IDEX Online Research: Flat Start to 2014 For Polished Diamond Prices

February 04, 14

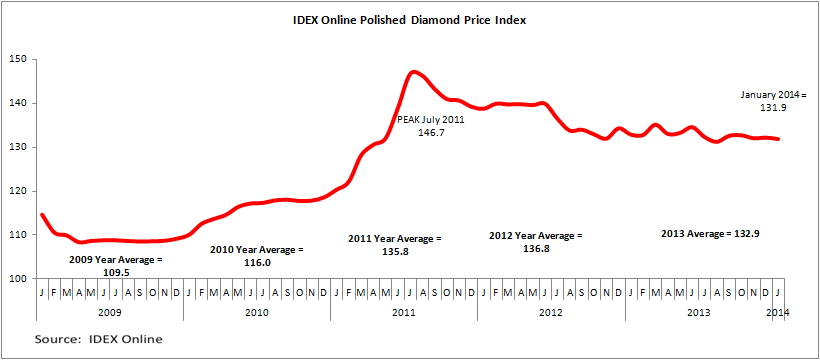

(IDEX Online) – The IDEX Online Polished Diamond Index was largely unchanged in January, averaging 131.9 compared with 132.2 in the final month of 2013. Round items were mixed, with 0.5, 1.0, and 1.5-carat diamonds rising while 3.0, 4.0 and 5.0-carat stones declined on the month.

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here.

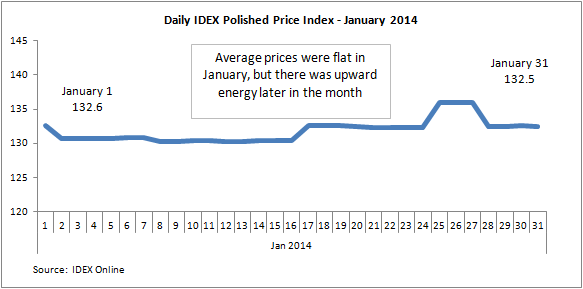

The IDEX Online Polished Diamond Index began the new year up at 132.6 and ended the month at close to the same figure – 132.5 – but between the start and end of the month spent most of the time at around 130-131.

A look at the wider picture shows that the index is roughly where it was in the final months of 2012.

Prices of polished goods made several attempts to break higher, but were unable to sustain the push as the graph shows clearly.

The latest data will give no New Year cheer to diamond manufacturers, traders and wholesalers. With the holiday season already history, manufacturers and others were hoping to see some sort of sustained rise in prices ahead of the Chinese New Year and Valentine’s Day.

Outlook

The New Year started off with rises in prices of rough diamonds supplied by De Beers and Alrosa, as the producers assumed that inventory levels had declined due to lower levels of production in recent months and sales for the Christmas and Chinese New Year which begins on January 31.

Prices are reportedly seen as having increased by an average of low-to-medium single digits by both diamond mining giants, with the majority of assortments affected and some adjustment of boxes taking place in a bid to moderate the rises.

Mike Aggett, Managing Director of H. Goldie, a De Beers broker, said the first Sight of 2014 was the largest sold so far in Gaborone and estimated to have a value of around $750 million. “Some Ex-Plan was offered and a limited quantity of additional J stock goods were presented during the week. The price increases that clients saw in paper were fairly significant, however some presentations were improved and some boxes in the better quality ranges were left relatively unchanged. We believe the overall increase to be around 3 percent.

“The price adjustment came as no surprise to Sightholders. Since factories opened post Diwali, shortages of rough in many areas have been apparent and premiums in the secondary market have increased accordingly. This coupled by a good seasonal sales period in the U.S. and positive expectation for the forthcoming Chinese New Year has also contributed to the improved mood amongst the rough buyers. However, first quarter over-enthusiasm is not something new, and although certain areas of polished have seen an upward shift in price the rough is moving up at a significantly higher speed based primarily on the expected restocking of retailers in America.

“Having made a positive start to the year it will be crucial over the coming months that there is alignment amongst all elements of the pipeline working towards stable growth and avoiding the speculative behavior that inevitably causes longer term disruption. Already we are seeing market premiums increasing still further despite the price adjustment and this is not a healthy sign for long term stability.”

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here. Click here for more information on how to subscribe or become a member.