IDEX Online Research: Polished Diamond Prices Drop in October

November 02, 15

Polished diamond prices dropped in October, continuing a trend seen since August. Here is the underlying detail:

· The IDEX Index of Global Polished Diamond Prices averaged 126.01 during October, down 3.4% from 130.4 in September. Prices exhibited a steady slide from the beginning of the month, which began at 129.2 and ended at 123.3.

· Diamonds in the 0.5-carat range continued to see a significant drop in price, falling 15.3 percent year-over-year. The only good news was 4-carat stones, which increased 4.8 percent year-over-year.

Polished Diamond Prices on a Downward Journey

Price volatility, which began in the third quarter of 2014, continued into October.

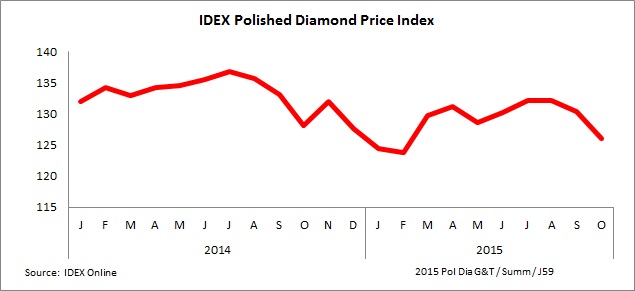

The graph below illustrates short-term trends – and recent volatility – for polished diamond prices.

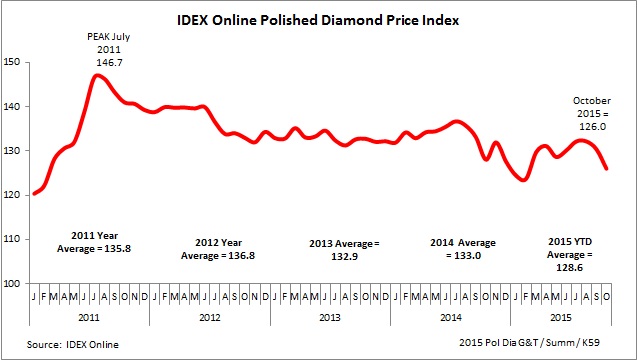

A graph of polished diamond prices for the past five years puts the recent price volatility in perspective, as shown below:

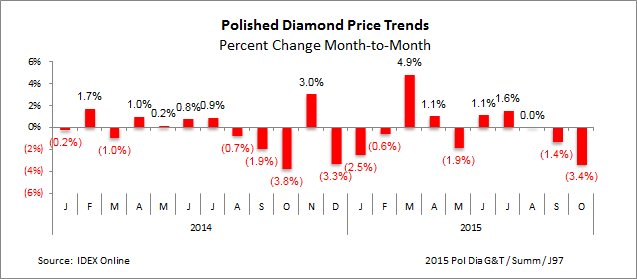

On a month-to-month basis, October global polished diamond prices were down 3.4 percent, when compared to September, as the graph below illustrates. The graph further illustrates the volatility of recent polished diamond prices.

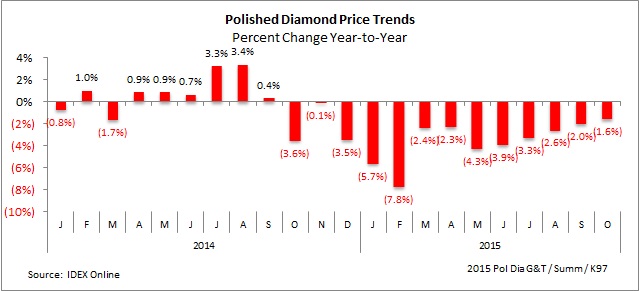

On a year-to-year basis, global polished diamond prices were down 1.6 percent compared to October 2014 – as the graph below illustrates.

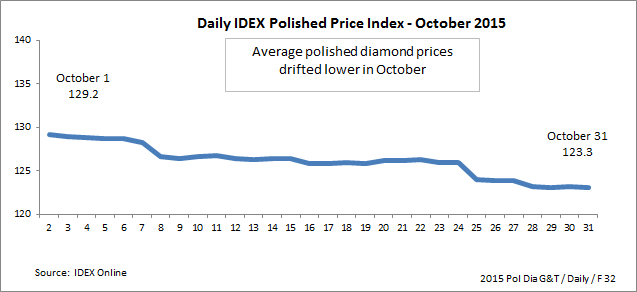

Daily Diamond Prices Slide

In October, polished prices slid lower from day to day. By the end of the month, they were down from 129.2 to a low of 123.3.

The graph below summarizes polished diamond prices on a daily basis during October 2015.

Diamond Prices by Size Bounced Around in October

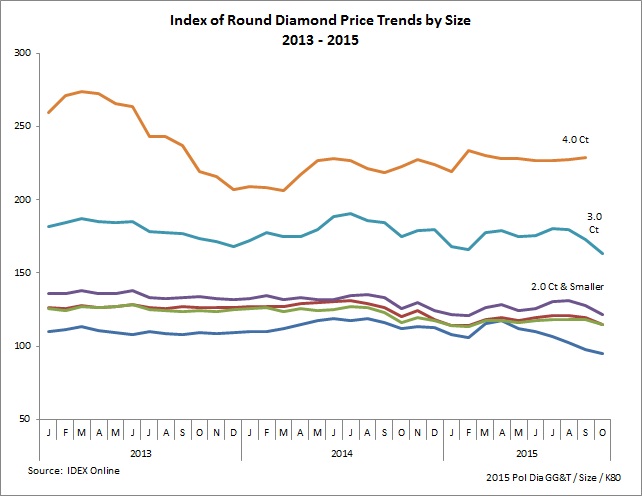

On a year-over-year basis, 0.5-carat diamonds declined by 15.3 percent. On a month-over-month basis, they declined by a more moderate 2.9 percent. In fact, diamonds of all sizes – with the exception of 4-carat stones – saw declines, with 3-carat stones dropping by a noticeable 5.5 percent month-over-month. Four carat stones, on the other hand, increased 4.8 percent year-over-year and a modest 0.7 percent on a month-over-month basis.

On a month-to-month basis – comparing prices in October 2015 to September 2015 – prices for most sizes of diamonds were down, with the exception of 4-carat stones, which have maintained a positive price increase for the past three months.

On a year-to-year basis – comparing prices during October 2015 to October 2014 – polished diamond prices were lower for all major sizes of gemstones with the exception of 4-carat stones. The graph below illustrates the year-to-year price trends for polished diamonds by size.

Over the longer term, the most price volatility has occurred among stones 3-carats and larger, although 0.5-carat stone prices have trended lower (dark blue line at bottom of the graph) as illustrated below. These larger goods are much rarer and . Tracking the smaller goods, the “bread and butter” items that are more commonly traded, offers a much more accurate representation of how the market is actually performing than following the more expensive and rarer larger goods.

Outlook: Diamond Prices Facing Many Challenges

There are a number of factors affecting diamond prices – some of which have been impacting business for a while – including less credit and liquidity in the market and sluggish consumer demand, especially in China, which is facing reduced demand owing to the weakness of the yuan and a clampdown on corruption.

Hopes of a strong buying season in India for the upcoming festival of Diwali look to be something of a dream, with a number of factories in Surat already closing early for the holiday due to slow demand.

Perhaps the only potential bright spot is the United States, where there are predictions for a decent holiday season – although there is no guarantee that shoppers will turn to diamond jewelry.

An additional factor that must be taken into account is the upcoming Sight, which is likely to have even more rejections than the estimated 35-50-percent of items that were left on the table at Sight 8, as diamantaires take stock of their situation and postpone buying until times – and prices – are better. Although the producers are trying to project the view that it is business as usual, diamantaires are unwilling to buy owing to continued high prices and a surplus of inventory that is not allowing them to make a profit.