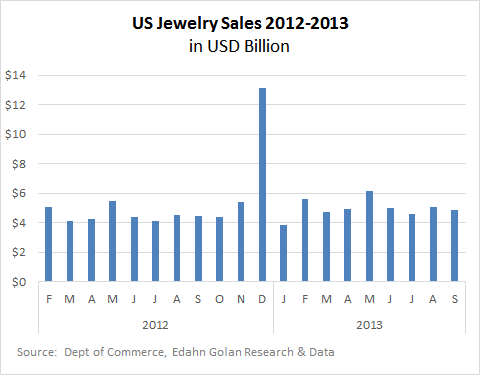

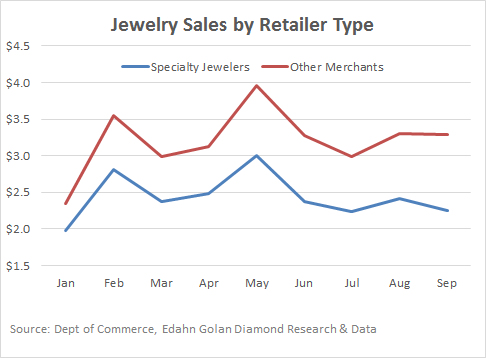

(IDEX Online) – Jewelry and watch sales in the U.S. totaled $5.54 billion in September, a 5.3 percent year-over-year increase, based on preliminary US government figures. Of this, specialty jewelers' sales increased to $2.26 billion.

Total Jewelry Sales +5.3%

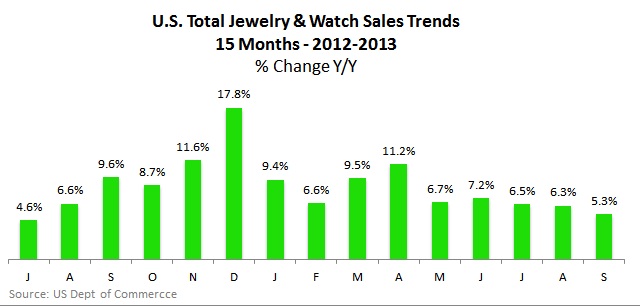

Jewelry sales alone, excluding watches, totaled $4.9 billion in September, up 5.3 percent year-over-year, based on US Department of Commerce data. On a positive note, the mid-high single digit increases in jewelry sales is very encouraging, averaging 6.3 percent so far this year. This rate of growth is clearly outpacing the current inflation rate of less than 1 percent.

At the same time, the rate of sales growth is shrinking, marking a third consecutive month of decline since June of this year. In June, the year-over-year growth rate stood at 7.1 percent according to recently adjusted figures. As we enter the important holiday season, the hope is to see a change in direction. We will have those figures in February 2014.

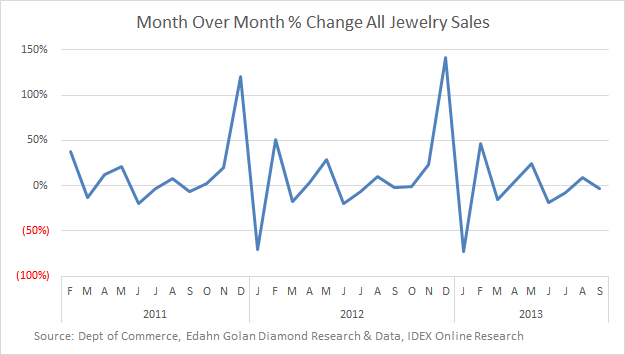

On a month-over-month basis, jewelry sales in September decreased by 3.1 percent, a strong fall after a robust 9.4 percent increase in August. However, this decline is part of a cyclical trend. Historically, after decreasing in June and July, jewelry sales in the U.S. increase in August and decline again in September, as the following graph shows.

For the first nine months of 2013, jewelry sales are estimated to total $44.7 billion, up 7.4 percent year-over-year. In other words, despite the slowdown in growth, jewelry sales in 2013 are still faring much better than during 2012.

Fine Watch Sales +5.9%

Watch sales in September continued the strong growth trend seen so far this year. Watch sales of an estimated $655 million increased by 5.9 percent on a year-over-year basis. While far less than the +7.5 percent seen so far this year, these figures are preliminary and are usually upwardly revised.

The August figures, for example, were initially stated at $662 million, rising by 5.5 percent year-over-year. According to revised figures, watch sales in August increased by 7.5 percent to $675 million. We therefore expect actual September sales to be higher than currently stated.

Month-over-month, watch sales decreased by 2.9 percent in September. Once again, after the June-July decreases, sales increased in August and declined in September, as they typically do.

Jewelry & Watch Spend

Overall, American consumers’ expenditure on jewelry and watches represents just a fraction of total expenditure. Annual expenditure in the U.S. economy exceeds $11 trillion, compared to annual jewelry and watch sales of less than $80 billion.

Spending on jewelry and watches is just shy of 0.7 percent of total consumer expenditure. This figure has been fairly consistent over the years, however due to the size of the U.S. market, tiny changes of a fraction of a percentage point represent large changes in how much of their budget Americans are willing to spend on jewelry in dollar terms.

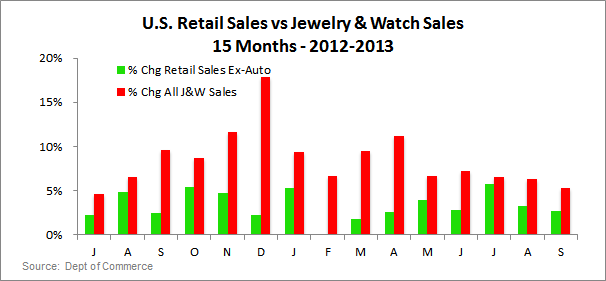

Change in total retail sales in the U.S. is less pronounced than change in jewelry and watch sales in the country. While both are growing, jewelry and watch sales are growing at much greater rate than total retail sales (excluding autos), as the following graph shows.

Specialty Jewelers

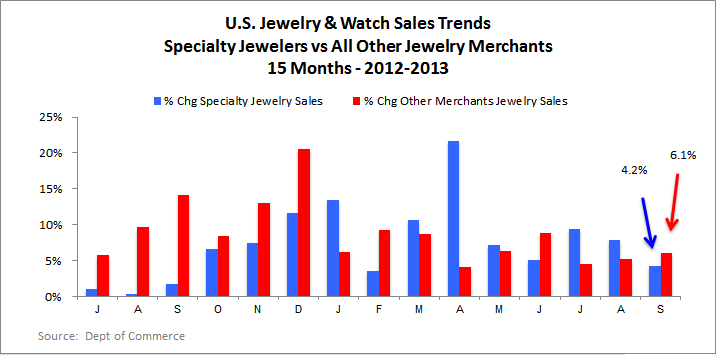

Specialty Jewelers market share is shrinking again after a brief resurgence earlier in the year. In September, their market share was 40.7 percent compared to a 59.3 market share held by other merchants.

These are merchants are retailers that offer a wide variety of goods, such as clothing, handbags and even food and include department stores and discount stores such as Wall Mart.

Outlook

American consumers are voting with their wallets – and showing an interest in jewelry in 2013. While we see a long-term growth trend, in the past few months this growth has been slowing. This is not a reason for concern, at least not yet. However, all sectors of the jewelry industry should pay attention to this change and ensure that they are ready for a shift in direction – if it indeed happens.

Meanwhile, we can take comfort in the knowledge that American consumers have not lost their appetite for jewelry, and opportunities are clearly still there for a wide variety of categories, including diamond jewelry.