Gem Diamonds Turns to Profit in 2009 Despite Decline in Revenue

March 16, 10

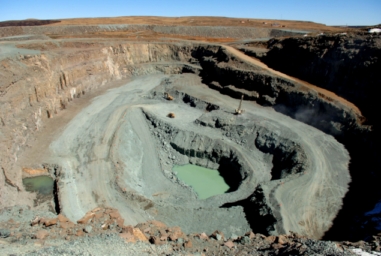

Gem's income in 2009 came mostly from the diamonds

recovered at the Letseng (above) and Ellendale mines

Gem Diamonds revenues in 2009 declined to $244.4 million, compared to $296.9 million generated in 2008. The company, however, posted a $15.5 million attributable profit, compared to a $552.8 million loss in 2008.

Most of the company’s income was from the sale of rough diamonds recovered at the Letseng and Ellendale mines. A rise in the price of rough diamonds in the second half of 2009 pushed up the average price of the Letseng and Ellendale goods to $1,818 and $348 per carat respectively, compared to $1,308 and $160 p/c in the first half of the year.

Letseng produced in 2009 more than 700 rough gem quality diamonds weighing more than 10.8 carats each that generated 78 percent of Letseng's total annual revenue. Of these, 68 rough diamonds sold for more than $20,000 p/c each. In the fourth quarter, Letseng sold a 35.51 carat, D color, type IIa rough diamond for $51,253 p/c.

According to the company’s estimates, its claims - in

The value of these goods is currently estimated at $10.47 billion. Most of the value is in Lesotho, estimated at $6.52 billion.

In its 2010 outlook, Gem Diamonds notes that demand for diamond jewelry in

“[T]he medium and long-term shortage in diamond supply created by falling production from existing mines, a lack of new mines coming on stream and growth in the Indian and Chinese markets impacting on demand, is positively impacting the market,” CEO Clifford Elphick wrote in the annual report.