IDEX Online Research: US Retail Jewelry Prices Decline Slightly In May

July 06, 14

(IDEX Online News) – American retail jewelry prices declined slightly in May from the month before, while producer prices showed a slight rise.

JCPI Rises in May

For April 2014, the Jewelry Consumer Price Index (JCPI) stood at 161.0 compared with 162.4 in April. Here’s what this means:

· Retail prices of jewelry fell back stood still on a month-to-month basis.

· Retail jewelry prices decreased by less than two percent on a year-to-year basis: May 2014 versus May 2013.

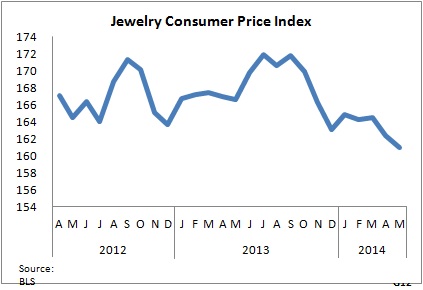

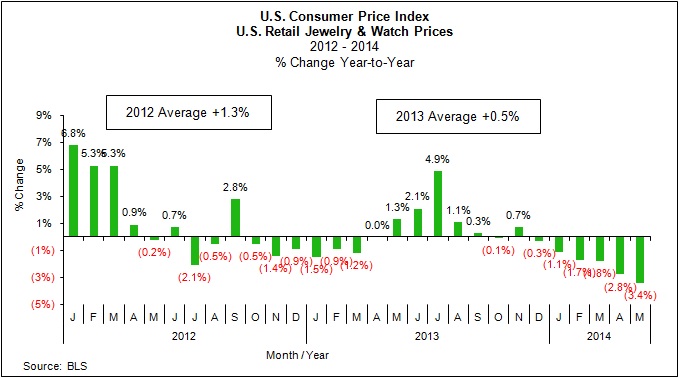

The graph below indicates the changes in the JCPI over the past two years. There was a great deal of volatility for most of the period, and since September 2013 there has been a downward trend.

The situation is clear: retailers are not able to dictate higher prices to customers. The JCPI has been in decline since March. After reaching a high-point in mid-2013 retailers have failed to push through higher prices or even to maintain levels.

JPPI Puts In Small Rise

For May 2014, the Jewelry Producer Price Index (JPPI) came in at 214.3 compared with 213.1 for the month before. Here’s what this means:

Wholesale jewelry increased slightly on a month-to-month basis: May 2014 versus May 2014.

However, wholesale jewelry prices fell by more than 1 percent on a year-to-year comparison basis: May 2014 versus May 2013.

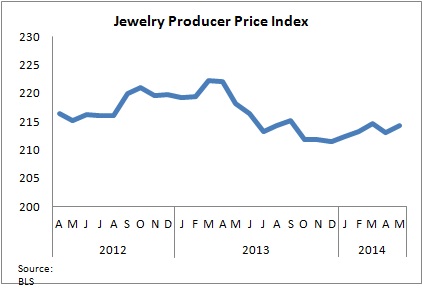

The graph below summarizes monthly JPPI over the past two years.

Looking at producer prices since the start of the year, it prices have headed upwards.

That may be a result of rising prices of polished diamonds, as well as that of gold and other precious metals and inputs as the yellow metal has broke through the $1,300 barrier.

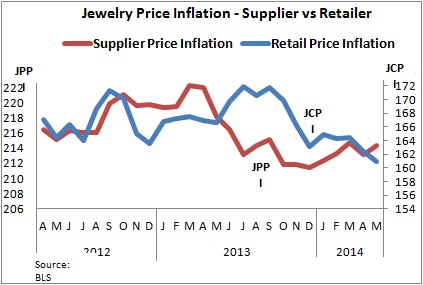

The graph below shows very clearly the directions and trends of the JCPI and JPPI during the past two years. The blue line represents retail prices of jewelry in the U.S. market and the decline since March, while the red line shows wholesale prices rising again after a decline in April.

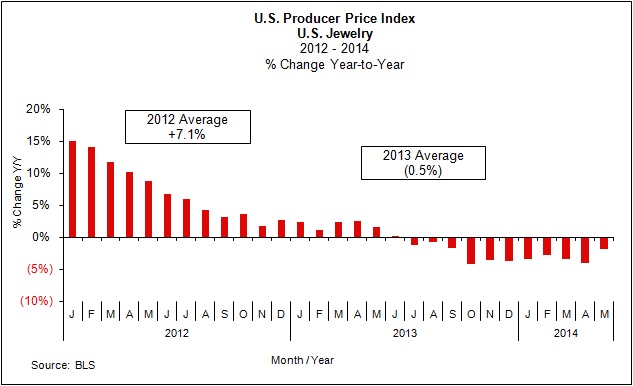

The graph below shows the continuing decrease in suppliers’ jewelry prices since last July with a consistent level of decline on a year-on-year basis. Suppliers’ prices have fallen consistently since July 2013.

Meanwhile, the graph below shows the change in monthly retail jewelry prices on a year-to-year basis, and has declined consistently since December last year.

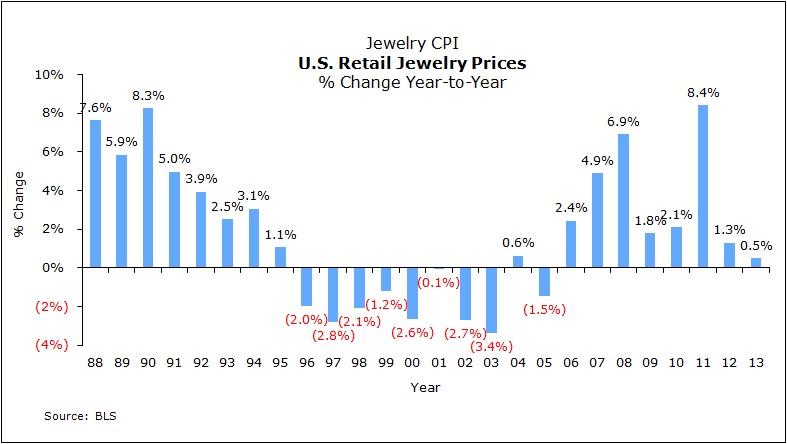

The graph below shows how low inflation was at stores in 2013 when compared with previous years. The 0.5 percent rise was considerably lower than in previous years, especially when compared with the years 2006-2008 and 2011.

Outlook – Inflation Seen Staying Modest

Although the United States economy has been showing signs of picking up speed in recent months with the number of jobs being created rising higher than analysts’ forecasts, the inflation outlook is still modest. The Federal Reserve’s continuing relaxed monetary policy aimed at stimulating growth shows that central bankers do not believe the American economy has reached a point where it can take care of itself but, rather, needs continuing help.

In June, employers added 288,000 jobs and helped cut the unemployment rate to 6.1 percent, the lowest since September 2008. June capped a five-month stretch of 200,000-plus job gains — the first in nearly 15 years.

After having shrunk at a 2.9 percent annual rate from January through March — largely because of a brutal winter — the U.S. economy is expected to grow at a healthy 3 percent pace the rest of the year.

For 2014, analysts forecast a rise in the CPI to 2.0 percent from around 1.2 percent in recent times.