IDEX Online Research: Jewelry Industry is Loser in Deflationary Environment

January 29, 15

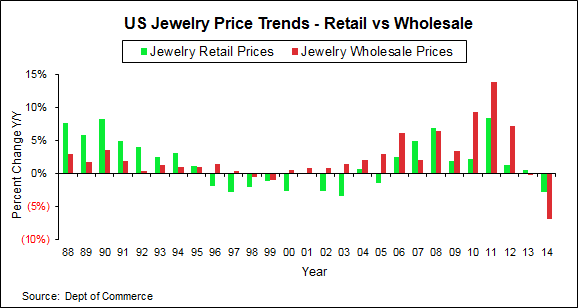

American jewelry shoppers were the winners in 2014, and jewelry retailers, along with their suppliers, were the losers. That’s because the US jewelry industry experienced a highly unusual situation: there was price deflation at all levels of the jewelry distribution chain in 2014, according to new government data. The government reported that retail jewelry prices dropped by about 3 percent, and jewelry suppliers’ prices plummeted by 7 percent.

· Consumers were the winners because 2014 jewelry retail prices dropped modestly from 2013 levels.

· Jewelry retailers and their suppliers were the losers because they had to work much harder to generate revenue growth, and profits were negatively affected.

Simultaneous price deflation at both the retail and supplier level is highly atypical – it last occurred in 1999, 15 years ago. Even more uncommon, though, was the unprecedented depth of jewelry price deflation in 2014. The graph summarizes price inflation and deflation for the past 26 years. Retail jewelry prices are shown by the green bars, and suppliers’ jewelry prices are shown by the red bars. It is clear that deflationary trends in the US jewelry industry in 2014 were far greater than any other time in recent history.

US Consumer Impact – Positive

Jewelry shoppers benefitted from price deflation. Here’s why:

Jewelry Cost Less in 2014 – Overall jewelry prices in 2014 were 3 percent lower than in 2013 for the same items, as measured by the Jewelry Consumer Price Index (JCPI).

The JCPI decline of 3 percent was in contrast to the overall US inflation rate, measured by the Consumer Price Index (CPI, less food and energy), which rose by nearly 2 percent in 2014.

When jewelry’s JCPI 3 percent price decline is compared to the nearly 2 percent CPI gain, the “value gap” favoring jewelry widens to five points.

Conventional economic theory suggests that demand will increase as prices drop; this is called “price elasticity.” That happened in 1999, when both retail jewelry prices declined – by a modest 1.2 percent – and supplier prices dropped by 1.1 percent. Total jewelry sales in 1999 rose by a robust 9.4 percent, and specialty jewelers’ sales soared by 11.4 percent. That year was a win-win situation: jewelry shoppers paid less for their jewelry and jewelry industry sales and profits were robust.

However, the laws of price elasticity did not prevail in 2014.

Jewelry Demand Barely Budged in 2014 – Sales in the US jewelry industry rose by a very modest 2 percent in 2014, based on preliminary estimates. Given the significant decline in the retail price of jewelry, we would have expected to see a larger increase in jewelry sales. However, that didn’t seem to happen in 2014 for two reasons: 1) consumers are accustomed to enjoying jewelry merchants’ “normal” discounts of 50 percent or more, so an extra few percentage points simply didn’t register; and 2) other retail merchants – primarily clothing and accessories retailers – offered discounts up to 70 percent to shoppers.

Therefore, the value created by jewelry price deflation was largely lost in the cacophony of other retailers’ price-based promotions. Still, jewelry shoppers were the winners in 2014, even if they didn’t realize it.

US Jewelry Industry Impact

In 2014, jewelers’ sales and profits throughout the chain of distribution felt the negative impact of price deflation. Here’s why:

Sales Dollars Down; Units Up – With overall retail jewelry prices down by about 3 percent in 2014, jewelers had to generate 3 percent more unit sales just to stay even with 2013 sales levels. And that’s assuming that their average ticket was unchanged. Sales of charms (think Pandora) have brought the typical jeweler’s average ticket down – way down, in some cases – over the past several years.

Overall US jewelry industry sales rose by an estimated 2 percent in 2014. Based on that, jewelers unit sales – again, assuming a flat average transaction value – had to rise by five percent, just to maintain market share. Here’s how that’s calculated: the spread between a 3 percent price decline and a 3 percent industry sales gain is 5 percentage points. Because of reduced average tickets in 2014, some jewelers have reported that their unit sales – typically measured by number of transactions – were up by 25 percent or more, and, even then, their sales were flat year-to-year!

In short, both the number of units sold and the number of sales transactions had to increase sharply, if jewelers’ sales showed revenue growth in 2014.

Gross Profit Dollars Down – With jewelry prices down, jewelers’ gross profit dollars were lower, even if margins remained constant. Worse, with intense price-based competition, many jewelers reported a decline in their gross margin, which further reduced gross profit dollars.

Fewer gross profit dollars in 2014 meant that jewelers had less money to pay fixed – and rising – expenses like rent, labor, utilities, health care and other costs of doing business. Overall inflation in the US may have been under 2 percent, but costs for services such as health care are soaring.

Operating Costs Up – Most jewelers reported that their variable costs – especially labor – were up in 2014. Why? It takes more sales associates to move more units and handle more transactions, especially when the average transaction value is lower. Other variable costs related to higher unit sales – inbound freight, packaging, and inventory levels – were greater in 2014, even if sales were only flat.

One Small Bright Spot for Retail Jewelers – While retail jewelers’ merchandise theoretically cost 7 percent less in 2014 than the prior year, they reduced retail prices by only 3 percent. This helped cushion the intense margin squeeze they’ve experienced over the past decade and a half. Since the year 2000, jewelry retailers’ merchandise costs have risen by about 60 percent, based on the JPPI inflation index of jewelers’ supplier prices, while retail jewelry prices have advanced by just 19 percent. That has resulted in a severe long-term margin squeeze for jewelry retailers.

Inflation – Good For The Economy, Good for Jewelry

There’s an old adage: “growth is the only evidence of life.” While that saying was coined for people, it equally applies to the economy and the businesses that make up – and drive – economic growth.

We won’t get into a protracted discussion about why the US Federal Reserve thinks that overall inflation of 2-3 percent annually is reasonable in America, except to say this: we agree with them.

For jewelers, moderate jewelry price inflation does two things:

· It provides a basis for “automatic” sales growth.

· It creates a sense of urgency with shoppers, encouraging them to buy jewelry before the next price increase.

We’re thinking that inflation in the US jewelry industry will be about flat in 2015; that’s a significant improvement over 2014. If jewelry price inflation rose by a couple of percentage points, that would be even better for the industry.