U.S. Jewelry Sales Post Strong Gain in February

April 17, 17

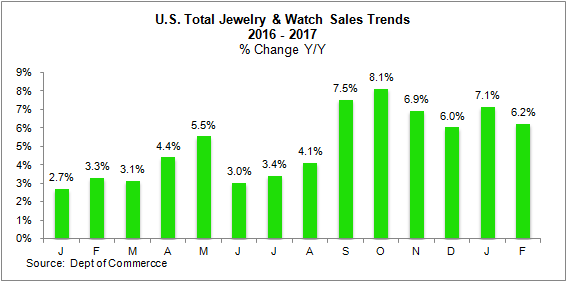

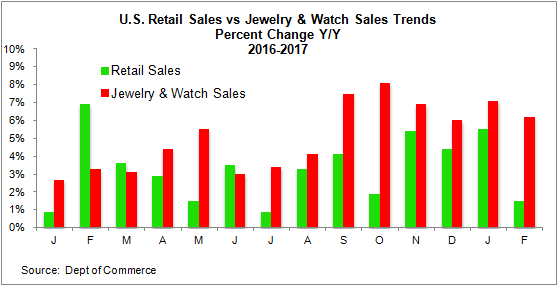

Sales of fine jewelry and fine watches rose by 6.2 percent in the U.S. market in February 2017, when compared to the same month a year ago, as the graph below illustrates.

Sales were an estimated $7.1 billion, according to preliminary data from the U.S. Commerce Department. February sales reflect Valentine’s Day demand for jewelry; this is the third largest sales period in the U.S. market, after Christmas and Mother’s Day. This was the sixth consecutive monthly gain that has been well above more modest gains reported during the early months of 2016.

Specialty Jewelers Lost Market Share Again in February

After weak sales in early 2016, specialty jewelers in the American market posted strong sales in the all-important 2016 holiday selling season of November and December, and they took market share from multi-line retailers who also sell jewelry.

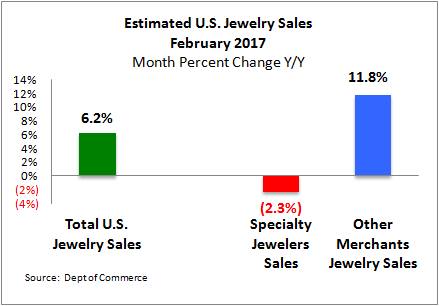

However, in both January and February, specialty jewelers’ sales were much more modest, and they lost market share to competing multi-line retailers. Specialty jewelers posted a 2.3 percent sales decline in February, while other multi-line merchants who sell jewelry generated an estimated 11.8 percent sales gain year-over-year, as the graph below illustrates.

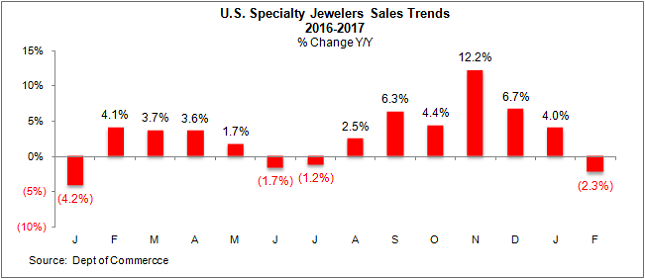

The graph below summarizes sales trends for specialty jewelers since the beginning of 2016. For American jewelers, demand is highly elastic. Their sales gains have not been as consistent as sales trends for the total jewelry market, including sales at all retailers who sell jewelry.

Specialty Jewelers Losing Market Share Even in Key Selling Periods

Historically, specialty jewelers have posted solid sales gains during the three key selling seasons during the year: Valentine’s, Mother’s Day, and Christmas / Holiday. During other months, multi-line retailers capture impulse sales for jewelry. When shoppers are browsing those big-box stores, they often find something special in the jewelry department.

However, in 2016, specialty jewelers took market share in only two of the three key jewelry sales periods: Valentine’s (February and March), and Christmas (November and December). This year (2017), specialty jewelers lost market share to multi-line merchants in the important Valentine’s selling period.

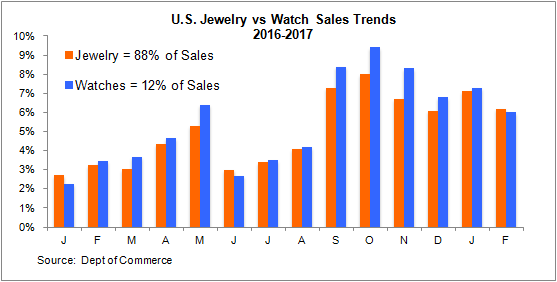

Clearly, specialty jewelers are struggling while multi-line merchants are enjoying strong jewelry sales. The graph below summarizes the disparity between specialty jewelers’ sales gains and jewelry sales trends for all other retail merchants who sell jewelry. Specialty jewelers’ sales are represented by the red bars; multi-line retailers’ jewelry sales are shown on the blue bars.

Fine Watch Sales Slightly Weaker than Fine Jewelry Sales

By category, fine jewelry sales were up about 6.0 percent in February, and fine watch sales rose by 6.2 percent. Watch sales lagged jewelry sales for several months earlier in 2016, but demand for watches picked up at the end of last summer, according to both the government survey and our panel of jewelers. However, watch demand is typically muted for the Valentine’s selling period.

Consumer Demand Weakened Notably in February

Total retail sales of all goods, except autos, posted a modest 2.2 percent sales gain in February, a change from the past three months. The good news: jewelry took share of wallet from other consumer goods in February, as it has since July 2016. The graph below illustrates sales trends for all retail sales (green bars) versus sales gains for jewelry (red bars).

Data Revisions Modest

The Commerce Department revises its preliminary numbers for about three months following initial reports; it also makes annual revisions which are often quite large.

During February, the Commerce Department revised January’s total jewelry and watch sales gain to 7.1 percent, up from the preliminary 6.8 percent gain.

Specialty jewelers’ January sales gains were trimmed modestly: revised data shows that January sales gains were 4.0 percent down slightly from the preliminary gain of 4.1 percent.

Outlook Optimistic for 2017 Jewelry Sales

While chain jewelers have been reporting generally soft sales for the most recent fiscal quarter ended January 2017, independent jewelers have generally been reporting stronger sales gains.

Our preliminary forecast for jewelry sales gains in the U.S. market for 2017 is a gain in the four percent range, year-over-year.