Bubble? We Don’t Need No Stinking Bubble

June 22, 11

Is the current diamond market healthy? Is it operating in accordance to real demand or will we look back one day and say that Summer ‘11 was a repeat of the Fall of ‘08? Is the market a shooting star shining bright, but burning out quickly, or conversely, at a positive turning point.

Let's examine the market:

Polished diamond prices are racing upwards. In the past month the price index is practically shooting straight up, rising at 13.7% in the past three months, based on monthly averages and up by 21.4% between January 1 and today (IDEX Online Polished Diamond Index).

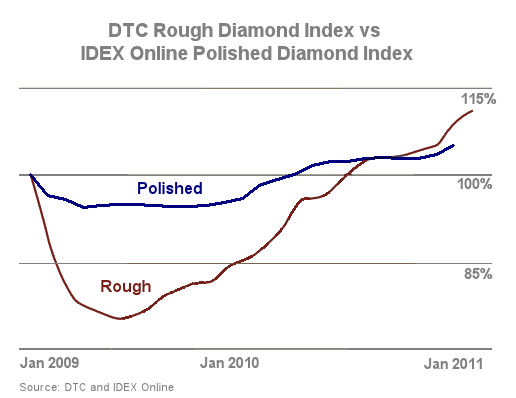

Demand for rough diamond keeps pushing up their prices. According to a DTC rough diamond index, 2010 prices are 27% higher than 2009. IDEX Online’s research found that DTC's rough prices have increased more than 20% in the first six months of 2011, and, depending on the volumes, prices may have increased by as much as 26%.

That means rough prices are growing at twice the rate they did last year.

Consider the following two graphs. The first juxtaposes the IDEX Online Polished Diamond Index against the DTC Rough Diamond Index. The timeframe is January 2009 to January 2010. Rough prices fell significantly, therefore the recovery is steeper, compared to polished.

The second graph shows IDEX Online's Index in the past year. It show how the moderate gains in the second half of 2010, which are also seen in the first graph, turn into runaway pricing in the first half of 2011.

The last few upward jumps took place just before major shows: Hong Kong and

This is normal, taking place before every major trade show. The question that must be asked is rather this: Is it sustainable? Talking with traders and other stakeholders, their concern is that these hikes are simply unhealthy.

Recently we wrote that while the sun is shining on the diamond business, we should still remember to keep our umbrellas handy. Considering the latest round of price increases, let's make sure that our umbrellas are also in good condition, without any holes.

Is it a bubble? Maybe…barring any negative external economic event, rough prices may hold for awhile. Polished may decline. But, at the end of the first day of the

We really don't need a bubble. If traders are starting to look at the graphs above, and realize that this is a time for caution, maybe a calamity will be averted.

Have a cautious weekend and stay dry!