IDEX Online Research: US Jewelry Sales Show Solid Growth in April

June 16, 16

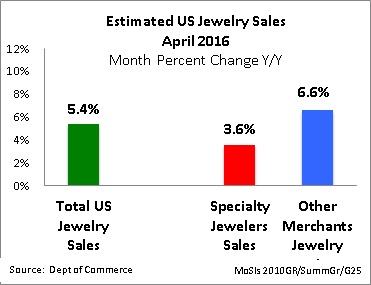

Total sales of fine jewelry and fine watches in the US market rose by a strong 5.4 percent in April 2016 when compared to April 2015, according to preliminary data from the US Department of Commerce. This gain was slightly above sales increases posted earlier this year.

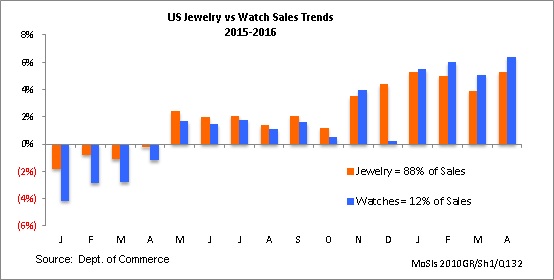

Fine jewelry sales rose by an estimated 5.3 percent in April, while fine watch sales rose by a more robust 6.4 percent.

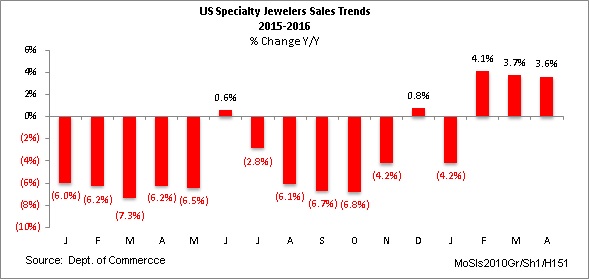

Preliminary April sales gains for specialty jewelers show that they are continuing to lose market share to other merchants – mostly multi-line retailers – who sell jewelry. Specialty jewelers, who generate a majority of their business from jewelry sales, posted a sales gain of 3.6 percent, below both February and March sales increases for their retail category, and below overall jewelry industry gains.

Other retailers who sell jewelry – mostly multi-line merchants such as Wal-Mart, J.C. Penney, and others – posted a very strong 6.6 percent gain in sales during April.

Our outlook calls for more moderate sales increases in the next few months, primarily because comparisons are much more difficult against last year’s strong growth.

Total Jewelry Sales Up 5.4 Percent in April

Total sales of fine jewelry and fine watches in the US market in April were an estimated $5.9 billion, according to the latest preliminary data from the Department of Commerce. April sales were somewhat above the typical level of monthly jewelry sales – $5 billion or so – in the US market.

Specialty jewelers – These specialty merchants who derive a majority of their revenues from the sale of jewelry and watches, posted a moderate sales gain of 3.6 percent in April. Specialty jewelers’ sales represent about 40 percent of total US jewelry sales, based on new data recently released by the government.

Multi-line merchants – Retailers such as Wal-Mart, Costco, and others who sell jewelry generated an estimated jewelry sales gain of 6.6 percent during the month of April. Jewelry sales through multi-line merchants represent about 60 percent of total US jewelry sales, a number that has been growing for several decades.

Consumer Spending on Jewelry Strengthened in April

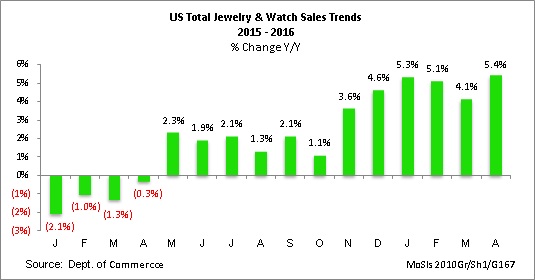

Consumer demand for jewelry has continued to show growth, especially in the past several months. In part, this is due to easy sales comparisons against last year’s very weak gains in the first quarter of the year.

In part, consumers seem to be spending more freely on jewelry, now that the US economy appears to be posting moderate, but consistent, growth. Further, employment levels continue to strengthen. We also sense that some diamond promotions are beginning to have a positive impact on consumer demand; in addition, fashion jewelry remains a strong category at multi-line merchants.

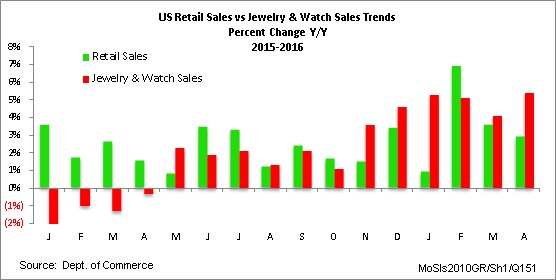

The graph below illustrates monthly jewelry sales growth since the beginning of 2015, on a year-to-year basis, of fine jewelry and fine watch sales in the US market. It is clear that jewelry sales gains have been showing positive momentum.

Fine jewelry sales (approximately 88 percent of the market) rose by an estimated 5.3 percent in April, while fine watch sales (approximately 12 percent of the market) were up by 6.4 percent. In most months, fine jewelry and fine watch sales track fairly closely. The graph below compares fine jewelry sales gains (red bars) to fine watch sales growth (blue bars).

Specialty Jewelers’ Sales Growth Below Average

Specialty jewelers’ sales during April were an estimated $2.3 billion, a 3.6-percent increase over April 2015, as the graph below illustrates. This monthly sales gain was below the overall jewelry industry average (all US retailers who sell jewelry) of +5.4 percent for April. While this growth may seem positive, this year’s sales comparisons are easy, since they are against especially weak sales last year in the first half.

Jewelry Gained Share of Wallet in April

Total US jewelry sales rose by 5.4 percent in April. This was well above the average retail sales gain (all retail categories) of 2.9 percent posted among all US retail merchants. As a result, the US jewelry industry took share of wallet from other retail merchants. Most of the increased share of wallet accrued to multi-line merchants who sell jewelry.

When compared to total retail sales gains, recent monthly sales of fine jewelry and watches have been generally strong, and they have taken share of wallet from other retail categories

every month this year except February, as the graph below highlights. Jewelry sales gains are represented by the red bar; total retail sales gains are represented by the green bar.

Outlook – We Are Optimistic

The US retail jewelry sector has been relatively robust since the all-important November-December period, based on revised data. First quarter 2016 sales, which include the important Valentine’s Day sales, were also very strong, with those solid gains continuing into the second calendar quarter of 2016.