US Fine Jewelry & Watch Sales Grow Modestly in 2015

February 14, 16

The fine jewelry and fine watch retail market in the US posted sales growth in 2015, though it was the smallest gain in six years, since the economy and the jewelry industry began its recovery from the devastating recession of 2008-2009.

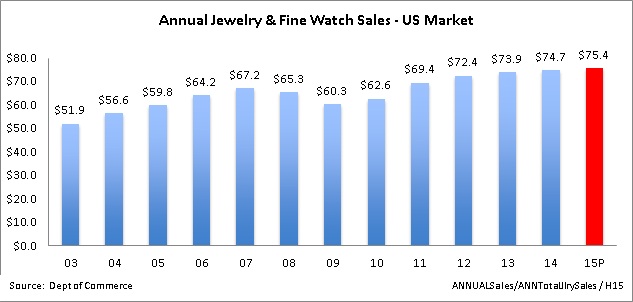

Total sales of fine jewelry and fine watches in the US in 2015 were an estimated $75.4 billion, according to the latest preliminary government data, as the graph below illustrates.

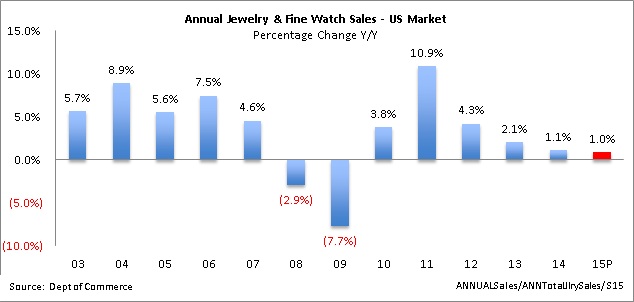

That total of $74.5 billion represented a gain of one percent, as the graph below illustrates.

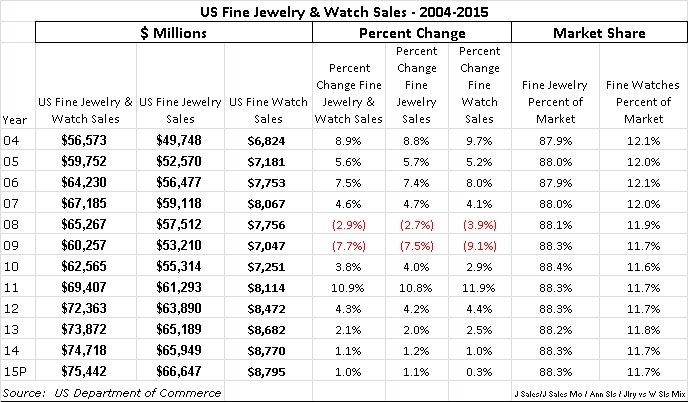

Total sales of fine jewelry in 2015 were $66.6 billion in the US, a gain of 1.1 percent.

Total sales of fine watches over the same period were an estimated $8.8 billion, a gain of 0.3 percent. Fine watches represented a little less than 12 percent of the total fine jewelry and fine watch market in America.

The table below summarizes fine jewelry versus fine watch sales for the US jewelry industry since 2003. It shows that fine watch sales have grown at a slightly slower rate than the growth of fine jewelry.

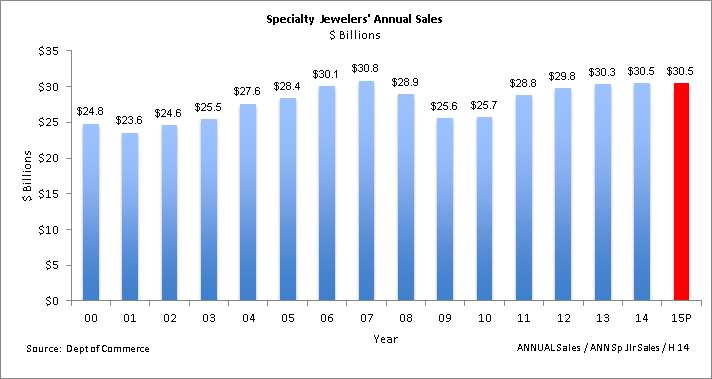

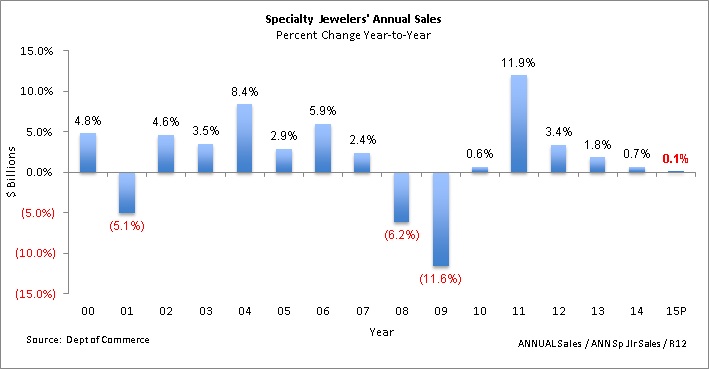

Specialty jewelers in the US – those merchants who derive a large majority of their revenue from jewelry and watch sales – generated an estimated $30.5 billion in sales in 2015, as the graph below highlights.

Specialty jewelers’ sales were up a miniscule 0.1 percent from the prior year, as the graph below shows.

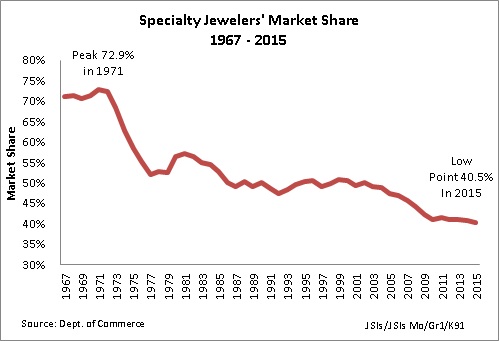

Specialty jewelers’ market share continued to decline in 2015; they now sell just over 40 percent of the total fine jewelry and watches that American consumers purchase, the lowest level since market share data became available.

There was one glimmer of good news for specialty jewelers: their December sales rose by an estimated 5.4 percent, well ahead of the industry 2.1-percent average. Specialty jewelers’ total November-December Holiday sales advanced by 4.6 percent, well ahead of the industry gain of 2.4 percent.

Note that all data is preliminary; final figures will be available by mid-2016, though we do not expect any material change in trends.

Big Ticket Diamond Sales Helped Specialty Jewelers

Two factors helped boost specialty jewelers’ sales in 2015, especially during the all-important holiday selling season of November and December.

Diamond jewelry sales were strong, particularly in the second half of the year. Diamond jewelry carries a much higher average ticket than any other jewelry category.

Sales of beads, while slowing, remained strong and helped boost year-over-year sales levels for most specialty jewelers.

Fashion jewelry demand was solid, but a large portion of consumer expenditures for fashion jewelry were made at multi-line retail merchants such as Wal-Mart, J.C. Penney, Costco and others.