Big Five Could Soon be Sitting on Four Months' Supply of Diamonds

June 07, 20

(IDEX Online) - The five biggest diamond producers have excess inventories valued at an estimated $3.5bn.

And that figure could rise to $4.5bn - four months' worth of annual rough-diamond production - according to Gemdax, the Antwerp-based diamond consultants and analysts.

It is based on stocks held by De Beers and Alrosa - each producing around a quarter of the world's diamonds - together with Rio Tinto, Petra and Dominion.

"They've tried to restrict rough-diamond supply to protect the market and protect value," said Gemdax partner Anish Aggarwal in an interview with the Bloomsberg news website.

"The question will be, how does this destocking occur? Can miners destock and keep protecting the market?"

De Beers and Alrosa have seen sales to their Sight holders and approved buyers plummet as demand slumps, and have allowed unprecedented deferrals.

Both companies have reportedly held firm on prices, although junior miners are said to be offering discounts of as much as 25 per cent.

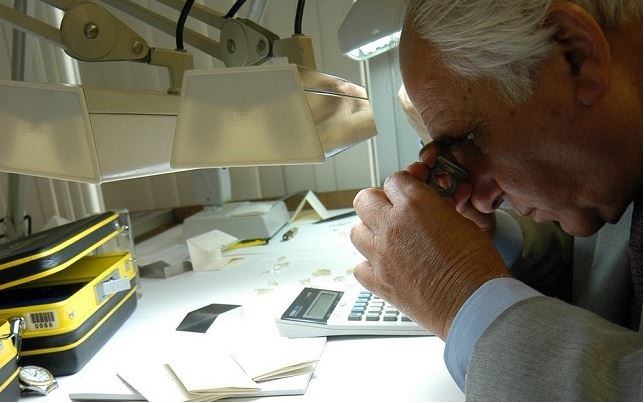

Pic courtsey De Beers