IDEX Online Research: February Polished Diamond Prices Remain Static

March 07, 16

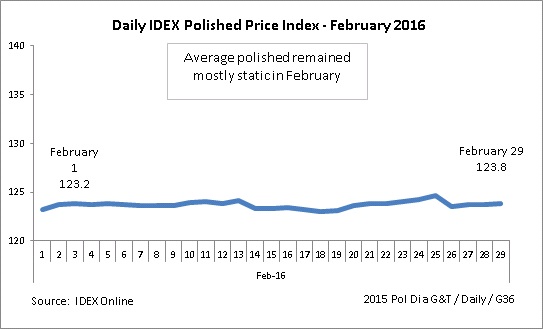

The cautious optimism that has been apparent since the start of the year was reflected somewhat in polished diamond prices in February. The Index began the month at 123.2 and ended at 123.8 – the price at which January also closed.

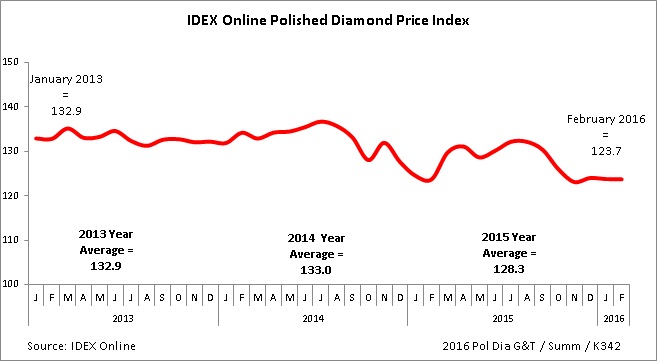

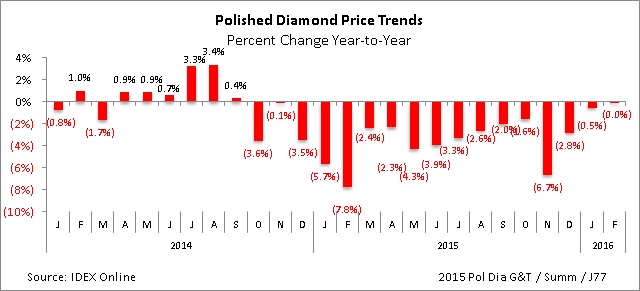

On a year-over-year basis, February’s average price was static, the first time that there has not been a year-over-year drop since September 2014.

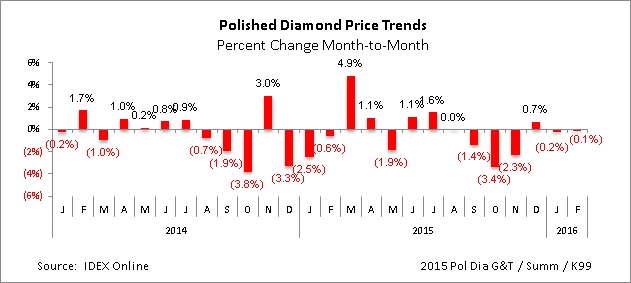

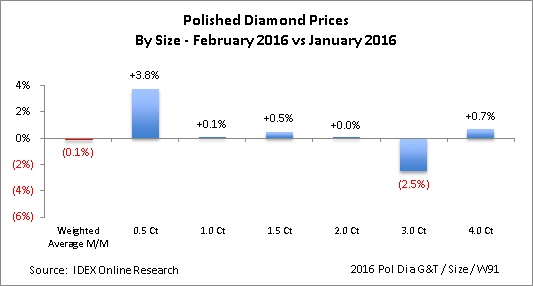

On a month-to-month basis, February’s global polished diamond prices were stable, only registering a 0.1-percent decline over January, and still much less volatile than other commodities.

Diamond Price Showing Stability

Polished diamond prices have been relatively stable since November, with February’s minimal slip hopefully providing evidence that prices can be galvanized following December’s uptick.

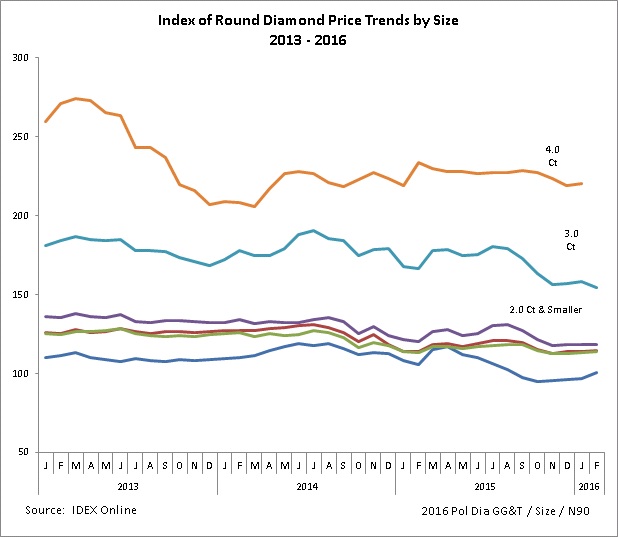

Although the graph of polished diamond prices since January 2013 shows a 6.85-percent decline – and taking into account that polished prices have seen more volatility during 2015, overall prices currently seem stable, especially when we factor in that there was no year-on-year price change between February 2016 and February 2015.

On a month-to-month basis, February’s global polished diamond prices were down a statistically insignificant 0.1 percent over January.

On a year-on-year basis, February’s global polished diamond prices remained the same – the first time that there has not been a decline since the fall of 2014.

Diamond Prices by Size Remained Mostly Static; Increases in Some Items

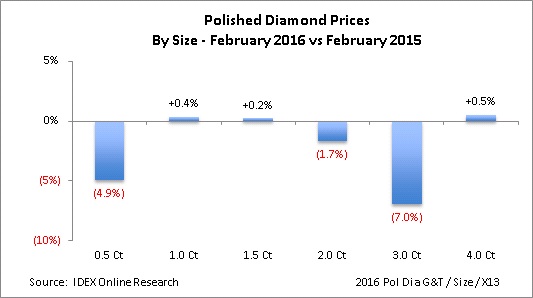

On a year-to-year basis – comparing prices during February 2016 to February 2015 – polished diamond prices varied for all major sizes of gemstones.

On a year-over-year basis, 0.5-carat diamonds declined by 4.9 percent in February, although their 3.8 percent month-over-month increase represents the most improved item size.

The performance of 3-carat diamonds, however, continues weaker than the same month a year ago, with a 7-percent decrease, and on a month-to-month basis, saw its price fall 2.5 percent compared to January 2016.

On a year-over-year basis 4-carat stones increased 0.5 percent, and also showed a month-over-month improvement, rising 0.7 percent.

Over the longer term, 4-carat stones (brown line) have shown the most price volatility, although 3-carat diamonds have displayed the steepest declines since mid-2015. Recent results show that all sizes of diamonds, with the exception of 3-carat stones have seen their prices leveling off.

Outlook

The polished market is still uncertain and we should not expect an upturn until at least the second half of the year. One bright spot is in comparing the mostly static polished diamond market with the highly volatile precious metals market. Gold, silver, palladium and platinum showed declines of 2 percent to 37 percent during February.

The end-of-year specialty jewelry figures were encouraging, showing that holiday season sales advanced 4.6 percent. We do not, however, expect any significant material change in our predicted trends.

January’s trend for strong demand for rough diamonds continued in February, according to rough diamond brokers Bluedax.com. Both ALROSA and De Beers’ Sights reflected a positive and active market in many categories. Figures are not available for ALROSA, but the De Beers Sight was estimated at $610 million. The strong demand in the secondary market, with buyers prepared to pay a high premium, also continued during the month.

The Antwerp World Diamond Centre (AWDC) recently announced that its February figures showed a marked improvement in the rough trade. Both imports and exports of rough saw significant gains, but the value of polished diamonds fell by 10 percent.