IDEX Online Research: Household Jewelry Spending Reached Record Levels in 2013

November 26, 14

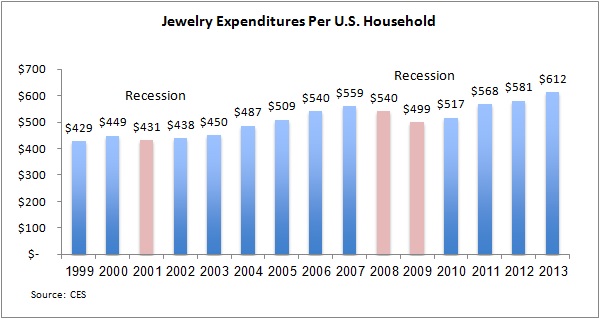

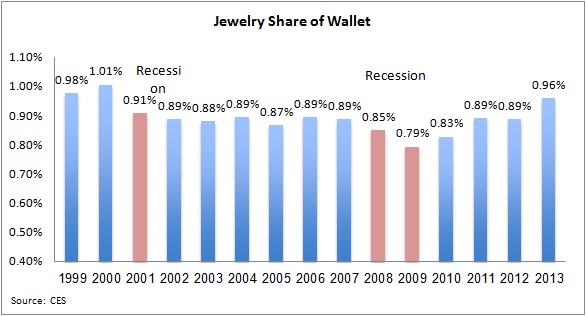

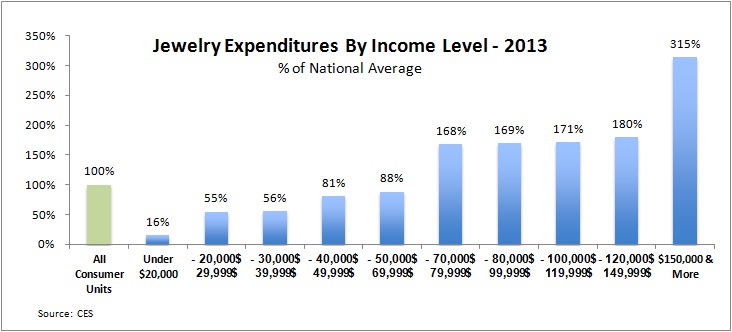

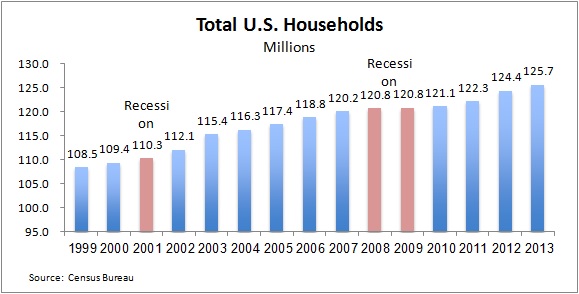

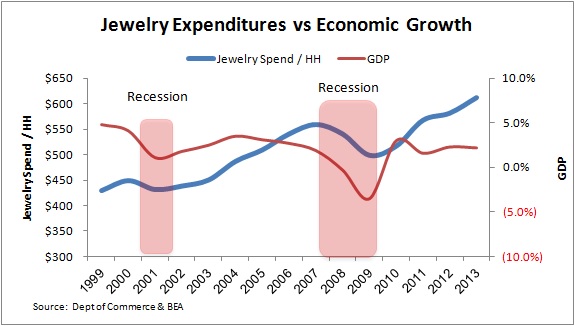

IDEX Online Research: Household Jewelry Spending Reached Record Levels in 2013 The typical American household spent a record $612 on jewelry in 2013, more than five percent greater than 2012’s $581 per household, according to newly released data from the government’s Consumer Expenditure Survey. After weak spending in the recessionary years of 2008-2010, consumers loosened their purse strings, returned to the shopping malls, and resumed their “normal” spending levels on jewelry in 2011 and 2012, followed by record spending levels in 2013. The graph below summarizes per-household spending on jewelry in the U.S. market since 1999. Jewelry Share of Wallet Up Solidly in 2013 Jewelry’s share of wallet was almost 1 percent of total consumer expenditures in 2013, nearing levels last seen in 1999 and 2000 when jewelry sales were booming and shopper demand for fine jewelry and fine watches was exceptionally strong, as the graph below illustrates. Factors Driving Jewelry Demand in 2013 Several factors drove shoppers to retail merchants to buy jewelry in 2013, including the following: · Pent-up demand from the recent recession · Declining precious metals prices which made jewelry more affordable · New fashion jewelry designs which are appealing to young Millennial shoppers, a group which spends more on jewelry than any other age group of Americans. · Merchants’ increased use of enticing promotions which appeal to the “experience” of buying jewelry (“every kiss begins with Kay”) rather than price-based promotions (“50% off every day") which have limited credibility Further, fundamental factors in the consumer market also helped boost retail spending on categories such as jewelry. Those factors include the following: · Growth in the number of consumer households · Increased per-household consumer spending · Increased spending on online jewelry · More trips by shoppers to retailers who sell jewelry In addition, macro economic factors helped drive household spending on jewelry, such as: · Rising incomes among consumers · An improving employment market · Higher consumer wealth levels from a strengthening housing market and a strong stock market These positive factors are expected to remain in place in 2015, and consumer spending on jewelry is expected to be robust for at least another year. 2013 Consumer Expenditures Reach Record $76.9 Billion Overall, fine jewelry and fine watch sales increased to $76.9 billion in 2013, based on final numbers from the government, a solid 6.3 percent increase over 2012 sales. After three weak years – 2008-2010 – jewelry sales showed a recovery in 2011 and have been at record levels each year since then, as the graph below illustrates. Household Growth Accelerated in 2013 The number of U.S. households grew by just over 1 percent in 2013, a rate which has usually occurred only during periods of solid economic growth. In the past, household growth slows during a recession – in 2009, for example, there was virtually no growth in households – and then household growth recovers when consumer factors stabilize and the economy rebounds. The graph below shows the historic growth in U.S. households. As the number of households increase, jewelry demand also increases. Jewelry Spending and Economic Cycles Correlate When the U.S. economy is expanding solidly, American shoppers open their wallets and spend on discretionary merchandise such as jewelry. When the economy slows – and unemployment rises and wages stagnate – consumers cut back sharply on discretionary items, including jewelry. The graph below shows the correlation between economic cycles and jewelry demand in the U.S. market. Long Term Outlook for Jewelry Demand: Two More Good Years Since the end of World War II (1945), economic cycles in the U.S. have lasted about five years. Today, many economists think that the cycle has extended, and boom-to-bust periods are on 7-8 year cycles. If so, then it could be 2016-2017 when the current bull economy finally succumbs to the bear, and begins to slow. Based on historic demand patterns for jewelry, we would expect to see strong jewelry sales in 2015, a peak in 2016, and a significant slowing in 2017.