Anglo Slashes Value of De Beers by over 40%

February 20, 25

(IDEX Online) - Anglo American today (Thursday 20 February) announced a $2.9bn write down in the value of De Beers, its loss-making diamond miner, as tough market conditions persist.

The UK-based mining conglomerate said its 85 per cent stake in the company is now valued at just $4.1bn, a reduction of over 41 per cent. The remaining share belongs to the Botswana government.

An estimated $2bn - half the company's current value - is tied up in unsold inventory amid ongoing weak demand.

De Beers is now worth less than when Anglo acquired its controlling stake in De Beers in 2011.

It bought the Oppenheimer family's 40 per cent share for $5.1bn.

Anglo, which fought off a hostile takeover bid by rival BHP last year, is seeking to divest De Beers, among other assets, to focus on copper and other more profitable operations.

It posted an attributable loss of $3.07bn for 2024 today, down from a $283m profit the previous year.

In its Full Year Results 2024 Anglo said: "The work to separate De Beers is well under way, with action taken to strengthen cash flow in the near term and position De Beers for long-term success and value realisation.

"Given prevailing diamond market conditions, we have reduced our carrying value of De Beers by $2.9 billion."

This is the second write-down in two years. It reduced the value of De Beers by $1.6bn in 2023.

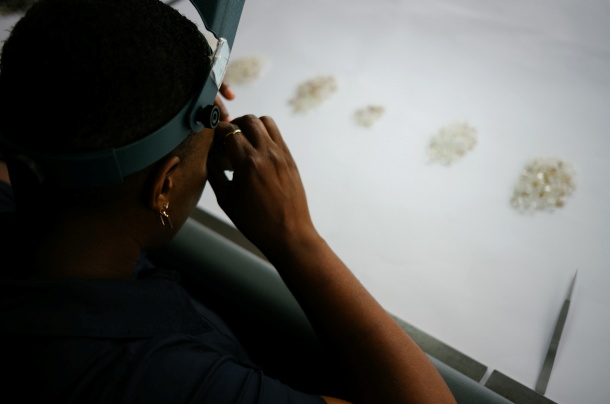

Pic courtesy De Beers.