De Beers 2009 Sales $3.84 Billion, ‘Cautiously Optimistic’ for 2010

February 11, 10

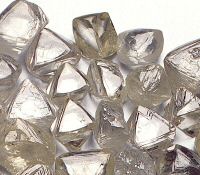

De Beers rough diamond sales totaled $3.233 billion in 2009 and mined 24.6 million carats |

As was expected, diamond giant De Beers S.A. posted a sharp drop in income in 2009. Rough diamond sales by the Diamond Trading Company (DTC) totaled $3.23 billion, 45.5 percent below last year’s $5.93 billion. Annual diamond production was 24.6 million carats, 49 percent below 2008.

De Beers reported $3.84 billion in sales for the group during the year, a 44.3 percent drop from 2008.

The plunge in sales left De Beers with a large loss of $743 million for 2009, compared to $90 million net earnings in 2008.

As the rough diamond market picked up, sales in the second half of the year increased by 24 percent over the first half of the year.

EBITDA (earnings before interest, taxes, depreciation and amortization) were sliced in half to $654 million, bringing pre-tax profit to $318 million, down from $823 million in 2008.

The figures, reported by De Beers Société Anonyme on Thursday morning, included limited details about refinancing. De Beers is in discussions with its lending banks to renew its outstanding $3 billion borrowing facility, of which $1.5 billion is due in March.

“International and South African financing term sheets have been agreed, and credit approval granted, by the syndicates of lending banks,” the company said, adding that the shareholders willingness to infuse $1 billion will enable a reduction in overall debt. “The detailed documentation of the new financing structure is expected to be concluded before the end of March 2010.” The shareholders are Anglo American (45%), the Oppenheimer family (40%) and

In its outlook, De Beers said it will continue to take a cautious and prudent approach to production and sales in 2010. “[W]ith the fragility of the world economy and perceived weakness of the global recovery post recession, the company would only expect a gradual increase in production levels, sales and prices,” the company stated.

Citing improvement of industry fundamentals, De Beers expressed cautious optimism for medium-term prospects.

In the longer-term, De Beers expects demand growth for diamond jewelry, driven by the emerging markets of China and India, to “outpace what is forecast to be lower levels of diamond supply for many years to come, providing a sound foundation for future profitability.”