Chapter 02 – Specialty Jewelers Musical Bumps?

May 15, 06

By Ken Gassman

America is known as “the land of opportunity.” Besides the opportunity for life, liberty, and the pursuit of happiness, America offers retailers the opportunity to tap into a rich and rapidly growing market with a seemingly insatiable appetite for conspicuous consumption.

America has more cathedrals of consumption - shopping malls – than any other country in the world. In the U.S., merchants can achieve “the American dream.” There are almost no barriers to entry into retailing. Merchants can open a store almost anyplace, sell whatever they want, whenever they want, and at whatever price they choose. Almost no industry in America has fewer government restrictions than retailing.

As a result of few barriers to entry, retailing attracts a large number of merchants who will try to sell anything to make a profit. Because jewelry is such an attractive industry - gross margins are healthy and the long term characteristics of demand are positive - there are many merchants who are trying to sell jewelry.

|

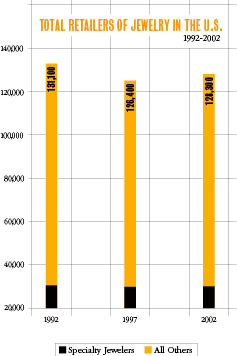

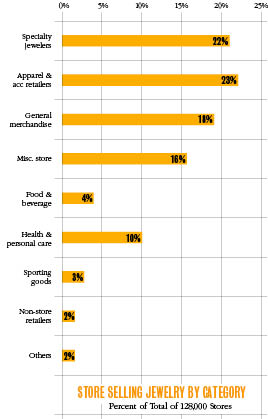

There are just over 128,000 retailers in the U.S. who sell jewelry in their stores, according to the latest Business Census data from the U.S. Department of Commerce (see graph on left). Roughly 28,000 of those stores, or about 22% of all jewelry retail outlets, are specialty jewelers; the others represent a wide variety of retail categories including department stores, general merchandise stores, warehouse clubs, apparel retailers, non-store retailers, and a number of other specialty retailers.

In addition to the list of logical purveyors of jewelry, there are a number of surprises on this list of jewelry outlets. For example, the Commerce Department’s Business Census, lists 117 stores that sell primarily beer and wine that also sell jewelry. You can gas up your car at 178 gasoline stations that also sell jewelry. In addition, there are about 385 convenience stores (such as a 7-11) that sell jewelry; 1,210 book stores sell jewelry; and, 37 pet stores also sell jewelry. In the prior Business Census (1997) about 85 automobile dealers also sold jewelry; by 2002, however, those car dealers apparently had stopped selling gemstones and watches.

The graph on the right summarizes the key retail categories where jewelry can be purchased in the U.S.

However, many of these merchants who sell jewelry do not have a meaningful level of sales. Specialty jewelers have the largest market share - roughly 48% of all U.S. jewelry sales (by value), but operate only 22% of the total stores selling jewelry in America (prior graph). Further, there are more apparel and accessory retailers who sell jewelry (23% of the total of about 128,000 stores) than there are specialty jewelers; however, those apparel and accessory retailers sell only about 7% of all jewelry in America by value.

Here’s an exhaustive list of the 52% of all merchants who sell jewelry, but whose primary product line is not jewelry.

§ Furniture & furnishings stores

§ Consumer electronics stores

§ Appliance stores

§ Home centers, including building materials, lawn & garden supplies, nurseries, farm supply and hardware stores

§ Grocery stores, supermarkets, convenience stores

§ Fruit, vegetable, confectionery, and nut stores

§ Beer, wine, and liquor stores

§ Cosmetics, beauty supplies, and perfume stores

§ Optical goods stores

§ Gasoline stations

§ Clothing stores, including men’s wear, women’s wear, children and family clothing, shoe stores, and infants’ stores

§ Luggage and leather goods stores

§ Sporting goods, hobby, and musical instrument stores

§ Sewing, needlework, and piece goods shops

§ Book stores, news dealers, college book shops

§ Music stores

§ Department stores

§ Warehouse clubs

§ Variety stores

§ Florists

§ Office supply, stationery, and gift shops

§ Used merchandise stores (pawn shops are included in this category)

§ Pet stores, art dealers, tobacco stores

§ Electronic shopping and mail-order retailers

§ Vending machine operators and direct selling, including in-home sales

IDEX Online Research maintains a complete list of the Department of Commerce Business Census data for the past three surveys, including the number of retailers in each category, their employment, their sales, and other data. This data is also available by state and metro area.

|

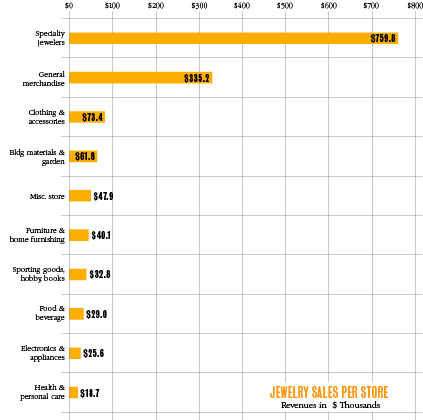

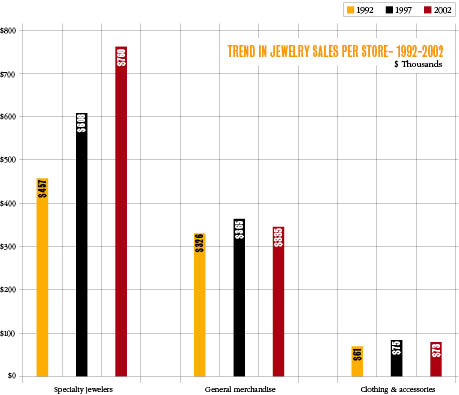

One reason that other retailers do not have meaningful jewelry market share is that their jewelry sales per store are so low.

Jewelry sales per store are highest among specialty jewelers, as expected. In the most recent U.S. Department of Commerce Business Census (2002 edition), the typical U.S. jewelry store generated sales of about $760,000. This is considerably below the $960,000 per store which the Jewelers of America (JA) reported in its Cost of Doing Business Survey for the same period. However, the JA survey included a sample of less than 400 jewelers; the Department of Commerce survey included roughly 21,000 jewelers.

No other category of retailer had substantially meaningful jewelry sales per unit. For example, retailers of clothing and accessories sell jewelry through more units than specialty jewelers, but have substantially less aggregate sales. This is because their sales per store are only about $73,000, or about one-tenth of the level of specialty jewelers’ sales per store.

In addition to modest per-store jewelry sales, some retail categories have shown no per-store sales growth of jewelry. For example, general merchandise stores, which generated jewelry sales of about $335,000 per unit (calculations are based solely on stores which sold jewelry), have experienced no growth in their sales per store over the past ten years. Jewelers’ sales per store have continued to rise at a 5% CAGR (compound annual growth rate) over the past ten years.

The graph below illustrates the solid, consistent rise of per-store sales for jewelry merchants while highlighting stagnant per-store jewelry sales trends for general merchandise retailers and clothing & accessories merchants.

Who Is Taking Market Share From Jewelers?

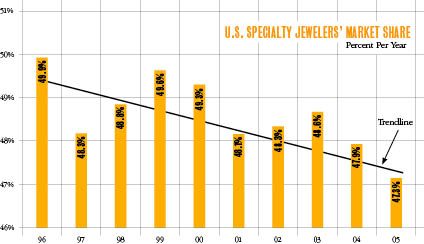

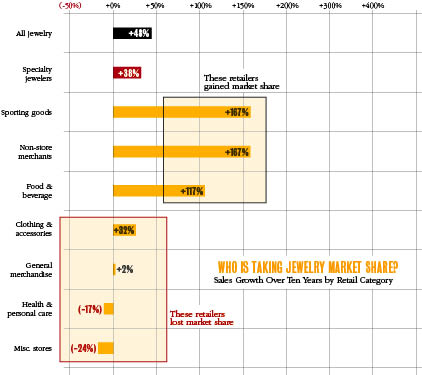

Jewelers have complained loudly - and correctly - that they are losing market share to other retail categories.

However, there may be some surprises among the list of retailers who are gaining – and those who are losing - market share. As expected, non - store retailers have among the strongest growth of any retail category. Stores which retail sporting goods, hobby supplies, books, and music (a single category, according to the Department of Commerce) have also posted strong jewelry sales gain, though this category generated an aggregate of just over $100 million in sales in 2002. That was just enough to be included on our list, which analyzes only retail categories with $100 million or more in annual jewelry sales.

A graph of those retail categories which are gaining market share and those which are losing market share follows:

How Are Retailers Classified by the Department of Commerce?

The U.S. Department of Commerce offers the following definitions for each retail category which has meaningful jewelry sales:

Jewelry stores - Establishments primarily selling one or more of the following items: 1) new jewelry (except costume jewelry); 2) new sterling and plated silverware; and, 3) new watches and clocks. Also included are retailers selling these new products in combination with lapidary work and / or repair services.

General merchandise stores - Establishments selling new general merchandise from fixed locations with facilities and staff capable of retailing a large variety of goods from a single location. Stores included are traditional department stores, discount department stores, warehouse clubs, and variety stores.

Non-store merchants - Retailers in this category include direct-response advertising, paper and electronic catalogs, door-to-door solicitation, in-home demonstrations, selling from portable stalls, party plan sales, and distribution through vending machines.

Clothing & accessories - Establishments selling new clothing and accessories from fixed locations. Retailers have facilities and staff that is knowledgeable of fashion trends and how to match styles, colors, and clothing combinations (with accessories) to the tastes of customers.

Miscellaneous store retailers - This includes establishments who sell specialty goods from fixed locations such as florists, used merchandise stores, pet supply stores, and other specialty merchants.

Health & personal care retailers - Establishments sell health and personal care merchandise, including beauty supplies, from fixed store locations. They may also have specialized staff including pharmacists, opticians, and other professionals.