IDEX Online Research: May US Jewelry Sales Perk Up, But Specialty Jewelers Lag

July 21, 15

(IDEX Online Research) – US shoppers bought fine jewelry at a record rate in May, but the beneficiaries were multi-line retailers such as Wal-Mart, Costco, J.C. Penney and other merchants who sell a wide variety of other merchandise. May, with Mother’s Day, is one of the three most important selling periods for jewelry during the year.

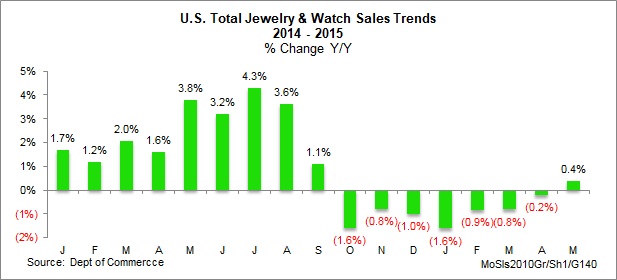

Total sales of fine jewelry and fine watches rose to an estimated $7.3 billion in the US market in May, an increase of 0.4 percent, when compared to the same month in 2014, according to new data from the US Department of Commerce.

This is the first month to show an increase in retail jewelry demand, after seven months of declining sales, as the graph below illustrates (green bars).

This sales gain, though modest, also confirms recent economic data: consumers appear to have loosened their purse strings during most of the second quarter, despite an uncertain economy.

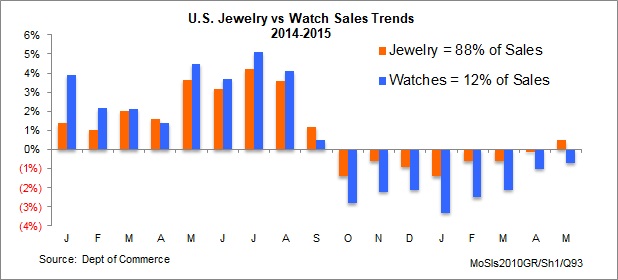

By segment, fine jewelry sales rose by 0.5 percent in May, while fine watch sales fell by 0.7 percent during the month, according to data from the Department of Commerce. Fine jewelry sales represent about 88 percent of total industry sales, while fine watches represent the balance. The following graph illustrates recent trends in sales of fine jewelry versus fine watches.

While jewelry demand perked up, the entire gain was due to increased sales at multi-line merchants, as the following illustrates.

Fine Jewelry & Watch Estimated Sales by Segment – May 2015

Multi-Line Merchants $4.6 billion Up 4.5 percent

Specialty Jewelers $2.7 billion Down 4.4 percent

Specialty Jewelers’ Sales: A Disappointment

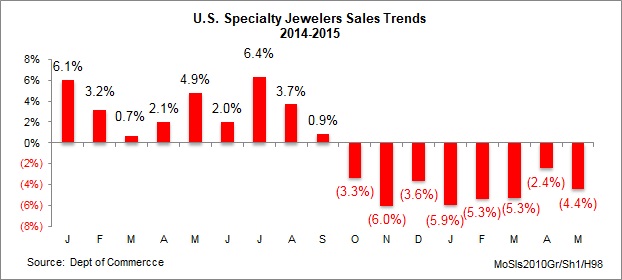

Specialty jewelers’ sales in May were an estimated $2.7 billion, a decline of 4.4 percent. May’s performance was surprisingly weak, since shoppers usually buy most of their Mother’s Day jewelry at specialty jewelers. This is the eighth consecutive month that specialty jewelers’ sales have declined, as the graph below illustrates.

Year-to-date specialty jewelers’ sales are down 4.6 percent. If this trend continues, specialty jewelers’ 2015 sales will be among the weakest on record. Clearly, these merchants – both jewelry chains and independent jewelers – are losing market share to retail merchants who offer a variety of goods at credible, everyday low prices.

Retail Sales (All Goods) Outpace Jewelry Sales

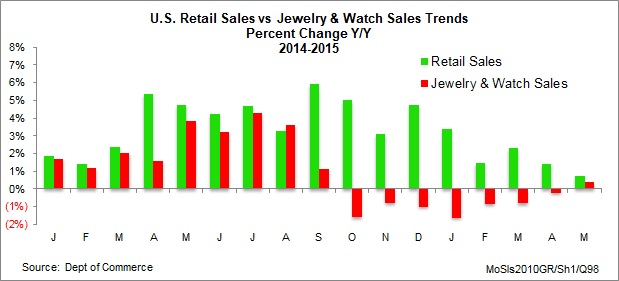

Sales growth of all categories of retail merchandise in the US market has significantly outpaced jewelry sales gains since late 2013. This means jewelry has lost share-of-wallet with American shoppers.

The graph below illustrates the disparity between total retail sales of all goods in the US market (green bars) versus sales of jewelry and watches (red bars).

Outlook & Forecast – Flattish Jewelry Sales in 2015

Early reports from our sample of specialty jewelers indicate that June sales were “satisfactory” – that is, not strong, but not weak, either. July sales, after two weeks, reflect the summer doldrums.

We continue to forecast that total US jewelry sales will be flat or up as much as 1 percent for 2015. Year-to-date (five months) fine jewelry and fine watch sales are down 0.6 percent.

Our sample of specialty jewelers who carry Forevermark diamonds have reported solid demand. De Beers’ Forevermark advertising is helping to drive diamond shoppers into those selected merchants. There are two keys to success with Forevermark: 1) you’ve got to have ample stock, if you plan to sell it and 2) proper sales training is imperative, especially for specialty jewelers who want to create a credible competitive differential versus the big box multi-line merchants who also sell jewelry.

De Beers’ decision to bring back the well-known tag line, “A Diamond Is Forever,” will be a major positive factor for both Forevermark retailers and the diamond industry.