IDEX Online Research: US Jewelry Retail Prices Drift Lower in April

May 25, 15

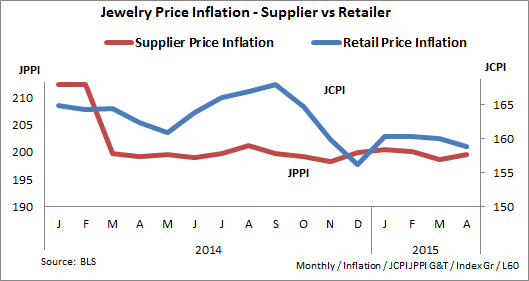

Retail prices for fine jewelry and watches in the US market slipped lower in April 2015, when compared to the same month of the prior year. This is the 17th consecutive month that retail prices have dropped on a year-to-year basis. However, jewelry suppliers’ prices edged slightly higher for the first time in 20 months. On a month-to-month basis – April compared to March – jewelry prices at both the retail and supplier levels in April were roughly flat.

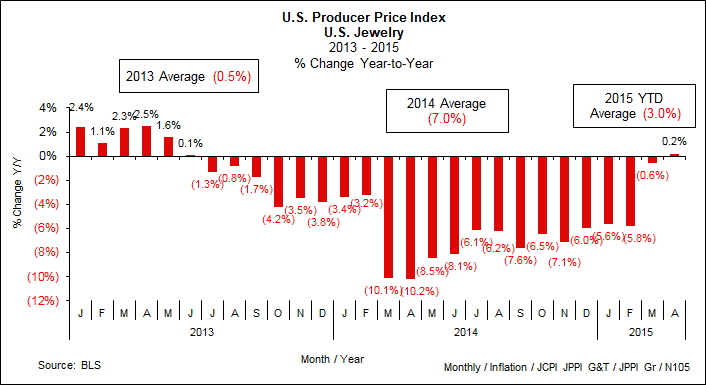

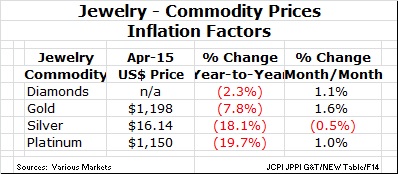

· The Jewelry Producer Price Index (JPPI) was 199.6 for April, reflecting slight price inflation from March’s index of 198.7, a gain of nine-tenths of 1 percent. On a year-to-year basis, the JPPI was up for the first time since mid-2013 by two-tenths of 1 percent. While jewelry commodity prices remain low, labor costs and currency exchange rates have negatively affected some suppliers’ prices.

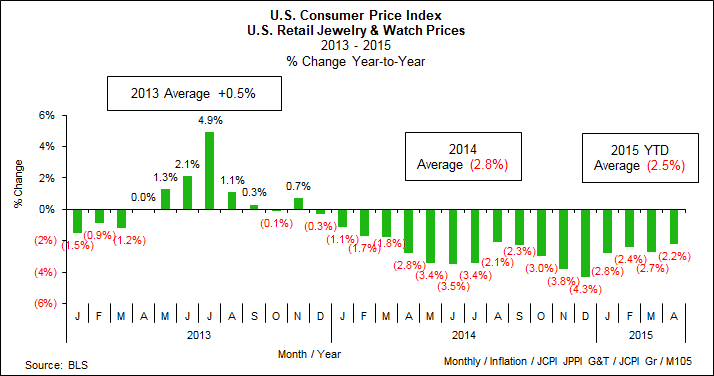

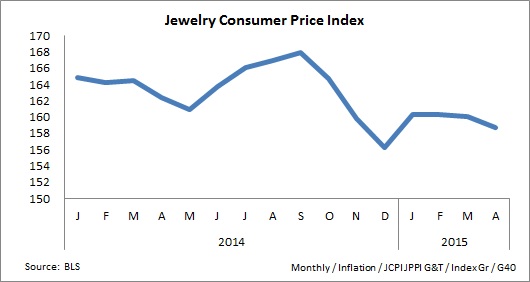

· The Jewelry Consumer Price Index (JCPI) was 158.8 in April, a decline of 1 and two-tenths of a percent from March’s 160.1. It is also a decline from February’s 160.4 and January’s 160.3. In short, jewelry retail prices appear to have slipped slightly in the first four months of 2015. On a year-to-year basis, the JCPI was down 2.2 percent, reflecting more price-based promotions and greater levels of discounting in jewelry stores.

The graph below compares jewelry supplier prices (red line) with jewelry retail prices (blue line) since the beginning of 2014. Prices bounced around in 2014, but have been far less volatile in 2015.

While some commodity prices have shown some modest strength recently and suppliers have attempted to raise their prices, consumer demand at the retail level for jewelry remains tepid, at best. Until shoppers show that they are willing to buy jewelry – and consumer demand rebounds – jewelers have no pricing power, so prices will remain low and the market will be extremely competitive.

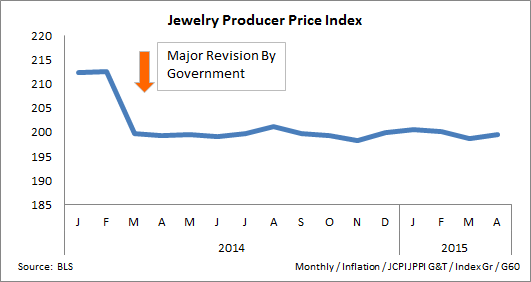

Jewelry Supplier Prices Holding Mostly Steady

Despite low underlying jewelry commodity prices, suppliers have not reduced – or raised – their prices significantly for several months, as the graph below illustrates. Month-to-month swings in the price index since March 2014 are not meaningful, though April’s slight uptick is a sign that suppliers are trying to push prices higher, in our opinion.

On a year-over-year basis, jewelry suppliers’ prices have been below the same month a year ago since mid-2013, and substantially below the prior year since March 2014. In March 2015, suppliers’ prices were about flat with March 2014, and in April 2015, prices edged up very slightly, as the graph below illustrates. On a year-to-date basis, suppliers’ jewelry prices are down 3 percent for the first four months of 2015, which is far less than the decline of 7 percent experienced for all of 2014.

Jewelry Retail Prices Slip

Retail prices of jewelry in the US market slipped slightly in April, after being relatively steady since January, as the graph below illustrates. Valentine’s Day jewelry sales were disappointing, and jewelers are heavily discounting merchandise in an effort to entice shoppers into their stores.

On a year-over-year basis, retail jewelry prices have fallen since the end of 2013, as the graph below illustrates.