The Year Prices Were Polished Down

January 02, 14

What an odd year it was. Polished diamond prices, which tried to rise in the early part of the year, were nearly flat throughout the second half of 2013. Rough diamonds, trading at a very different pace than in the past, were under tremendous pressure by manufacturers to bring down prices – and at times, this pressure was very effective. The rationale for bringing down rough diamond prices was that retailers are buying goods at a lower than expected volume while stalling any attempts to increase their outlay on diamonds. Coupled with an uncertain economic environment, eroding profitability and a steadfast decision by the banks to take matters into their own hands by decreasing the percentage of rough purchase financing (see Banks Are the New Market Custodians http://bit.ly/JLbinv the main producers reacted.

Throughout 2013, in this column we argued that prices of rough diamonds must decrease, as it was the only way to jump-start any kind of healthy, long-term demand for this unique product. If consumers at best prefer lower-priced items, and at worse passed on diamond jewelry altogether mainly because of price, the entire pipeline above them must align to that shift in demand. There was no resistance to break, but rather a change to accept. Eventually, it was accepted and rough prices gave in. However, it was not that simple.

Not All Items Were Price Stubborn

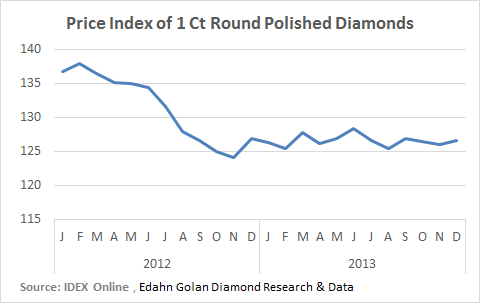

The mainstay of loose polished diamond trading and consumption are 1-carat round diamonds. Continuing to decline after the highs of late 2011, prices of 1-carat rounds hit a low in November 2012, according to the IDEX Online Polished Diamond Price Index. As the following graph shows, through 2013, prices zig-zagged in a limited range rising in June following the important Las Vegas trade fair (reaching 128.4 on the IDEX Index), and then softening towards the end of the year, closing 2013 at 126.5.

Overall, the IDEX Online Polished Diamond Index averaged 132.2 in December, declining 1.6% year-over-year. For the entire year, the Index averaged 132.9 in 2013, down 2.8% compared to 2012. With traders stating that 2013 was somewhat better than 2012, we can only assume that they are either selling more for less, or suffering from a slight case of amnesia – preferring to forget some of the rollercoaster horrors of 2012. It is a well-known fact that in hindsight, we know better and remember less – especially if it is a series of bad memories…

Polished Prices Decline Year-Over-Year

On a year-on-year basis, all round diamonds declined in 2013, and the more price volatile larger goods suffered from it in a pronounced way. While rounds smaller than 2-carats lost less than 1% in December 2013 compared to the end of 2012, 2-carat rounds lost 4.3%, 5-carat rounds lost 11% and 4-carat rounds fell 14.9% year-over-year. This was clearly a tougher year for the higher-end items.

This is partially because of the American consumer. In the US, where consumers are becoming more price-conscious, they were less inclined to buy diamond jewelry in 2013. This possibly reflects more on bridal-related purchases. The bride may still get a handsome diamond, but her mother, sister and future mother-in-law are now more reserved about such an outlay for themselves.

In China, the big hope for market expansion, demand did not meet expectations, and the growth was not one that can be characterized as fast-paced.

Rough Ends Low

The last Sight of 2013 was not very big, and prices seemed a little low. We know that the assortments were a little different, and so the higher priced boxes were mainly priced higher because there were more larger goods then in the past few Sights. That aside, prices at the end of the year were “softer” as the industry likes to say.

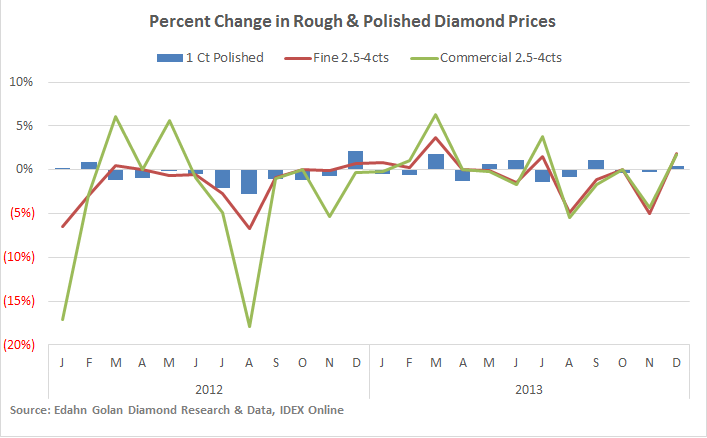

It is interesting in this respect to compare price changes of rough diamonds to those of the specific polished diamonds that are manufactured from them. We compared the month-over-month price changes of the very popular 1-carat round polished goods to the Sight-to-Sight price changes of two rough diamond assortments (‘boxes’ in industry lingo) that when polished generate 1-carat rounds. The polished goods in the graph below are for round, D-K color, IF-I1 clarity polished. They represent about 12% of the total value of goods offered by traders on the IDEX Online trading platform and as such are the most popular category of diamonds found on the platform.

The rough goods weigh 2.5-4 carats, and are two of the most popular DTC boxes – Fine and Commercial. Fine are better goods and priced about 50% higher than Commercial. At the January 2012 Sight, Fine 2.5-4 carat boxes were sold by De Beers at nearly $3,000 per carat while Commercial 2.5-4 carats were listed at close to $2,000 p/c. At the last Sight of 2013 in December, these two boxes sold for $2,475 p/c and $1,861 p/c, respectively.

What is interesting to see is that De Beers actually responded quickly to changes in the market. As prices of polished rose and fell, so did the prices of the goods from which they are polished.

The fluctuations in rough prices are far wider than those of polished prices and in the secondary market, the price fluctuations of rough diamonds are even wider. These fluctuations moderate as the goods move down through the diamond pipeline, tapering off at very little change in stores. This explains the earlier point of price resistance. The large retailers offer price points and plan their offerings in advance. Retailers know how to sell to consumers, and are a lot less interested in negotiating frequent changes in prices. In their perfect world, prices are motionless.

There is a lesson here for many. Retailers must understand that motionless equals dead, prices always move around, and they need to adapt. Manufacturers, who as always are stuck between a (rough) rock and a hard place, were mistaken to think that they are powerless against De Beers or Alrosa. They, too, live in the market and while always very hungry and quick to increase prices, understand that they need to adapt at times to manufacturer’s limitations.

At the same time, miners cannot look at the graph above and brush off manufacturers as ideal complainers. The banks, folks with a watchful eye on their clients’ ability to maintain a profit, were alarmed earlier this year to the point of taking aggressive action to curb rough diamond purchases. It’s not a badge of honor for rough buyers or miners; the banks’ call for restraint was in order.

Finally, in total, 2013 was not a very good year - no great new marketing campaigns emerged, no real financial growth, limited market expansion, plenty of illegal issues that should not have happened. It was a year of being on the sidelines more than anything else and it is disappointing that the promising diamond ETFs did not take off.

Now that Christmas is behind us and the buzz of New Year’s Eve has faded, let’s bid farewell to the year of omnishambles http://bit.ly/1g2ERMc and start working towards a better year in 2014.

Follow Edahn on Twitter

Get in touch on LinkedIn

Connect on Facebook

Or visit EdahnGolan.com