IDEX Online Research: Polished Prices Up In June

July 06, 14

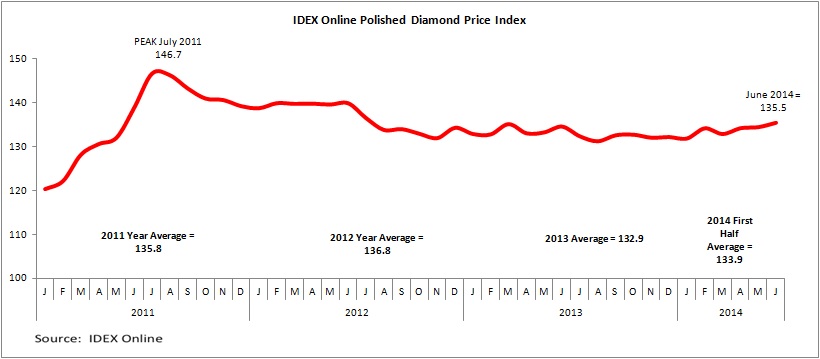

(IDEX Online) – The IDEX Online Polished Diamond Index increased in June to 135.5 from 134.5 in May. In round items, all sizes increased in price apart from 2.0 carats which were unchanged.

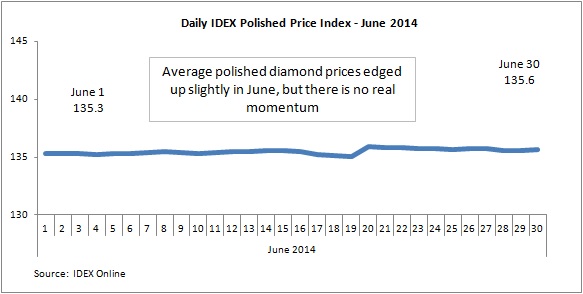

The IDEX Online Polished Diamond Index began June at 135.3 and ended the month up only marginally at 135.5 as is seen in the graph below. As in past months, prices were for the most part unchanged on average in June.

Taking a more long-term view, the index is approximately at the same point it recorded in mid-2012.

Prices of polished goods moved up in June and the coming months will confirm whether that it a rising trend or whether they will slip back.

Market reports confirmed a rise in polished prices in the first few months of this year, however many market players were expecting polished prices to slip back as diamantaires took a step back to consider their next moves.

Outlook

The fifth Sight of 2014 took place in June, indicating ongoing strong demand for rough diamonds, with sales estimated at $600 million to $650 million.

The Sight sales figure was close to the figure for the previous Sight of the year, compared to the Sights before that which were around the $700 million mark.

Sightholders said that prices and assortments were more or less the same as for the previous sight, although there were some cosmetic price changes on certain boxes.

Mike Aggett, the CEO of H. Goldie & Company said, “De Beers reported that in overall terms the prices were flat, however clients were pleased to see that certain boxes in the cheaper ranges had improved in value. Assortments remained fairly consistent although the normal variations in box composition did result in price changes, both up and down.

“In terms of price, Sightholders reported that they were able to hold firm in their negotiations.

With India now enjoying a stable government, and rupee rate, expectations for a more buoyant domestic market are running high. This now puts the industry in the relatively unusual position where the 3 biggest markets USA, China and India, are all showing positive signs of growth simultaneously.

“Overall the mood at the Sight was very positive, despite the underlying problem of liquidity constraints still being very much in people's mind. Rough prices are firm and virtually all boxes are trading with premiums of between 5-8 percent (average). However, despite the increase in rough demand, prices have remained relatively stable, and speculation, which has caused so much damage in the past, has been curtailed most likely by the liquidity issues.”

The full analysis of the polished prices data is available to IDEX Online Research subscribers and IDEX Online members here.