No Reservations: Talking Auctions With Christie’s

April 28, 10

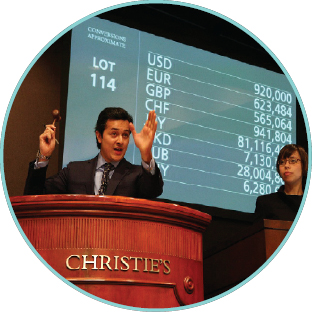

In the world of diamond auctions, Christie’s is top of the lots. The auction houses has experienced a run of auction fever over the past few years, selling some of the most valuable diamonds and jewels in the world, and setting many records in the process. IDEX Magazine Editor-in-Chief put some questions to Rahul Kadakia, Head of Jewelry at Christie’s

Danielle Max: Where are jewelry and diamond prices headed at auction? Just how high can they get?

Rahul Kadakia: Prices for high-quality signed jewels and top diamonds at auction have remained remarkably stable since the recession began in the fall of 2008, and in some cases have exceeded peak prices to set new auction records. In December of 2009, Christie’s Hong Kong set a new per-carat record for a pink diamond with the sale of the 5 carat Vivid Pink diamond for $2.1 million per carat, and in October of 2009, Christie’s New York set a new per-carat record for a white diamond with the sale of the 32 ct Annenberg Diamond for $240,000 per carat.

These are extraordinary prices given current economic conditions, and while no one knows how much higher they will go, we do predict another strong spring auction season for jewels and diamonds worldwide.

Danielle Max: Why did jewelry and diamond prices manage to stay so strong – and in many cases reach record-breaking heights – during the recent economic downturn? Was it the case across the board or was it just that some pieces did especially well?

| |

Rahul Kadakia: Rarity and demand are the two main factors. Top-quality diamond rough, especially among highly sought-after colored diamonds, is increasingly rare. At the same time, demand for investment-grade diamonds is continuing to grow worldwide, driven by the growing number of collectors in Asia, Europe,

The stability we have seen throughout this recessionary period is in some ways a function of the economy itself. Diamonds and gemstones have long been regarded as a stable store of value, and it is not unusual for collectors to seek out these alternative investments, especially in times of economic uncertainty.

Danielle Max: What type of diamond, gemstone and jewelry pieces have done particularly well of late and why?

Rahul Kadakia: As mentioned, demand for rare colored diamonds and top-quality white diamonds at auction has remained strong over the course of the last five years. In addition, prices for one-of-a-kind jewels, special contemporary creations, and jewels of exceptional provenance have risen dramatically in recent years. Rarity and demand are the driving factors behind these increasing prices, as clients have come to recognize unique jewels as works of art in their own right.

Danielle Max: Which areas of the world have proved strongest for diamond, gemstone and jewelry sales? How has this changed historically?

Rahul Kadakia: Christie’s hosts jewelry sales in our major salerooms around the world – in

Danielle Max: How do you decide where certain sales are held? Does it depend on the origin of the piece are where the market is currently strongest?

Rahul Kadakia: Client taste and demand informs our decisions about what to offer in each of our major sales, and we work closely with our consignors to ensure the best possible result for their particular piece of jewelry. For example, clients in the

Danielle Max: Who are the purchasers currently buying big and important pieces? Can they be categorized into those buying for pleasure and those buying for investment?

Rahul Kadakia: We find that clients from mainland

| |

Danielle Max: How has the profile of the “typical” jewelry and diamond buyer at auction changed?

Rahul Kadakia: There was a time when most of the clients in our salerooms were members of the trade and you would rarely see a private collector. Today, it’s a very different scenario, with private clients spending days at the pre-sale exhibitions and then turning up at the auctions to bid just as vigorously as the most seasoned dealers. In fact, in our

Danielle Max: What have been some recent sale highlights?

Rahul Kadakia: In just the last few years, Christie’s has offered some of the most significant diamonds to come on the auction block, including the Vivid Pink and the Annenberg Diamond (mentioned above), the 39 carat D color Evening Star Diamond for $5.4 million, a 62 carat D Flawless pear-shaped diamond for $8 million and the 101 carat shield-shaped F color Shizuka Diamond for $6.2 million, the largest diamond ever sold at auction in Asia. The crowning glory of recent years however is the Wittelsbach-Graff blue sold at Christie's

Danielle Max: What are some future sales to look out for?

Rahul Kadakia: On April 22, Christie’s New York will offer two historic jewels at auction: The Emperor Maximilian Diamond of 39.55 carats (estimate: $1-1.5 million) is one of two large diamonds the Archduke Maximilian acquired in Brazil in 1860, in the years just before he was named Emperor of Mexico, and the Catherine the Great Emerald and Diamond Brooch, with a central Columbian emerald of over 60 carats (estimate: $1-1.5 million).

Danielle Max: Which item would you most like to be able to sell at auction?

Rahul Kadakia: The 105 carat Kohinoor Diamond, which is part of the Crown Jewels of England as the center piece of the crown that was made in 1937 for Her Majesty the Queen Mother. It is one of the oldest known diamonds first recorded in 15th Century Mughal