IDEX Online Research: US Jewelry Prices Mixed In January

March 04, 15

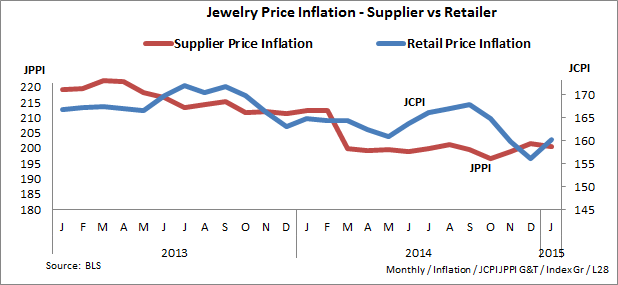

Jewelry suppliers’ prices were stable in January in the US market, but retail jewelry merchants pushed their prices higher, after heavy discounting in the fourth quarter of 2014. As it turns out, despite heavy price-based promotions, jewelers’ sales were down in the all-important November-December holiday selling period in America. Normally, we expect to see some price elasticity – discounting usually drives demand – but in the fourth quarter of last year, shoppers did not react favorably to lower jewelry prices.

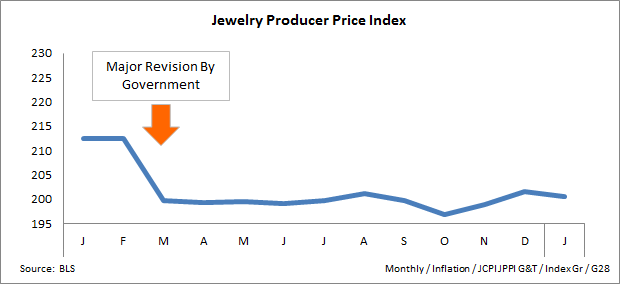

The Jewelry Producer Price Index (JPPI) stood at 200.5 for the month of January 2015, down barely one-half of 1 percent from December, but down a significant 5.6 percent from the same month in 2014.

The graph below summarizes jewelry suppliers’ prices over the past year. Supplier prices have been mostly stable for nearly a year, with little month-to-month movement.

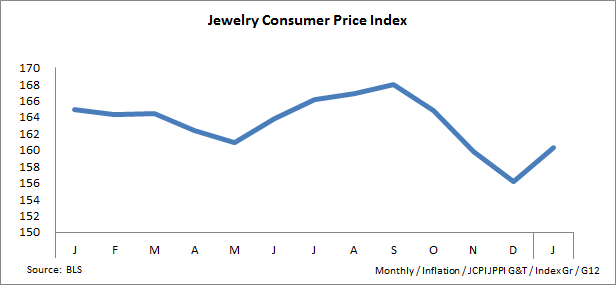

The Jewelry Consumer Price Index (JCPI) stood at 160.3 for January 2015, up 2.6 percent from December levels, but down 2.8 percent from prices in January 2014. Despite the sharp rise in January, retail prices of jewelry in the US market, prices are still below year-ago levels, as the graph below illustrates.

While there has been some month-to-month jockeying of prices between jewelry suppliers and jewelry retailers, the trend for both the JCPI and the JPPI is deflationary. In short, jewelry prices are sliding slowly lower, as the graph below illustrates.

Weak Commodity Prices Responsible for Most of Jewelry Price Deflation

We believe the underlying cause of the current jewelry price deflation is the decline in prices of key commodities used in jewelry manufacturing – primarily gemstones and precious metals. The table below summarizes key commodity prices and trends for four major commodity categories used in jewelry production.

Jewelry - Commodity Prices Inflation Factors

Jewelry Jan-15 % Change % Change Commodity US$ Price Year-to-Year Month/Month Diamonds n/a (5.7%) (2.5%) Gold $1,252 0.6% 4.1% Silver $17.10 (14.1%) 5.3% Platinum $1,243 (12.6%) 2.1% Sources: Various Markets JCPI JPPI G&T/NEW Table/F14