South African Diamond Corruption: De Beers Launches 'Full-Scale Investigation'

April 03, 14

“Even though every rough diamond is unique, buying and selling them depends upon assigning value to agreed standards of size, shape, color and clarity. De Beers combines these factors into 12,000 different, identifiable categories of diamonds. Deciding how to classify any given diamond is a task that requires skill and experience. It is at the heart of what we do,” states the De Beers company website. Perhaps De Beers' most valuable and best-protected trade secret is its Price Book by which the value of each mine’s production is set. Mixtures of these thousands of different categories are ultimately combined into selling assortments that the DTC clients find in their sight boxes. The highly secretive DTC Price Book and its descriptions and values on the mining output of each and every De Beers mine (in Excel file format) is merely one of a host of other highly confidential De Beers’ and Petra Diamonds’ documents that is apparently floating around in South Africa and, apparently, quite readily acquired by unscrupulous elements – including, as far as we could ascertain, at least one DTC sightholder.

We don’t live in a perfect world. Unfortunately, there are still instances of bribery, kickbacks, etc. among industry stakeholders. There is one type of corruption, however, which severely damages (and might even cripple) competitiveness and threatens to destroy a fair playing field among diamond traders. It is the allegedly illegal and ostensibly criminal theft of corporate secrets and sensitive (or even secret) proprietary information. As DIB was told, “For some money (or a new Audi, Mercedes or similar gifts), a diamond trader can gain enormous competitive advantages in the South African diamond market. Call it industrial espionage, call it information theft, the practice seems to running out of control – and it’s time for the police to be called in.”

After weeks of journalistic sleuthing and considerable travel, Diamond Intelligence Briefs discovered an elaborate, illegal scheme in which, apparently, "some diamantaires as a matter of routine receive in real time copies of all invoices issued by DTC South Africa to each and every sightholder!" Thus, these merchants know precisely what boxes, articles, specials, etc, have been received by everybody else in their market.

But the obtainment of these invoices, which is bad enough by itself, turned out to represent just the tip of the iceberg. We discovered that hundreds – if not thousands - of detailed Excel file worksheets containing a breakdown of the entire production of the De Beers Consolidated Mines by categories, qualities, etc to the level of each single stone and their various values and valuations are, apparently, being made available to these new types of 'contracted' parties. Considerable skills are required to match the 12,000 price points to the sales mixtures, but comparing these lists on a sight-to-sight basis, using a simple computer program, would show precisely where prices have been adjusted and by how much.

Output Per Mine; Per Stone

The information out in the market gives details and summaries. There is a “Producer Summary of Mixture” (dated January 9, 2014) providing the number of stones, carats, and values of Voorspoed and Venetia production (and three stones from Pool CTF). But the information does not just originate from De Beers. It includes Petra Diamonds’ production as well: the Finsch Mine, Cullinan, Kimberley Underground, Koffiefontein, and a mine called Helam. Once upon a time, all these mines belonged to De Beers, but that’s a story for another day.

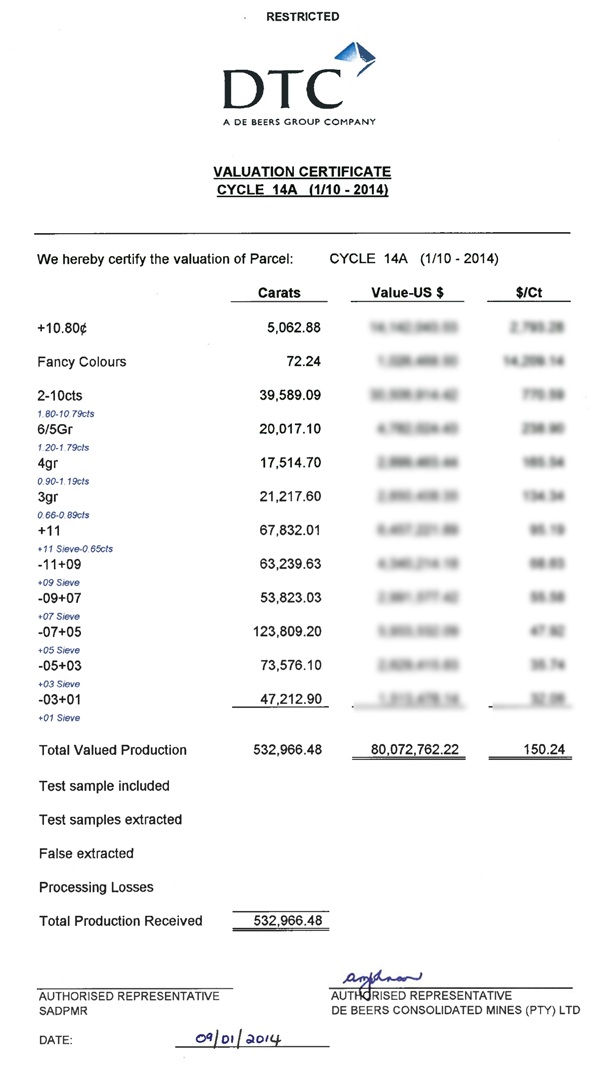

The mining output of De Beers in South Africa is now a fraction of what it used to be. Its production cycle 14A, which is the output sold at Sight 1 in 2014, shows production output of 532,986.48 carats valued at $80,072,762.22. That makes for a $150.24 per carat average price. The duly signed DTC Valuation Certificate, dated January 4, 2014, is among the documents floating around the market and obtained by DIB (and who knows by how many others).

Presumably, this cycle might represent some 10 percent of annual output.

A retired South African official, intimately familiar with De Beers’ pricing and valuation mechanism, to whom we turned for guidance in understanding this treasure trove that is available in the market, literally quivered and went pale when seeing the documents. “Chaim, this is the most secret part of De Beers – this has never been shared beyond a small, select and high nucleus of people.”

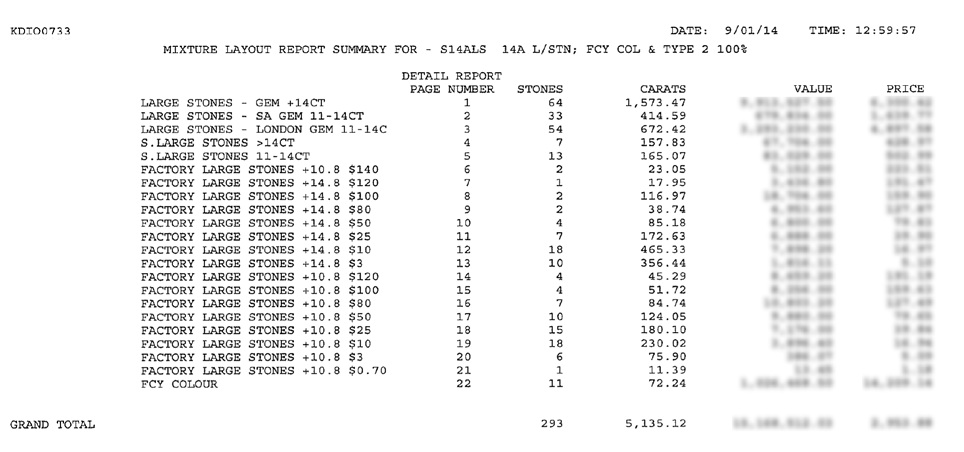

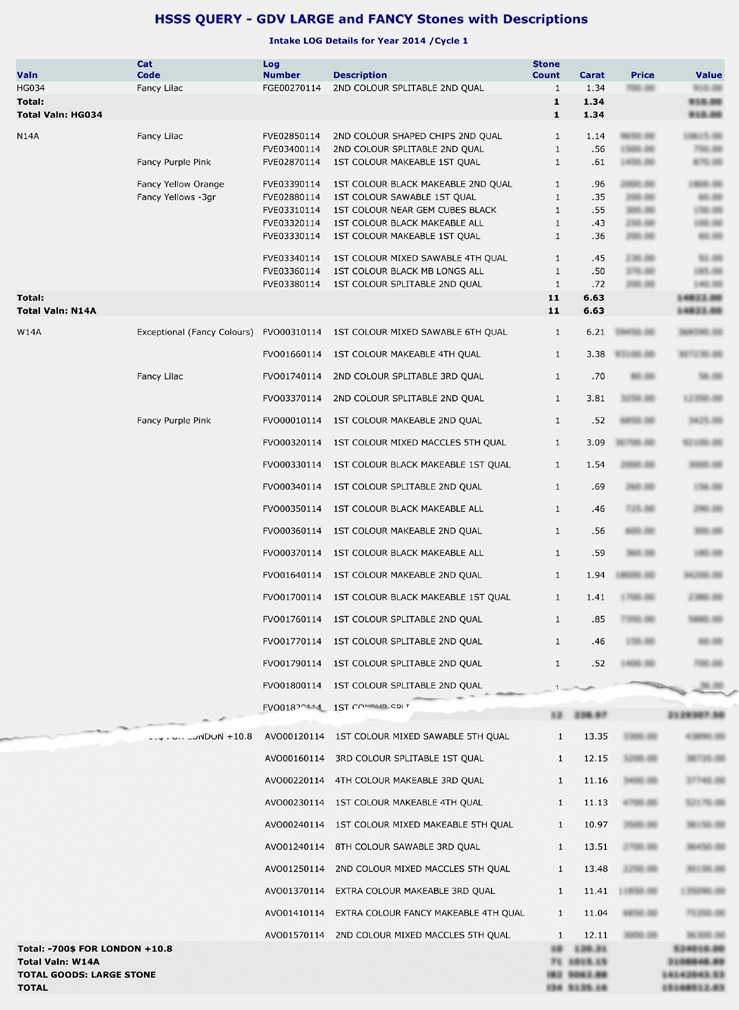

The documents not only provide the entire output; they also contain separate reports such as the “Mixture Layout Report Summary” for the 10 percent that is sold to South Africa’s State Diamond Trader. There are also valuations by the Government Diamond Valuator (GDV) who valued the parcel at 7 percent less. It was explained to us that, generally, the GDV’s estimates would be 5 percent below those of De Beers.

The after-sight reports prepared by DTC brokers for clients give only general information on price movements and may, in some instances, provide percentage changes in the size composition in the boxes. But details on clarities, colors and a host of other criteria can only be discovered if a sight box is sorted back to the original categories; it is a tedious, time-consuming activity, which only the highest skilled sorter can do. But when one gets the detailed production reports (and, thus, the DTC Price Book) month after month, there is no need for this box analysis. All the answers are there, in full Excel glory.

Specials 10.8 Carats and Up

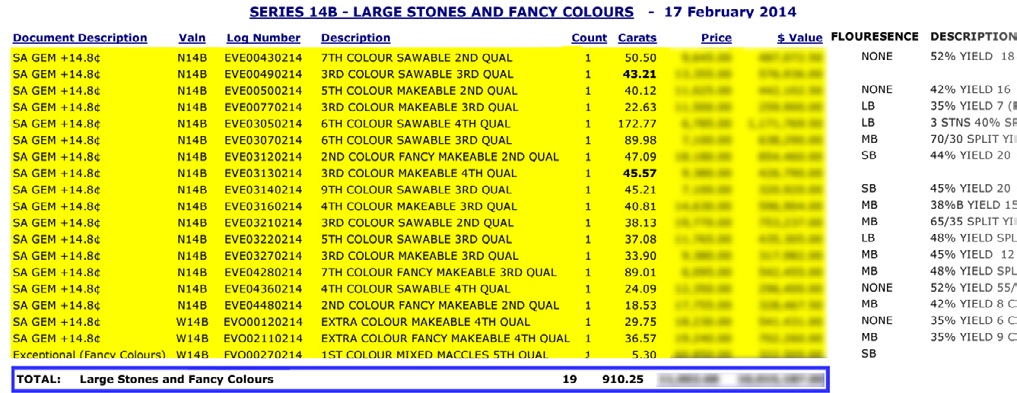

The cream of the South African production is, of course, the many large special stones (the exceptional stones). Here, De Beers Consolidated Mines is almost second to none. The materials circulating, on each production and sight cycle, contain precise descriptions on each and every large and fancy stone. (Exceptional diamonds are also a separate entry on DTC invoices, as they represent purchases that are not subject to the service fee.)

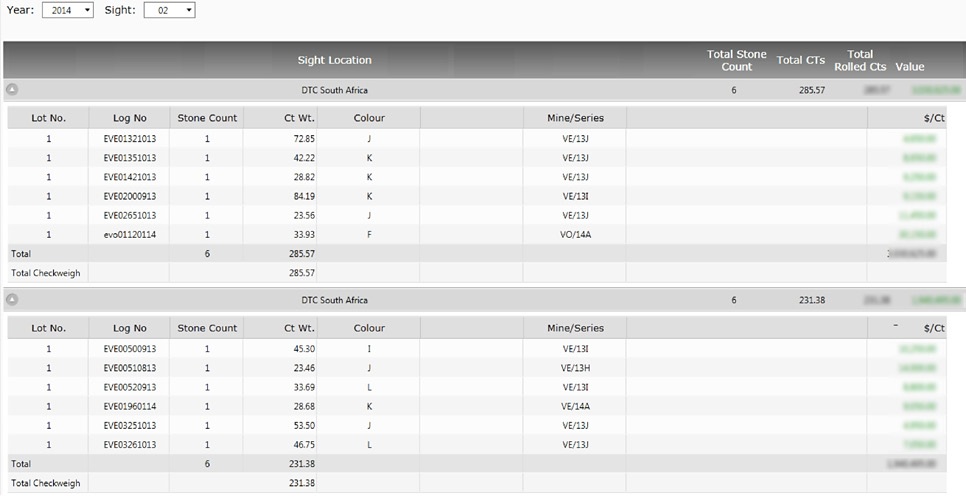

DIB tried to ascertain when this highly confidential data reached the market. We looked at the trail of the last sight, Sight 2, 2014. This sight was held February 24-28. On the illegal circuit, already as early as February 21, lists were available of the specials to be offered and their internal DTC Price Book valuations. These valuations may differ from those of the Government Diamond Valuator and of the asking (invoice) price of the DTC. Just imagine that a DTC sightholder wants to argue about a price offered while already having the internal DTC valuations in his pocket? (See sample of Sight 2, 2014, specials and large stones allocations, as available in the market prior to the sight week.)

The information floating around, however, is not limited to internal producer documents. The South African Government Diamond Valuator, for example, checks each box – especially the specials – where a specific breakdown is not often provided. The GVD will analyze each box and document the value and description of each stone – and match these against DTC Price Book prices. Quite shockingly, these analyses are also available. (See sample of some Sight 1, 2014, GDV valuations.) As it was explained to us, “No sightholder could ever reconstruct the category origins and the prices without having access to the producer Price Book.”

Even in the hands of non-sightholders, this kind of information is commercially toxic. It provides a total overview at any given time of all the large specials and exceptional stones offered at a given sight at their original valuation prices. One can figure out in what kind of goods there will be shortages; one can distinguish “mispriced” opportunities; one can play the market of the larger goods. Having invoices of all DTC South African sightholders, one can also do more effective 'shopping' – as one knows what the sightholders have to offer and what they paid for it.

The documents in our possession could easily fill this entire issue of DIB. However, publishing them wouldn’t be responsible and would not serve any constructive purpose. We learned of these leaks from very concerned diamantaires. We have no true idea of how widespread this is. Nor do we know for how many years this has been going on, or how institutionalized this practice has become.

Upon learning of the availability of these materials, we only made sure that we got evidence applicable to more than one DTC sight, which would exclude the possibility that it was just a one-off. Normally, when corruption is involved, those on the take will endeavor to optimize revenues in the shortest periods of time – for as long as the party lasts – and there would be multiple leaks. This is up to the police to investigate, as it goes beyond our journalistic efforts.

Though this article could easily become the longest we have ever written, we’ll keep it intentionally short. We just want to put South African DTC sightholders on notice that the integrity of their businesses may have been compromised and that any purchases they made from the DTC or Petra Diamonds (as far as we know) are known in great detail in the market by others, including to some of their own customers or suppliers. They ought to make internal risk and damage assessments and urge suppliers and authorities to get their houses in order.

BPP and Other Laws

We are not familiar with South African laws on trade secrets. The European Commission (EC) is finalizing a directive “on the protection of undisclosed know-how and business information (trade secrets) against their unlawful acquisition, use and disclosure.” A recent EC survey in the “Study on Trade Secrets and Confidential Business Information in the Internal Market” found that one in five companies suffered at least one attempted trade secret theft in the past decade, and the number of companies reporting theft of information has increased from 18 percent in 2012 to 25 percent in 2013. “The loss of a company’s trade secrets (both producers and clients) and “disclosure key data on a regular basis to competitors means a catastrophic drop in value and future performance for many enterprises,” says the EC study.

So what is happening in the diamond industry in South Africa may not be unique. Bribing someone to get this sight allocation data or, alternatively, getting it “freely” by someone who has official access to it is an abuse of the trust of his employers and is representative of criminal activity.

De Beers, however, doesn’t need these laws – it has a statement on each invoice stating that “the diamonds in this box are sold in accordance with DTC Best Practice Principles.” If data theft on these goods has already taken place well before the resulting invoices are issued, as we have reason to believe is the case here, it is certainly high time for the DTC to take the necessary step to restore the integrity of its sales practices. It is hoped that these few pages will convince those who need to be convinced that something must be done. This should raise red flags at De Beers, Petra Diamonds, the South African government’s Diamonds Precious Stones and Metals Regulators, and – most probably – also at the country’s special Hawks police unit (formerly called the Scorpions).

We understand enough of the paper trail to have some idea about some of the points in the value chain where the leakages and data thefts are taking place. We also have good reasons to believe – or to assume – that no De Beers officials are knowingly participating in these illegal schemes. From the little we have learned, we have reasons to believe that Petra Diamonds and De Beers, and their employees, are not the perpetrators, but rather the victims. At the same time, however, these producers are also the only organizations that have the ability to stop this practice of leaking secretive internal trade data. They are the only ones who can ensure that every stakeholder realizes that this is one red line that no one is allowed to cross. We have no doubt the producers will live up to the task – and that this subject will never come up again. Never!

De Beers: “We Are Immediately Launching a Full-Scale Investigation

A spokesman for the De Beers Group provided the following reaction to the DIB exposé:

“The De Beers Group of Companies has been made aware that some of our South African pricing information has been compromised. The evidence currently indicates that at least one other producer in South Africa has been similarly compromised, that the issue is confined to South Africa, and that it does not include information from De Beers’ other global operations. Initial investigations suggest the breach was not a result of any wrongdoing on the part of De Beers or any of its employees.

“De Beers treats the security of confidential market information with the utmost seriousness. We immediately launched a full-scale internal and external investigation to quickly and comprehensively address this incident. As the information in question is required to be shared legitimately outside of De Beers, the investigation will therefore address and close any potential breaches within or outside the business.

“De Beers is focused on ensuring that all current and future confidential information is secure to safeguard a fair and competitive marketplace in South Africa. We will continue to engage with our Sightholders as further information becomes available.”

This article is provided by Diamond Intelligence Briefs