Polished Diamond Prices Flat in 2014

January 08, 15

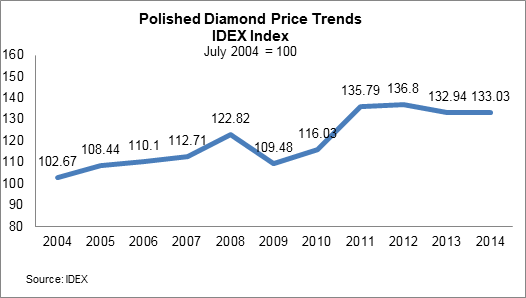

(IDEX Online News) – Global polished diamond prices were flat in 2014, continuing a trend that began in 2011, according to the IDEX Index of Global Polished Diamond Prices.

The IDEX Index for polished diamond prices averaged 133 in 2014, almost flat with 2013’s 133.9. In 2012, the IDEX Index stood at 136.8, almost flat with 2011’s 135.8.

The IDEX index is a weighted index based on trading volume by diamond size, and it is considered to be the most reliable diamond price indicator in the market.

The graph below summarizes global polished diamond prices for the past decade, based on the IDEX Index.

Diamond Price Growth Stalled

In the early years of the decade of the 2000s, global polished prices rose steadily, boosted by increased demand in both maturing markets – the Americas and Europe – and developing markets – mostly in Asia, including China.

The global recession that occurred late in the last decade took a heavy toll on diamond prices, wiping out nearly all of the gains since 2004.

Polished diamond prices recovered in 2010, followed by substantial gains in 2011. However, since then, global diamond prices have been flat, when compared on a year-to-year basis.

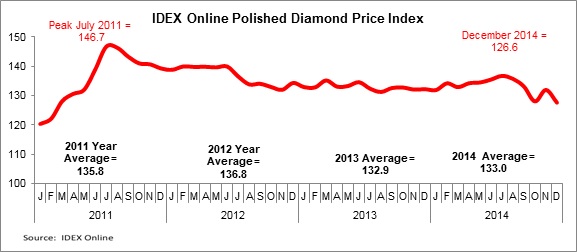

Interim monthly prices have been relatively stable, until just recently. In the second half of 2014, diamond prices have seen some movement: down quite sharply, followed by a rapid climb, only to fall again. Some of this is the natural reaction of the market following the anticipation of the Hong Kong trade show in September, as well as the seasonal drop at the end of the year. The graph shows the relative monthly stability of polished diamond prices between mid-2011 until the second half of 2014.

Long Term Price by Size Mixed

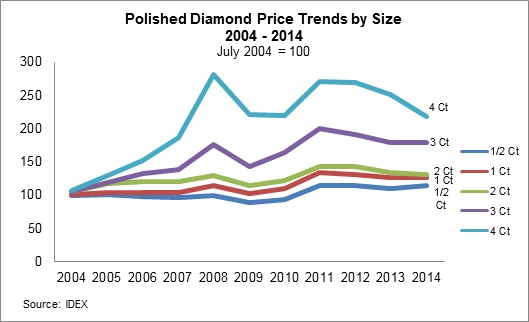

While diamond prices have generally moved in sync with the global economy, diamond prices by size seem to move more or less independently. A decade ago, prices for larger stones – 3- and 4-carat diamonds – seemed to be headed higher, with no cap in sight. However, the global recession caused prices to fall substantially.

When the global economy started to recover, dealers bid up prices for larger stones. Since then, prices of 4-carat diamonds have slipped lower, as formerly free-spending shoppers reined in their budgets for luxury items such as diamonds.

In contrast, prices of small stones – 0.5 carat and smaller – have remained nearly flat for the past 10 years.

The graph below summarizes global polished diamond prices by major size for the past decade.

Outlook: Uncertainty Reigns

After solid demand from both maturing regions and developing markets a decade ago, consumer uncertainty has had a negative impact recently on the growth rate of the polished diamond market. Consumer spending slowed in the recession, and shoppers have not yet loosened their purse strings in the face of continued high unemployment and slow-growth economies worldwide.

Diamonds are a luxury item, and not a basic necessity. And, like other luxury items, diamonds act as a barometer for confidence in the economy. As long as consumers are cautious, their diamond expenditures will likely show little growth.