IDEX Online Research: Specialty Jewelers’ Market Size Shrinks by 10 Percent

May 17, 15

The size of the US specialty jewelry market is almost 10-percent smaller than previously reported, according to new revised data from the US Department of Commerce. Here is the relevant information from the newly released government databases:

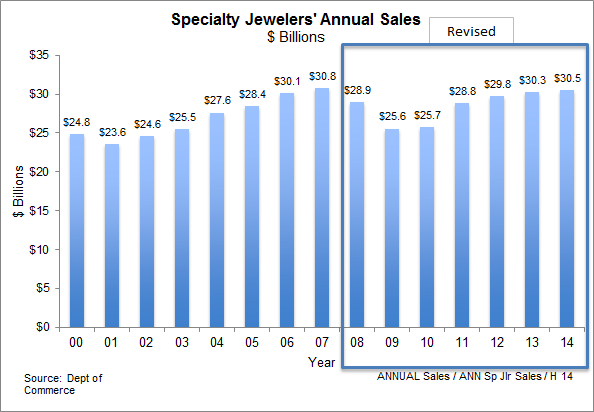

Specialty jewelers, retail merchants who generate most of their revenue from the sale of jewelry, generated about $30.5 billion in sales in 2014, down from $33.6 billion which was originally reported by the Department of Commerce. This indicates that the market is 9.3-percent smaller than earlier estimates.

New data indicates that the US specialty jewelry industry has not recovered to sales levels in the pre-recession period. Specialty jewelers’ sales peaked in 2007 at $30.8 billion, and have not recovered to that level since.

With their revised 2014 sales of $30.5 billion, specialty jewelers now hold only a 39.1 percent market share of the estimated $78.1 billion total market for jewelry in the US, down from the previous level of 43.0 percent, based on earlier data. This is a sharp decline for the specialty jewelry market; four decades ago, specialty jewelers sold nearly three-fourths of all jewelry in the US market.

Jewelry sales during the Holiday Selling Season (November-December) for both 2013 and 2014 were down; previously, data showed that sales declined only in the 2014 November-December period. Holiday jewelry sales in 2013 were down 1.5 percent, while holiday jewelry sales in 2014 were down 4.4 percent.

Revisions in the sales data were made back to January 2008, an unusually long period. Normally, the Department of Commerce makes minor revisions annually which affect only three or four years; this revision goes back seven years.

The graph below summarizes the market size in billions of dollars for US specialty jewelers since 2000. The government revised data for the seven-year period 2008-2014. In 2008, specialty jewelers’ sales were roughly 1 percent less than earlier data had indicated, with progressively greater declines until 2014 when sales were 9.3 percent less than prior government figures.

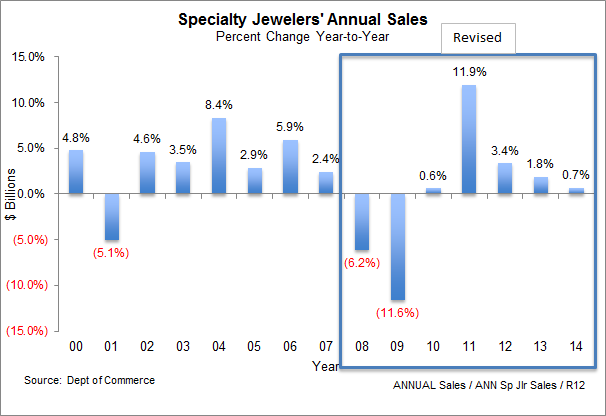

The graph below shows the percent change in annual sales for specialty jewelers since 2000. After sharp sales declines in 2008 and 2009, the market recovered significantly in 2011, but growth has been lackluster since then.

Outlook & Forecast

Specialty jewelers’ sales data was heavily revised in mid-May, and it is likely that total jewelry industry sales data – jewelry sales at all retail units including specialty jewelers and multi-line merchants such as Walmart, Costco and others – will be revised significantly mid-year. As a result, it is likely that specialty jewelers’ market share calculations will also be revised, but not by much.

As a result of the new data, we have revised our 2015 jewelry sales forecast for the US market to “flat” at best, with the possibility that the market will shrink by a couple of percentage points. For specialty jewelers, sales are likely to remain under $31 billion, and it may be a stretch for the industry to reach 2014 sales levels. Further, we believe that total jewelry sales in the US market at all retail outlets will likely remain under $80 billion in 2015, barely ahead of the $78.1 billion reported in 2014. All forecasts and numbers are subject to revision when the government releases it annual recasting of the market size of the total US jewelry industry in mid-year.