IDEX Online Research: Polished Prices Slip Back in March

April 05, 14

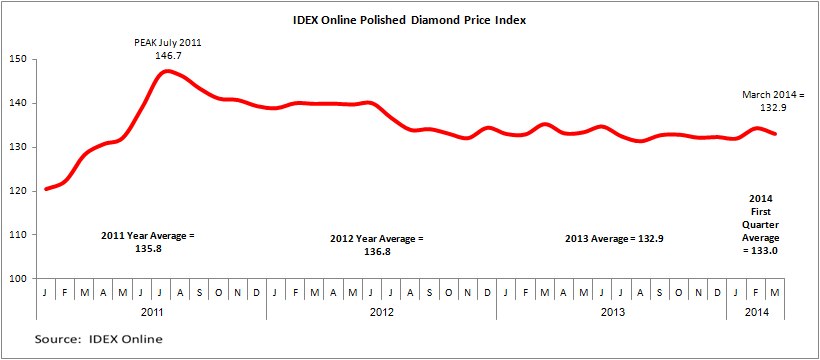

(IDEX Online) – The IDEX Online Polished Diamond Index slipped back in March to 132.9 from the February figure of 134.2. In round items, only 0.5-carat diamonds and 1.0-carat goods rose in price.

The full analysis of the polished prices data is available to IDEX Online Research subscribers and IDEX Online members here.

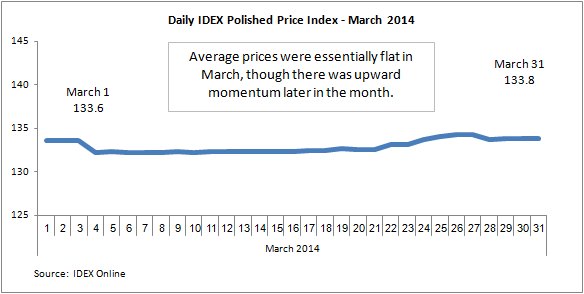

The IDEX Online Polished Diamond Index began March at 133.6 and ended the month up only marginally at 133.8 as is seen in the graph below. As in February, prices were largely flat during March although there was an increase in the last week of the month but there was a slight slip back down and a rise again the final days of last month.

A look at the bigger picture shows that the index is roughly where it was in the final months of 2012.

Prices of polished goods moved up slightly in February, but did not have the strength to maintain the rise last month. Reports from the market suggest polished prices have gained strength in the first quarter of this year, but the IDEX Index does not appear to back this up.

A comparison of prices in March on the same month last year shows that the prices of polished diamonds last month all declined, with the biggest falls seen for 2, 3 and 4-carat stones, with the latter declining by more than 23 percent.

The smallest decline on the year last month was recorded by 1-carat diamonds which slipped by just 0.3 percent. Meanwhile, 0.5-carat diamonds recorded the second-smallest decline – of 1.4 percent. The figures are hardly surprisingly, since round diamonds of 1 carat and under compose the largest section of the polished diamond market – so-called bread-and-butter goods.

The decline in 4-carat goods, although sharp, can be largely attributed to the high impact of relatively low levels of activity.

Outlook

The value of goods sold at the third Sight of the year in March was estimated to have been in line with the previous two Sights this year of about $740 million, according to Mike Aggett, Managing Director of diamond brokers H. Goldie.

Polished prices were raised by 2.5 to 3 percent at the Sight, Aggett believes. "Polished prices have certainly increased since the beginning of the year but now there is a definite resistance to further increase. One positive is that polished stocks in the market are at relatively low levels and the outlook from the leading consumer markets would appear to be positive.

"With three successive large Sights now completed and the approach of what is traditionally a slower period for the industry we believe the next Sights will be smaller with the annual holiday period in India approaching which may give some respite to the difficult liquidity situation the impact of which should not be underestimated in the coming months," Aggett concluded.

The full analysis of the polished prices data is available to IDEX Online Research subscribers and IDEX Online members here. Click here for more information on how to subscribe or become a member.