IDEX Online Research: May Polished Diamond Prices Soften

June 03, 15

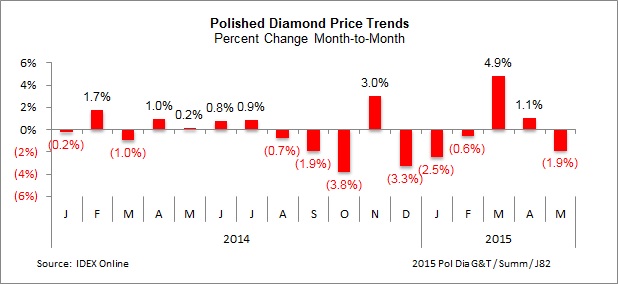

Polished diamond prices have been on a rollercoaster ride for almost a year, and May’s prices were on the downhill side of that ride. After a notable recovery in March and April, polished diamond prices slipped in May.

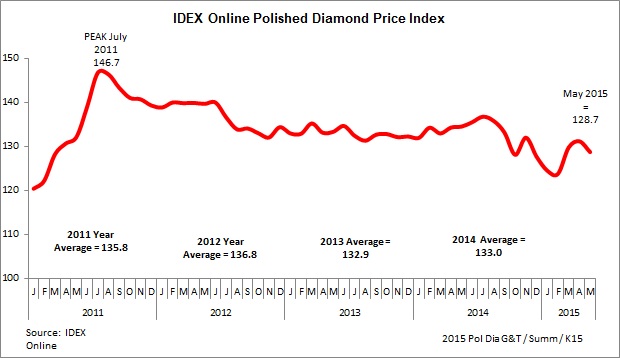

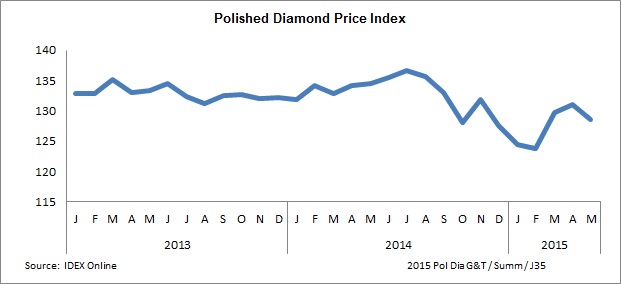

· The IDEX Index of Global Polished Diamond Prices averaged 128.7 during May, down from April’s average of 131.1. The only good news: May prices were well ahead of the year’s low of 123.7 in February. The IDEX Index is sales-weighted, so it reflects current market activity.

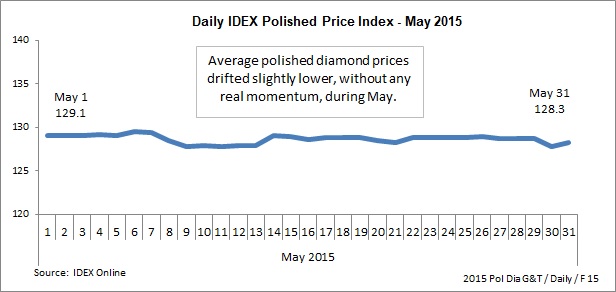

· Polished diamond prices reached a daily IDEX index high of 129.5 in early May, but settled back to 128.3 at the end of the month.

· Polished diamond prices were less volatile in May than in prior months. However, there was no energy or momentum, so prices settled lower at the end of the month.

Polished Diamond Prices On A Roller Coaster Ride

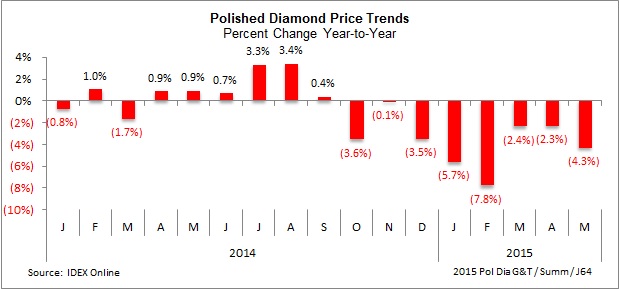

After significant volatility during the third and fourth quarters of 2014 and early 2015, global polished diamond prices in May slipped, after climbing modestly higher in March and April.

The graph below illustrates long-term price trends for polished diamond prices.

The graph below shows the volatility of polished diamond prices during the second half of 2014 as well as the first five months of 2015.

On a month-to-month basis, global polished diamond prices were down modestly in May, when compared to April, as the graph below illustrates. Further, the graph illustrates the volatility of recent polished diamond prices.

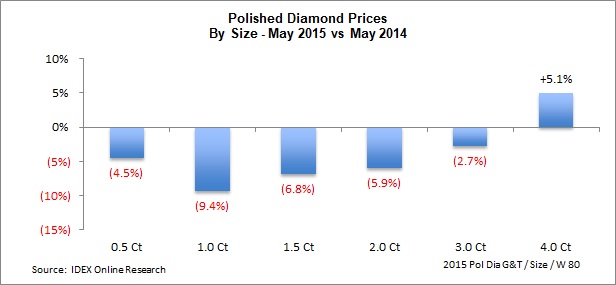

Not only were price comparisons negative on a monthly basis, but global polished diamond prices were lower in May, when compared to the same month a year ago – May 2014 – as the graph below illustrates. This is a worrisome trend, since this is the ninth consecutive month that polished diamond prices have been flat or below the prior year’s level.

Daily Diamond Prices Showed Little Movement in May

Polished diamond prices simply drifted lower in May, with little movement on a day-to-day basis. This trend was far different from April, when daily price movement was volatile. We believe that when diamond dealers saw they were not going to be able to push prices higher in April, they simply gave in to the current sluggish demand, and let prices settle back to a more realistic level.

The graph below summarizes polished diamond prices on a daily basis during May 2015.

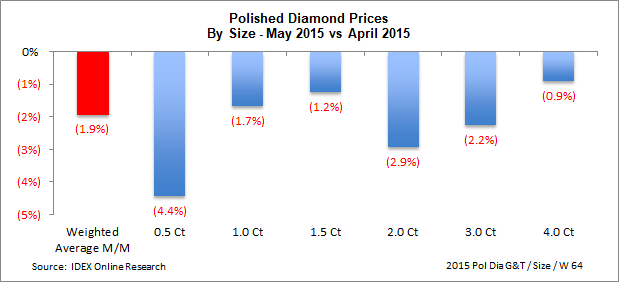

All Key Size Diamonds Declined in Price During May

All of the major diamond sizes – from large stones to smaller gems – experienced a decline in price during May. Small stones – about 0.5 carats in size – showed a price decline of more than 4 percent, the largest drop of any of the major stone sizes.

On a month-to-month basis – comparing prices in May 2015 to April 2015 – prices for polished diamonds moved lower, as the graph below illustrates.

On a year-to-year basis – comparing prices during May 2015 to May 2014 – prices were lower, except for 4-carat stones. The graph below illustrates the year-to-year price trends for polished diamonds by size.

Forecast: Weak Demand = Weak Diamond Prices

Growth of the global economy has slowed. Even in the US, which is still digging out from a major recession more than five years ago, consumers have showed restrained spending. First quarter 2015 Gross Domestic Product was revised to show a decline in the American economy, driven in large part by lack of consumer spending.

What is going on? We’ve all heard the “big picture” explanation. Baby Boomers — older, wealthier consumers — aren’t buying jewelry at the same rate as previous generations. Second, Millennials — a young, largely wealthy demographic group – are delaying marriage. Even when they get married, they aren’t buying the traditional diamond engagement ring, often opting for something more fashionable and less expensive.

However, there is another explanation about why jewelers have lost pricing power – the ability to raise prices: they have lost pricing credibility. Retailers’ signs of “50 Percent Off” everyday do not resonate with shoppers who see the same promotions day after day at the mall. Second, most jewelry is unbranded, so shoppers really don’t know anything about the perceived quality of the goods, especially in a market where the product is discretionary, consumers have limited knowledge of the merchandise, and purchases are infrequent.

Finally, the lack of an industry “voice” – typified by DeBeers for so many years – has hurt fundamental demand for diamonds worldwide.

All of these factors add up to a formula for flat-to-lower polished diamond prices.