Sierra Leone Transforms Into A ‘Dominantly Primary Resource’ Diamond Producer

August 01, 12

|

This dramatically transforming development in the diamond sector has been triggered by the formation of the Octéa Diamond Group – and its inauguration of a new processing plant at its flagship Koidu Diamond Mine, situated in the Kono District, 330 km east of the capital

As of the next quarter, Koidu’s open-pit mining will deliver 70 percent of the nation’s annual diamond production. The good governance, stability, steady employment, long-term certainty of cash-flow and related development benefits that are associated with kimberlite open-pit and underground mining will all impact the entire domestic economy of Sierra Leone.

Diamonds’ Growing Economic Role

Currently, some 50 percent of all the nation’s exports are derived from diamonds. Even though other commodities are now seeking investments in the country, the role of diamonds in the economy is set to increase. The nation’s president, Dr. Ernest Bai Koroma, lauded the launch of the newly formed Octéa Diamond Group while addressing (by video) a recent gala event that was attended by shareholders, government ministers, diplomats, NGOs, financiers, members of the Sierra Leonean community and media.

President Koroma said, “Our country has been blessed by significant mineral wealth, but the way that we manage this wealth is vital to the future prosperity of the country and the up-liftment of its people.” He stressed Octéa’s role “in nurturing the diamond sector here in

To foreign investors, the law provides security of tenure, encourages exploration, and is clear and transparent about rights and obligations. It is this law that provided the investor in the Koidu Mine with the confidence to embark on $300 million investment.

Koidu’s New Processing Plant

The gala event marked the official opening of the Koidu Diamond Mine’s new 180-tonne-per-hour processing plant – a key aspect of the Koidu Expansion Project – which will boost diamond output from 10,000 carats per month to 45,000 carats per month during the third quarter of this year. “This will effectively double diamond exports from

At an estimated average price between 250$ and 400$ per carat, the Koidu Mine will be producing over 500,000 carats, high quality diamonds, per year at a value of some $200,000,000. The new plant will more than quadruple the mine’s current output. The country’s rapidly dwindling alluvial output is estimated at some $75 million per year. Officials figures put the nation’s 2011 production figures at 357,160 carats, valued $124,150,581.

At the state-of-the art Koidu operation, diamonds are recovered fully automatically. The final recovery vaults can only be opened in the presence of a Government Monitor, a Government Valuer and a Mine Representative. This allows it to be a fully transparent operation where diamonds can be traced from the mine through the value chain straight into the stores of Tiffany & Co. – the world’s most renowned diamond brand retailer, which is a major stakeholder in the Koidu Mine by virtue of its rough off-take agreement with the Octéa Diamond Group

|

The Koidu Mine employs 1,570 permanent employees, 90 percent of whom are Sierra Leoneans. A back-of-the-envelope calculation by Paramount Chief Paul N. Saque, who heads the Tankoro Chiefdom on which the mine is located, shows that “directly and indirectly more than 20 percent of the some 350,000 people living in the rather populous Kono District are economically dependent on the Koidu Mine.”

At the inauguration of the new plant, the paramount chief recalled that “for the first time in the history of

Because open-pit hard-rock kimberlite mining requires frequent blasting (explosions) to break the rocks and “free” the diamondiferous ore, an activity that requires extensive safety measures to protect both employees and people living nearby, the Octéa Diamond Group has undertaken a relocation program for villagers living in the lease area. A wall has been erected around the 4.9 sq km mining grounds to prevent people from accidentally straying into the mining area – and to protect villagers against the impact of mine blasting. Some 500 houses have been, or are still being, built, dramatically improving the standard of living of a few thousand people.

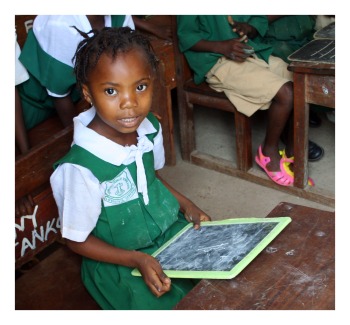

The Koidu Mine relocation areas also contain a few mosques and churches, several primary and secondary schools, a trading market, commercial areas and an impressive health clinic. The latter was inaugurated by Tiffany & Co. Vice President Andy Hart last year, to underscore the retailer’s involvement in the Koidu project. However, the greatest contribution to these villagers may well be clean tap water provided by the mine, something none of the villagers previously enjoyed.

In addition, the mine has built or refurbished some 110 kilometer of roads in the eastern district of Kono, opening trading and transportation corridors to many hitherto hardly accessible communities.

The central government is a major beneficiary. Royalties, corporate tax, export tax (6.5 percent compared to 3 percent for alluvial productions), leasing fees, provides the mine with the “honor” of being the single largest taxpayer in the country.

The Formation of the Octéa Diamond Group

“Inspired by our success at Koidu – as well as at our Tonguma Project – we undertook a major restructuring exercise towards the end of 2011 to enable the Group to invest in other exploration and development opportunities in

According to Joubert, four wholly owned subsidiaries of the Octéa Diamond Group have been established: Octéa Mining Ltd, Octéa Diamonds Ltd, Octéa Services Ltd and the Octéa Foundation.

“Octéa Mining Ltd now owns the mining assets of the group, including the Koidu Diamond Mine, previously called the Koidu Kimberlite Project, held by Koidu Limited, which was formerly Koidu Holdings,” notes Joubert. “It also includes the Tonguma Project held by Tonguma Limited. An application for an exploration license to the east of Koidu has been submitted by newly formed company, Broom Ltd.”

Octea is fully owned by BSGR, a diversified natural resource company with strong presence in West Africa; in partnership with Vale, BSGR is developing, in

As Octea plans to invest in other exploration and development opportunities in

Joubert doesn’t hide his personal aspirations: “The Octéa Diamond Group will be producing some 2 million carats annually by 2018,” he confidently predicts, saying that this might well be a very conservative figure. At today’s prices, that would be well over $700 million per year….

A Mine with Two Open Pits – Set to go Underground

The current government has completed a review of all mining licenses – and cancelled quite a few because of lack of progress or viability – and has given the remaining license holders considerable confidence and security of tenure. The Koidu mining lease is valid until July 2030, with the option to extend for a further 15 years. The property hosts two kimberlite adjacent pipes, K1 and

After completing a five-year open-pit operation, a transition to a further 12-year underground mining process is planned. At the Koidu Mine alone, total probable reserves (as of December 31, 2010) were estimated 4.2 million tonnes, with a diamond grade of 0.44 carats per tonne. However, taking another geological parameter, total indicated resources are estimated at 10.2 million tonnes, with a diamond grade of 0.54 carats per tonne. That translates into some 5.5 million carats of future production of predominantly high-quality rough diamonds.

Koidu is the single largest taxpayer in

The significance of the creation of the Octéa Diamond Group must not be viewed just from a governmental revenue perspective. After 80 years of alluvial mining, these deposits have largely been exhausted. Institutionally, most of the financial benefits have not helped the economy-at-large. Alluvial mining is entering its final decades.