IDEX Online Research: August Jewelry Demand Remains Solid in US

October 19, 15

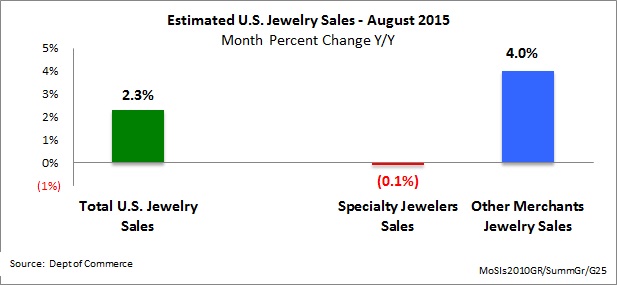

Total sales of fine jewelry and fine watches in the US market in August were an estimated $5.4 billion, up 2.3 percent from August 2014, according to the latest data from the Department of Commerce.

• Specialty jewelers, those merchants who derive a majority of their revenues from the sale of jewelry and watches, posted a slight sales decline of 0.1 percent in August. Specialty jewelers’ sales represent just over 40 percent of total US jewelry sales.

• Jewelry sales through multi-line merchants such as Wal-Mart, Costco and others rose by an estimated 4 percent during the period. Jewelry sales through multi-line merchants represent just under 60 percent of total US jewelry sales.

• Consumer demand for jewelry remains solid, but shoppers bought more of it from multi-line merchants than specialty jewelers, continuing a four-decade trend.

Jewelry Sales Gains In Line With US Economic Growth

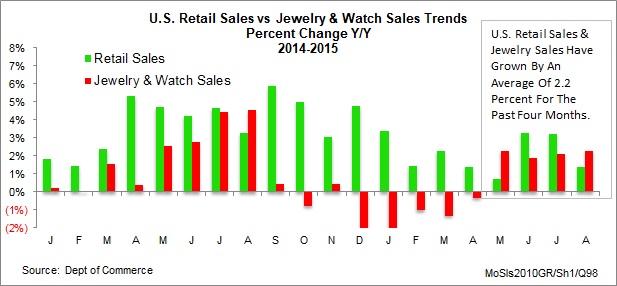

For the past four months, US jewelry sales have risen by an average of about 2.2 percent each month. This is nearly in line with consensus forecasts that call for US economic growth of about 2.5 percent this year. While economic growth – and jewelry sales growth – were rocky in the first half, most forecasters are calling for less volatility in subsequent quarters in 2015 and early 2016.

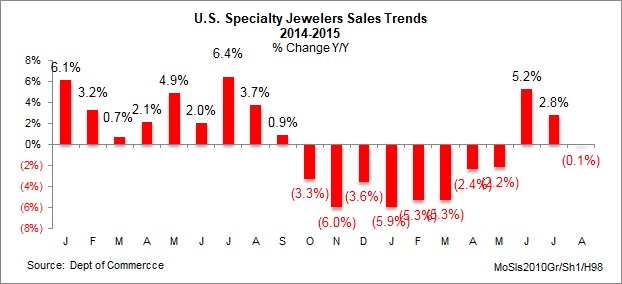

The graph below illustrates monthly growth since the beginning of 2014, on a year-to-year basis, of fine jewelry and fine watch sales in the US market.

Specialty Jewelers Post No Sales Gain

Specialty jewelers’ sales during August were an estimated $2.2 billion, a 0.1 percent decrease over August 2014, as the graph below illustrates. This is in line with reports from our sample of specialty jewelers. Most specialty jewelers report that customer traffic was weak this summer, though the average ticket increased due to slowing sales of beads and rising sales of diamond jewelry.

Outlook – We Remain Cautiously Optimistic

As the US jewelry industry heads into the all-important fourth quarter with sales driven largely by Christmas demand, we believe that current sales trends will continue: low single-digit gains. While total jewelry industry sales are up only 0.5 percent year-to-date through August, and specialty jewelers’ sales are down 1.7 percent for the first eight months, we continue to see positive signs.

• The economic data is solid: unemployment claims have fallen to levels approaching late 1973, inflation is non-existent and shoppers have extra money, especially with rock-bottom gasoline prices.

• Further, total US monthly retail sales have grown an average of 2.2 percent, year-to-year, during the four-month period May-August. Monthly jewelry sales have also grown by an average of 2.2 percent during the same four-month period, as the graph below illustrates. This bodes well for the industry during the upcoming holiday selling season.

• Jewelers seem ready for the holiday with adequate inventory. DeBeers is back to touting diamonds, a positive for the industry.

As a result, the mood of the American shopper seems more positive than it has been in several years, and the US jewelry industry will likely benefit. The big question: will specialty jewelers get their share of shoppers’ spending during the 2015 holiday selling season? Absent a compelling competitive differential, we think they will continue to lose incremental market share.