IDEX Online Research: US Jewelry Prices Drift Lower in Second Quarter

July 26, 15

Both retail prices and suppliers’ prices for fine jewelry and watches in the US market slipped lower in the second quarter of 2015, when compared to the same three-month period a year ago as well as when compared to the first quarter of 2015. For more than a year and a half, jewelry prices have softened.

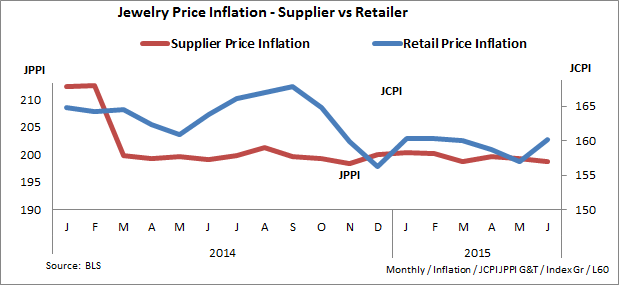

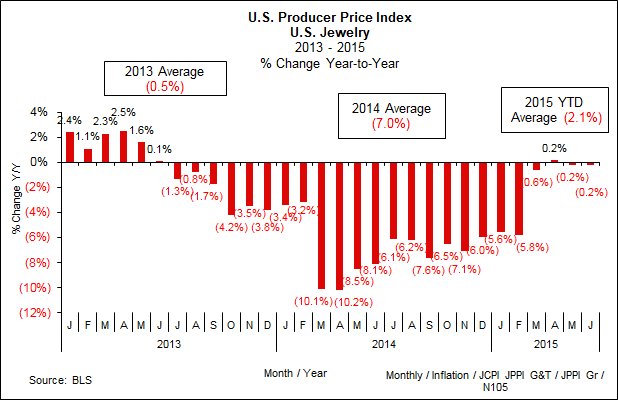

· The Jewelry Producer Price Index (JPPI) averaged 199.2 in the second quarter, down 0.3 percent from an average of 199.8 in the first quarter. The JPPI is an index that represents a broad sample of jewelry suppliers’ prices; the percentage change is the number on which to focus. On a year-to-year basis, JPPI was down by a very modest 0.1 in the second quarter. While jewelry commodity prices have fallen, they have been offset by rising labor costs and unfavorable currency exchange rates.

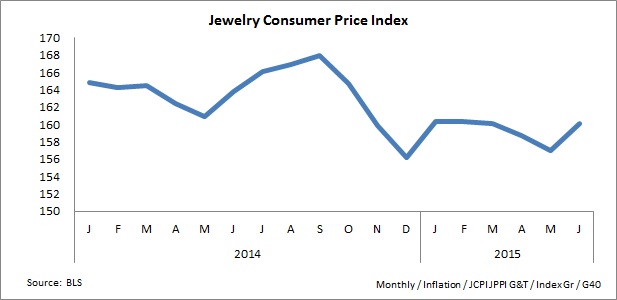

· The Jewelry Consumer Price Index (JCPI) averaged 158.6 in the second quarter, down 1 percent from an average of 160.3 in the first quarter of 2015. Like the JPPI, the JCPI is an index that represents a broad sample of retail jewelry prices in the US market. On a year-to-year basis, the JCPI was down 2.3 percent in the second quarter, reflecting more price-based promotions and greater levels of discounting in jewelry stores.

The graph below compares jewelry supplier prices (red line) with jewelry retail prices (blue line) since the beginning of 2014. Prices bounced around in 2014, settled down in early 2015, but were more volatile late in the second quarter of 2015.

The following table summarizes second quarter price trends for jewelry at both the retail level and the supplier level in the US market.

Jewelry - Inflation Retail Prices & Supplier Prices Second Quarter 2015 % Change % Change Segment 2Q Y/Y 2Q / 1Q Jewelry Supplier Prices (0.1%) (0.3%) Jewelry Retail Prices (2.3%) (1.0%) Sources: Various Markets JCPI JPPI G&T/NEW Table/Q 25

After a brief period when commodity prices rose earlier this year, they are hovering at long term low levels. As a result, jewelry suppliers are finding it difficult to raise prices. Jewelry demand at the retail level remains tepid, at best. Until consumers show that they are willing to buy jewelry – and demand rebounds – jewelers and suppliers have no pricing power, so prices will remain low and the market will be extremely competitive.

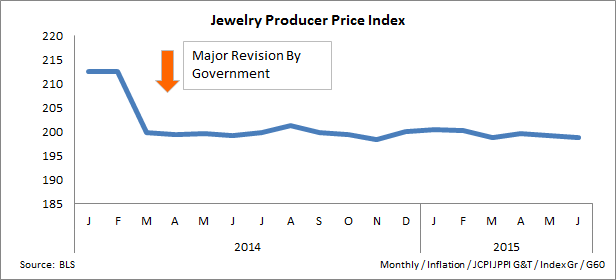

Jewelry Supplier Prices Soften Modestly

As a result of weak underlying jewelry commodity prices, suppliers have kept their prices mostly unchanged, as the graph below illustrates, though they are drifting slightly lower overall.

On a year-over-year basis, jewelry suppliers’ prices have been below the same month a year ago since mid-2013, and substantially below the prior year since March 2014. In the second quarter of 2015, suppliers’ monthly prices were slightly lower than the same quarter last year, as the graph below illustrates. On a year-to-date basis, suppliers’ jewelry prices are down one-tenth of 1 percent for the second quarter of 2015. Year-to-date, jewelry suppliers’ prices are down 2.1 percent versus the first half of 2014.

Underlying commodity prices for jewelry components remained mostly lower in the second quarter, both on a year-to-year basis and a quarter-to-quarter basis, as the table below illustrates.

Jewelry - Commodity Prices Inflation Factors Jewelry Avg 2Q 2015 % Change % Change Commodity US$ Price Year-to-Year 2Q / 1Q Diamonds n/a (3.5%) 3.2% Gold $1,193 (7.4%) (2.2%) Silver $16.35 (16.7%) (2.2%) Platinum $1,160 (19.8%) (2.8%) Sources: Various Markets JCPI JPPI G&T/NEW Table/F14

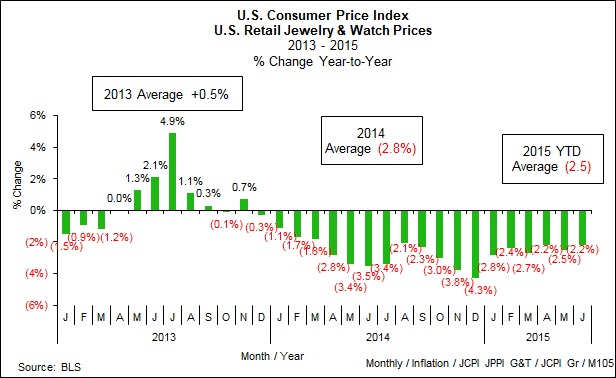

Jewelry Retail Prices Slip

Retail prices of jewelry in the US market slipped slightly in the second quarter, though they rose in June, which is a seasonal situation. The graph below summarizes monthly fluctuations in retail jewelry prices.

In the second quarter, retail jewelry prices remained low in April and May, but jewelers raised prices in June, as shown on the graph above, continuing a trend that began five years ago.

After heavy price-based promotions in April and May for Mother’s Day, retail merchants usually raise prices at the beginning of summer for two reasons: 1) to establish a high price for a few months, so the merchants can legally advertise discounts later in the year and, 2) the summer season is a major sales period for diamond engagement rings, where demand is relatively inelastic and couples are willing to pay an amount closer to “list price” without heavy discounting.

The strategy of raising prices so they can be marked down later is called “hi-low” retail pricing, and it is no longer used by most retail merchants because it creates an unfavorable impression with shoppers. Most shoppers know that those “discounts” really aren’t true discounts.

On a year-over-year basis, retail jewelry prices have fallen since the end of 2013, as the graph below illustrates.