IDEX Online Research: US Jewelry Sales Up Strongly In May

July 23, 14

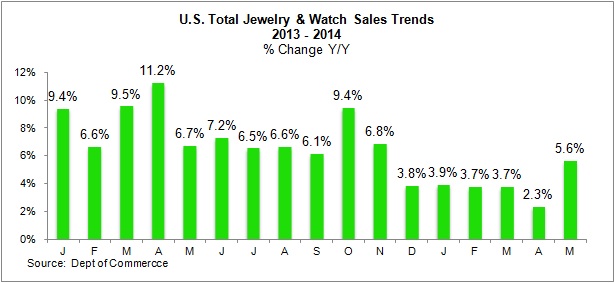

(IDEX Online News) – There was some good cheer for jewelry and watch retailers in May with sales in the U.S. rising by 5.6 percent on the year to $7.19 billion, based on preliminary US government figures.

The May figure was the highest monthly rise since November 2013 following increases of under 4.0 percent in the first months of 2014. The figures for the first five months of this year were all revised upwards.

The figures for January, February, March and April are 3.9 percent, 3.7 percent 3.7 percent and 2.3 percent, respectively.

The May figure and the revisions to the previous months give a boost to the case for rising jewelry and watch sales as economic recovery continues in the United States.

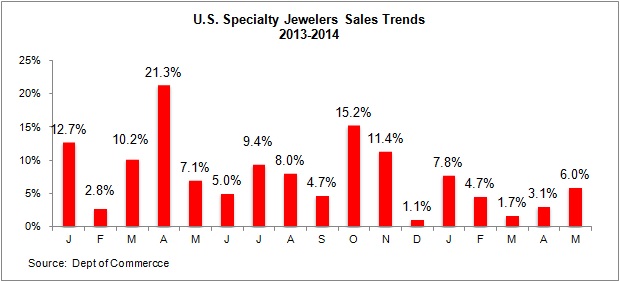

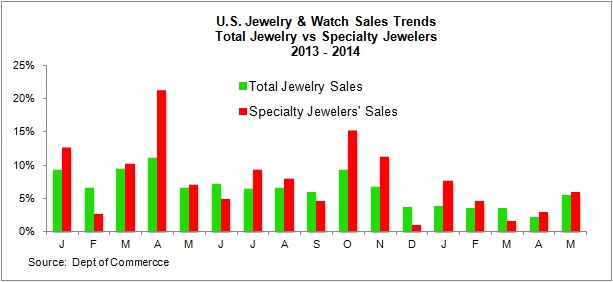

Meanwhile, May preliminary sales, including the crucial Mother's Day, showed a strong gain of 6.0 percent for specialty jewelers to $3.12 billion. And April sales for specialty jewelers were revised upward to a stronger 3.1 percent (year-on-year) from the preliminary gain of 2.4 percent reported last month .

During May, specialty jewelers took market share from other retailers who also sell jewelry. This often happens during the three key selling periods of the year: Valentine's, Mother's Day, and Christmas. People think of jewelry for those occasions, and they go to their local specialty jeweler. At other times of the year, they buy jewelry, on impulse, at discount stores, such as Costco and Wal-Mart.

Also, in May, specialty jewelers (and the total jewelry market) took market share from other retailers. Again, this can be put down to the ‘Mother's Day Effect’. In April, the jewelry industry, including specialty jewelers, lost market share to other retail categories, since there was no major sales event driving jewelry sales. Again, this is as expected.

There was a noteworthy rise on the month in sales at specialty jewelers in May compared with the figures for overall retail sales for the month as can be seen in the following graph, which reveresed the situation seen in April.

Consumers voted with their feet and bought goods at specialty jewelry stores rather than shops selling jewelry along with a wide range of other items.

Total Jewelry Sales +2.4%

Jewelry sales alone, excluding watches, increased by 6.0 percent on the year in May to $3.12 billion, based on US Department of Commerce data.

Fine Watch Sales +3.2%

Fine watch sales rose by 3.2 percent in May to $580 million.

Fine watch sales have kept their proportion in the broader jewelry and fine watch sales category at around 12 percent as is clear in the following graph.

This mix of watch sales is climbing, after falling to 11.6 percent of sales in 2010, as the industry was still reeling from the impact of the “Great Recession” that began in 2007.

In 2006, just prior to the recession, fine watch sales represented 12.1 percent of total fine jewelry and watch sales in the U.S. However, during the recession, consumers tightened their purse strings, and slowed their buying of expensive, flashy watches.

Outlook

There is no doubt that retail jewelry sales have risen over the past 5-6 months. Is this a harbinger of things to come or just a temporary blip? Given the reasonably strong upward revisions for the figures for the first four months of the year and the powerful performance recorded in May, there is good reason to believe that it is the start of an upward trend.

There is no doubt that American consumers continue to be enamored of jewelry, and their willingness and financial ability to buy jewelry on a continuing basis appears to have received confirmation in the latest figures