IDEX Online Research: Polished Diamond Prices Static in November

December 03, 15

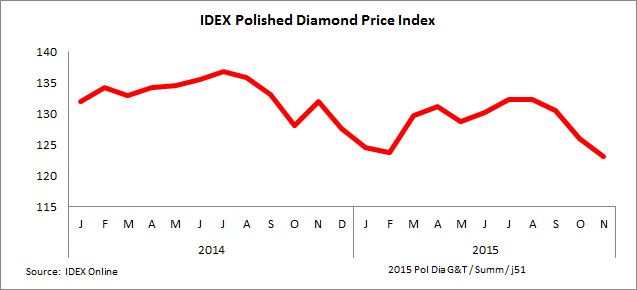

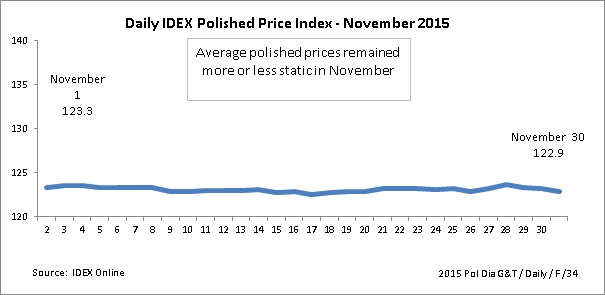

The daily price change for November showed only minimal movement across the entire month, with no significant price fluctuations. The month began at 123.3 and ended at 122.9.

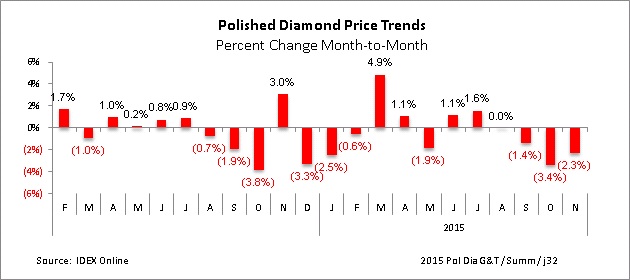

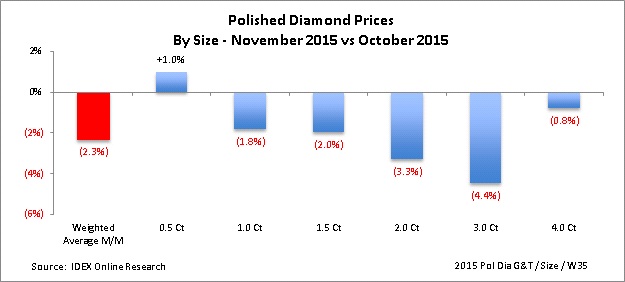

Despite the onset of the global holiday season, which should stimulate demand for diamonds, polished prices continued their decline in November on a month-on-month basis, with prices sliding 2.3 percent from their October price.

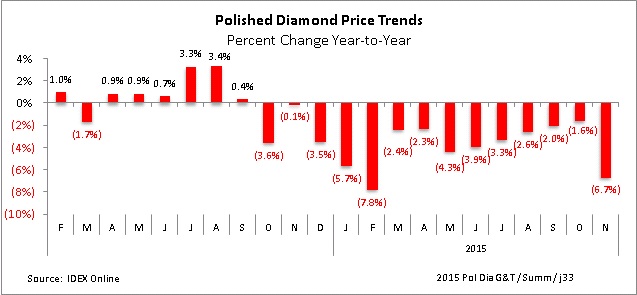

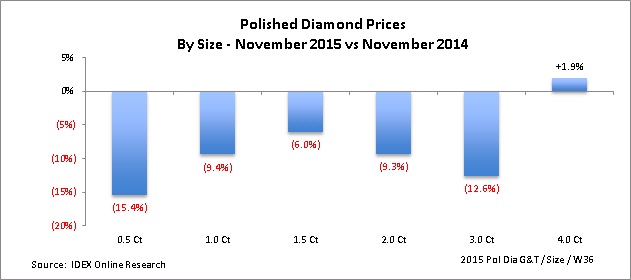

On a year-over-year basis, the 6.7-percent decline in November marks the second-largest price drop this year, coming second only to the 7.8 decline seen in February.

In November, 0.5-carat goods continue to see significant price drops, falling 15.5 percent year-over-year, continuing a trend seen of double-digit declines seen since August.

The “good news” if you can call it that, came in the 4-carat category, which saw prices increase 1.9 percent year-over-year

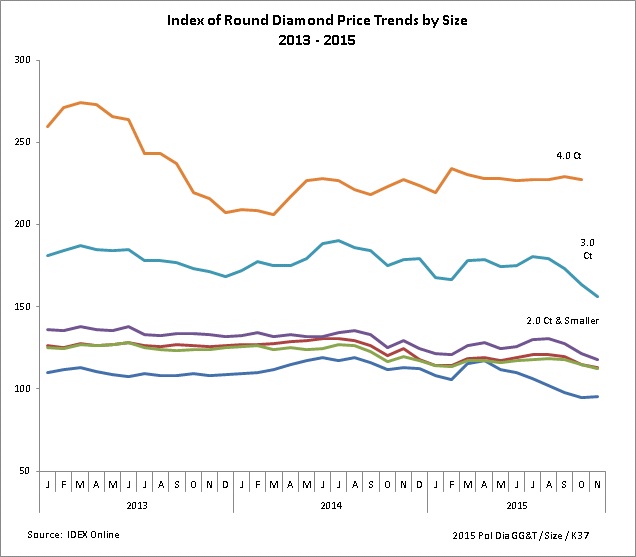

Diamond Prices Continue Downward Trajectory

While there has been volatility in the market, since the third quarter of 2014, the trend now just seems to be for continually dropping prices, a pattern that has been the same since August of this year.

The graph below illustrates short-term trends for polished diamond prices.

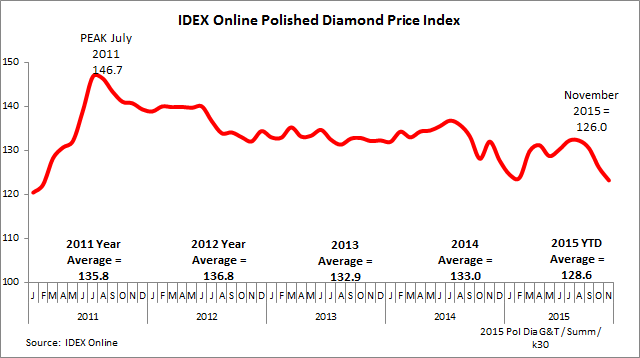

A graph of polished diamond prices for the past five years shows the price drop even more clearly.

On a year-on-year basis, November’s decline of 6.7 percent, represents the biggest drop since February 2015, and represents a far cry from last year’s miniscule 0.1 percent decline in November 2014.

Daily Diamond Prices Static in November

There was little discernible movement in the daily price index in November. The month began at a price of 123.3 and ended at 122.9, although there was a slight uptick in the last week of November, followed by a decline as the month concluded.

Diamond Prices by Size Slid in November

On a year-over-year basis, 0.5-carat diamonds declined by 15.5 percent in November, although they increased by a modest 1 percent on a month-over-month basis.

Three-carat diamonds saw a 12.6-percent decline year-over-year, and also saw the biggest drop on a month-on-month basis, falling 4.4 percent.

Year-over-year, 4-carat stones improved 1.9 percent, but slipped 0.7 percent month-over-month.

On a month-to-month basis – comparing prices in November 2015 to October 2015 – prices for most sizes of diamonds were down, with the exception of 0.5-carat stones, which increased for the first time since April.

On a year-to-year basis – comparing prices during November 2015 to November 2014 – polished diamond prices were lower for all major sizes of gemstones with the exception of 4-carat stones, which had a modest 1.9-percent increase.

Over the longer term, the most price volatility has occurred among 3-carat stones, which have declined for much of 2015, although 0.5-carat stone prices have trended lower (dark blue line at bottom of the graph) as illustrated below.

Outlook: Diamond Prices Unlikely To Improve Near Term

There was hope in some quarters that the holiday season, including Diwali, Thanksgiving and pre-Christmas buying would help bolster the market. Surat only returned to work toward the end of the month, with many businesses having closed several weeks prior to Diwali because of lack of demand.

Consumer demand in China is still sluggish as the effects of the weakened yuan and the government crackdown on corruption are still in evidence.

As predicted, De Beers’ November Sight was very small, only around $70 million. Other miners, including ALROSA, which has cut prices by 15 percent in the year-to-date and has not ruled out reducing production in 2016 if current market conditions prevail, have not been able to arrest the price slide.

One bright spot could be the United States where there are predictions of a decent holiday season, but this is no guarantee that consumers will turn to diamond jewelry.